During the National Assembly session on October 30, delegates proposed five specific groups of solutions to mobilize and monetize the gold held by the public. The aim is to utilize this valuable capital for infrastructure development, digital transformation, and technological innovation without increasing public debt.

Many experts estimate that the amount of gold held by the public is at least 500 tons.

Previously, the Vietnam Gold Traders Association (VGTA) also urged the State Bank to explore solutions for mobilizing gold from the public. The estimated amount of gold held by the public is around 500 tons, as Vietnam has primarily imported gold with negligible exports over the years.

However, the latest statistics from the Vietnam Association of Financial Investors (VAFI) estimate the country’s gold reserves at over 2,000 tons (equivalent to approximately $300 billion at current gold prices). “Most of this 2,000 tons of gold, once purchased, is stored under people’s beds and does not re-enter the commercial banking system. Meanwhile, the tax exemption policy for gold trading (primarily gold bars) has significantly increased the goldization of the economy,” stated a VAFI representative.

Given the complex dynamics of the gold market, VAFI has submitted a proposal to the Government and the National Assembly, advocating for tax policies on gold bar and jewelry trading to stabilize the market. “VAFI recommends that gold jewelry and gold bar trading be subject to VAT under the deduction method, similar to other goods, ensuring equal tax obligations. A 10% VAT should be applied to gold bar and jewelry trading,” the association proposed.

According to VAFI, Vietnam currently exempts gold bar trading from taxes, while many countries implement strong policies against the goldization of their economies to stabilize exchange rates, protect their currencies, and encourage idle capital to flow into banking and stock markets. This benefits businesses, citizens, and the economy by enabling lower borrowing rates.

Amid conflicting reports on the amount of gold held by the public, a VGTA expert spoke with Bao Nguoi Lao Dong on the afternoon of October 31. The expert noted that the 500-ton figure has been based on data from the World Gold Council (WGC) and customs records of gold imports from 1990 to 2023. However, there is no data on illegal gold imports during those years, especially when domestic and global gold prices were high.

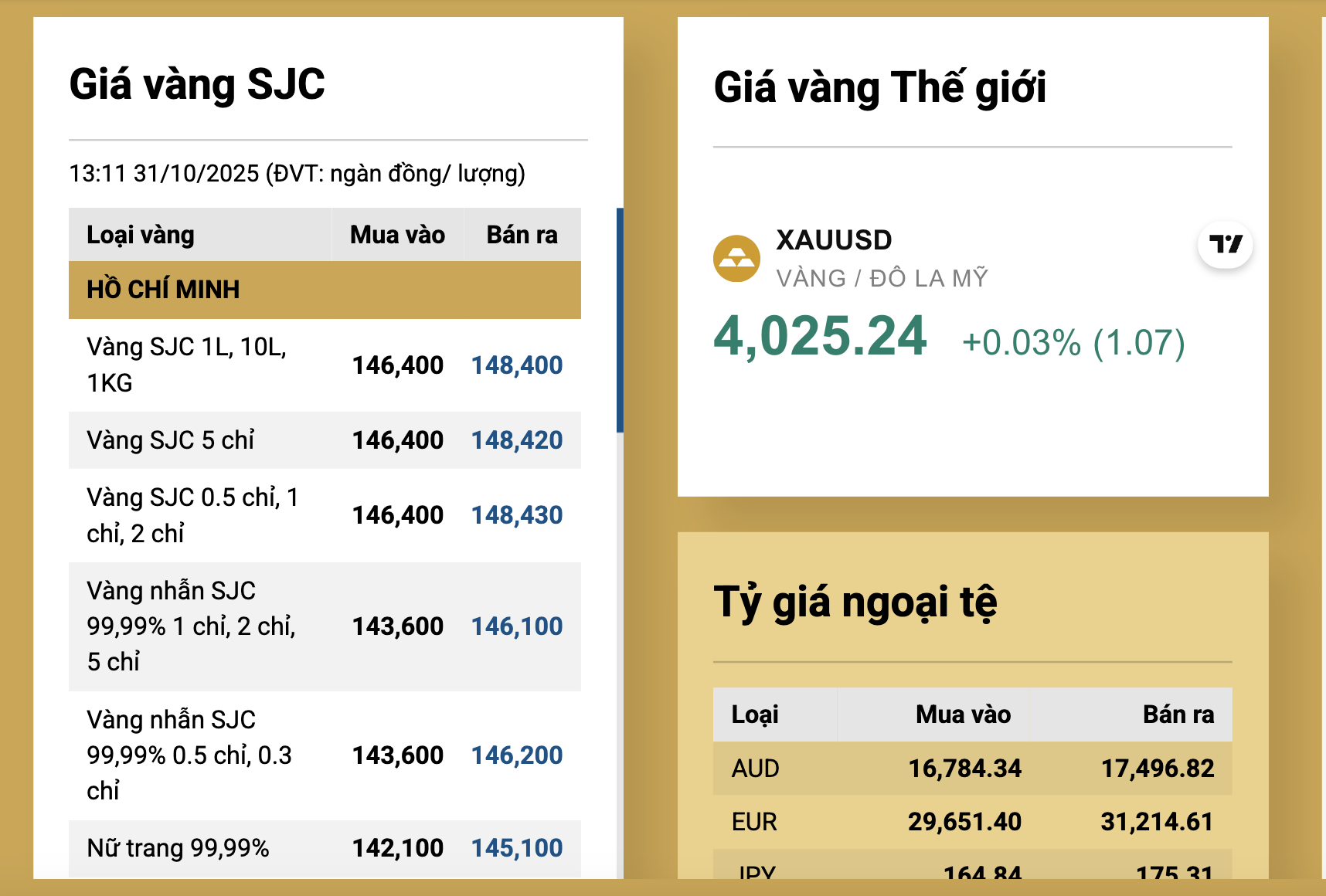

Domestic Gold Prices Continue to Rise

On the afternoon of October 31, SJC gold bars were quoted by businesses at 146.4 million VND per tael for buying and 148.4 million VND per tael for selling, an increase of 600,000 VND per tael compared to the morning.

Gold rings and jewelry were traded at around 143.6 million VND per tael for buying and 146.1 million VND per tael for selling.

According to Bao Nguoi Lao Dong reporters, domestic gold prices have been volatile in recent days due to global market influences. Despite high prices, public demand for gold remains strong.

SJC Gold Bar Prices This Afternoon

Unveiling the True Essence of the Real Estate Market

Head of the Economic and Financial Committee, Phan Văn Mãi, highlighted that by the end of August 2025, credit in the real estate sector had surged by nearly 19.7%, while capital for production and business faced significant challenges. The volatile gold market further complicated matters, restricting the ability to mobilize medium and long-term capital.

“Decree 232: Safeguarding Public Interests, Marching Towards a Transparent Gold Market”

As of late August 2025, the domestic gold price witnessed a complex upward trajectory. By August 29, 2025, SJC gold bars had surged past VND 129 million per tael, while gold rings had also climbed above VND 123 million per tael.