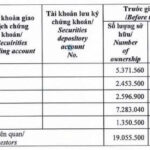

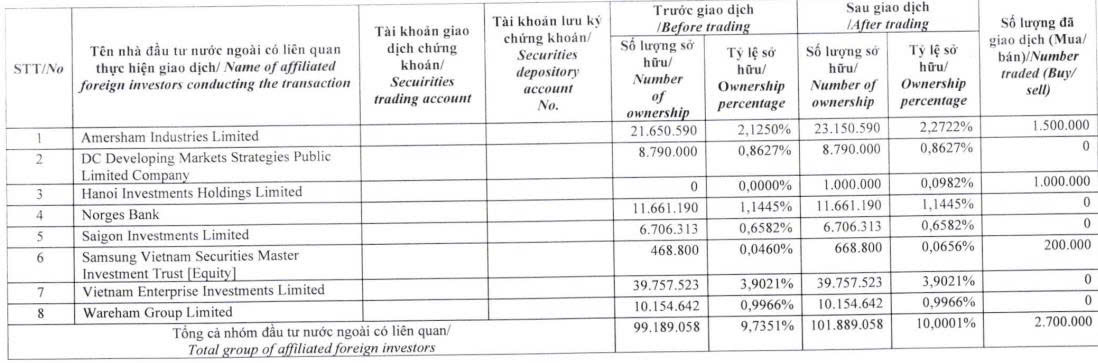

Dragon Capital, a prominent foreign investment group, has recently disclosed changes in ownership among its affiliated foreign investors who hold significant stakes in Dat Xanh Group Joint Stock Company (Stock Code: DXG, listed on HoSE). These investors collectively own 5% or more of DXG’s shares.

On October 27, 2025, Dragon Capital, through three of its member funds, acquired a total of 2.7 million DXG shares. Specifically, Amersham Industries Limited purchased 1.5 million shares, Hanoi Investments Holdings Limited acquired 1 million shares, and Samsung Vietnam Securities Master Investment Trust [Equity] bought 200,000 shares.

Source: DXG

Following this transaction, Dragon Capital’s holdings in DXG increased from approximately 99.2 million shares to nearly 101.9 million shares, raising its ownership stake from 9.7351% to 10.0001% of Dat Xanh Group’s capital.

Based on the closing price of DXG shares on October 27, 2025, at VND 21,200 per share, Dragon Capital is estimated to have spent over VND 57.2 billion on this acquisition.

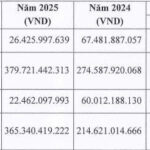

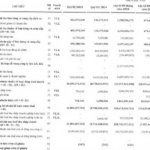

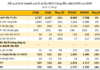

In terms of business performance, Dat Xanh Group’s consolidated financial report for Q3/2025 shows a net revenue of over VND 1,068 billion, a 5.4% increase compared to the same period last year. However, after deducting the cost of goods sold, gross profit reached more than VND 469.6 billion, a 7.6% decrease.

During the period, the company generated VND 41.6 billion in financial revenue, 3.2 times higher than the same period last year. Conversely, financial expenses decreased from VND 104.8 billion to VND 62.3 billion.

Additionally, selling expenses rose from VND 166.3 billion to over VND 243.8 billion, and administrative expenses reached VND 122.4 billion, a 16.9% increase year-over-year.

As a result, after deducting taxes and fees, Dat Xanh Group reported a net profit of nearly VND 163.6 billion, 2.2 times higher than the same period last year.

The Privé: Redefining Luxury Living in the Heart of Ho Chi Minh City

In the heart of Ho Chi Minh City, where prime real estate is increasingly scarce, the luxury apartment segment is experiencing a remarkable surge. As demand for exclusive, iconic living spaces outpaces the availability of land, each new project swiftly captures the attention of both investors and discerning buyers.

Pig Prices Cool Down, Baf Vietnam’s Q3 2025 Profits Plunge by 63%

Amidst a decline in pork prices and escalating costs, Baf Vietnam’s after-tax profit for Q3/2025 plummeted by 63% year-on-year. Despite this, the company has surpassed the halfway mark of its annual profit target after the first nine months.