According to the financial report, by the end of September 2025, BIDV’s total assets officially reached the milestone of 3,000 trillion VND. In Q3 2025, the bank’s total assets increased by over 80 trillion VND, and in the first nine months, they rose by more than 311 trillion VND.

Thus, BIDV became the first Vietnamese bank to surpass the 3,000 trillion VND asset mark. Following BIDV are Vietcombank, VietinBank, and Agribank, each with total assets exceeding 2,500 trillion VND.

In the first nine months of the year, BIDV’s customer loan portfolio grew by over 181 trillion VND, equivalent to an 8.8% increase, reaching more than 2,200 trillion VND.

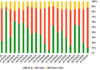

Regarding loan quality, BIDV’s non-performing loans (NPLs) at the end of Q3 stood at nearly 42 trillion VND, a 44% increase from the beginning of the year. The NPL ratio to total loans rose from 1.41% to 1.98% by the end of Q2 2025, then decreased to 1.87% by the end of Q3 2025.

BIDV maintained its position as the bank with the highest customer deposits in the system, surpassing 2,000 trillion VND, a 6.9% increase in the first nine months. The Current Account and Savings Account (CASA) ratio reached 16.7%.

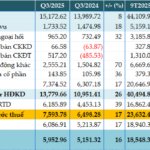

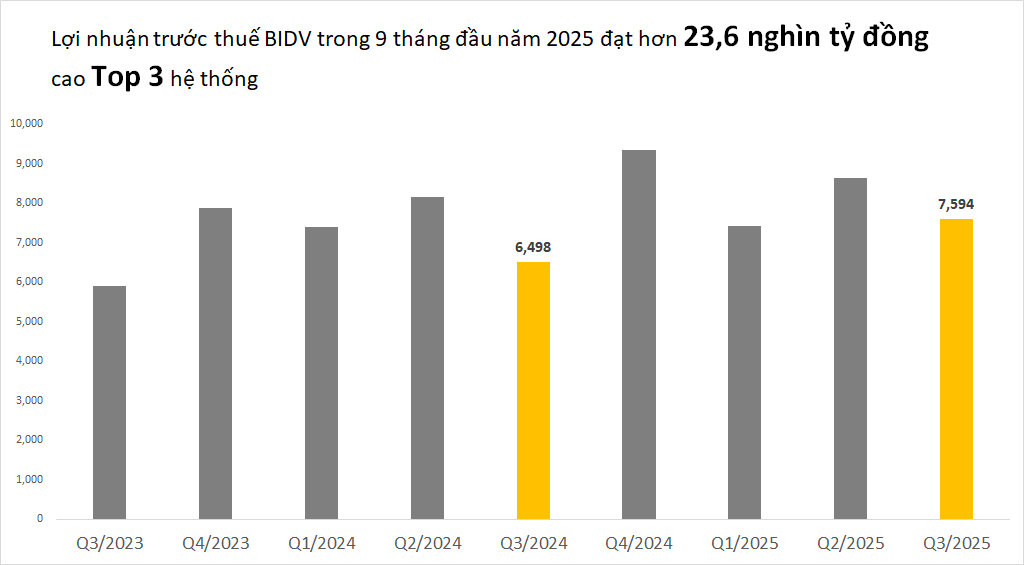

In terms of business performance, BIDV’s pre-tax profit in Q3 2025 reached nearly 7,600 billion VND, a 17% increase year-on-year. All business segments of the bank experienced positive growth compared to the same period last year, driving total operating income to over 21 trillion VND, up 22.6%. Operating expenses in Q3 2025 were nearly 7,400 billion VND, a 17% increase. Risk provisioning costs rose by 39% to nearly 6,200 billion VND.

For the first nine months, BIDV’s pre-tax profit exceeded 23,600 billion VND, a 7.2% increase year-on-year. Consequently, BIDV ranked third in the system in terms of profit, following Vietcombank and VietinBank.

Soaring Operational Costs Slash Vietbank’s Q3 Pre-Tax Profit by 14%

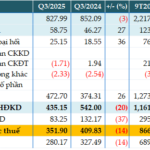

Vietbank (UPCoM: VBB) reported a pre-tax profit of nearly VND 352 billion in Q3/2025, reflecting a 14% year-on-year decline. This decrease is attributed to lower net interest income and higher operating expenses, as indicated in the bank’s consolidated financial statements.