Saigon Central Project, a Keppel Land Investment

Vietnam remains a pivotal market in Keppel Corporation’s strategy. Beyond its substantial land holdings, Vietnam serves as a dynamic hub for the corporation to expand into next-generation sustainable infrastructure services.

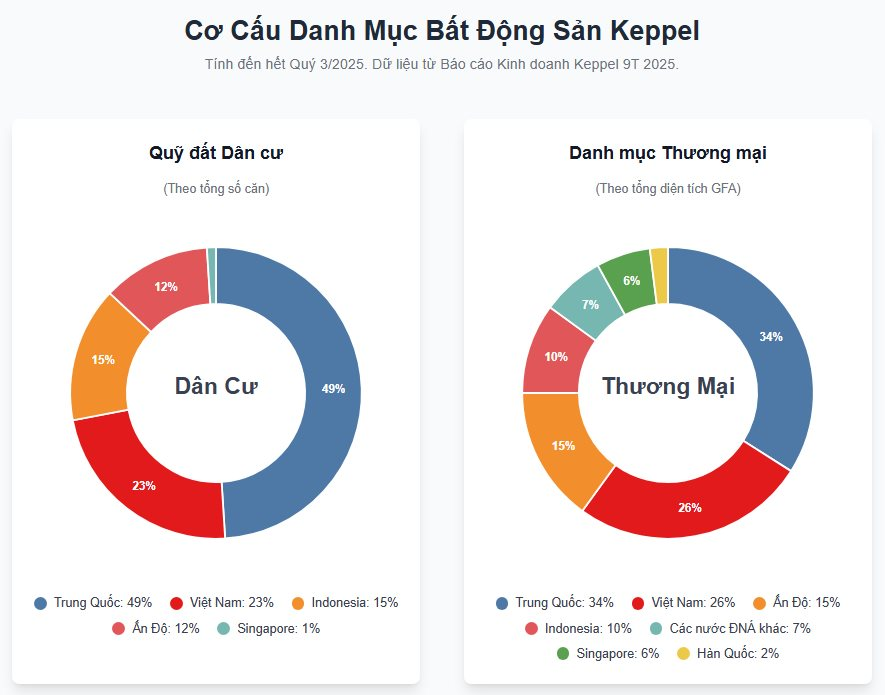

In the real estate sector, Vietnam continues to be a core market. As of September 2025, Keppel’s residential land bank in Vietnam stands at 6,937 units, accounting for 23% of its total portfolio. Simultaneously, its commercial real estate portfolio in Vietnam spans 401,210 square meters, representing 26% of the global commercial portfolio.

Breakdown of Keppel’s Real Estate Portfolio by Country

Alongside its land holdings, Keppel is accelerating its clean energy solutions. The corporation’s Sustainable Solutions and Decarbonization division has recently secured new Energy-as-a-Service (EaaS) contracts in six key markets, including China, India, the Philippines, Singapore, Thailand, and Vietnam.

Vietnam also plays a significant role in Keppel’s ongoing divestment program. Notable transactions include the divestment of a 22.6% stake in Phase 3 of Saigon Centre (SGD 98 million), a 42% stake in Palm City (SGD 141 million), and the divestment of Nam Long shares (SGD 58 million).

Robust Global Profit Growth

For the first nine months of 2025, the Singapore-based corporation reported strong financial results. Net profit for “New Keppel,” focused on three core segments—Infrastructure, Real Estate, and Connectivity—surged by over 25% compared to the same period in 2024. All three business segments recorded profit growth, driving a nearly 15% increase in recurring income year-over-year.

Even accounting for the accounting loss from the proposed divestment of M1’s telecommunications business (classified as Discontinued Operations), the corporation’s overall net profit for the first nine months of 2025 still rose by more than 5% year-over-year.

Strategic Divestment

These results underscore Keppel’s successful transition to a global asset manager and operator model. A key highlight is the “asset monetisation” program. In the first nine months of 2025, Keppel announced divestments totaling approximately SGD 2.4 billion, including the landmark divestment of M1’s telecommunications segment (estimated at SGD 1.3 billion).

Mr. Loh Chin Hua, CEO of Keppel, stated, “The market increasingly recognizes Keppel as a global asset manager and operator, and has begun revaluing the company as we execute our growth strategy.”

Since launching the program in October 2020, Keppel has announced total divestments of approximately SGD 14 billion, including the divestment of Keppel Offshore & Marine in 2023. The corporation aims to divest an additional SGD 500 million in the coming months.

Geleximco Consortium Wins Nearly $1 Billion Bid for Long-Stalled Quy Nhon Project After Decade of Inactivity

Nestled in the heart of Quy Nhơn, spanning across Quy Nhơn Bắc, Quy Nhơn Nam, and Quy Nhơn wards in Gia Lai Province, this expansive 279.7-hectare project redefines modern living. With its strategic location and ambitious scale, it promises to be a transformative development, blending innovation, sustainability, and community-centric design.

Văn Phú Surpasses 75% of 2025 Profit Target Ahead of Schedule

The recognition of revenue from The Terra – Bac Giang and Vlasta – Sam Son projects propelled Van Phu Real Estate Development JSC to a strong finish in Q3/2025, with after-tax profit reaching VND 119 billion, an 8% increase compared to the same period in 2024. For the first nine months of 2025, the company recorded an after-tax profit of VND 262.9 billion, achieving over 75% of its annual profit target.