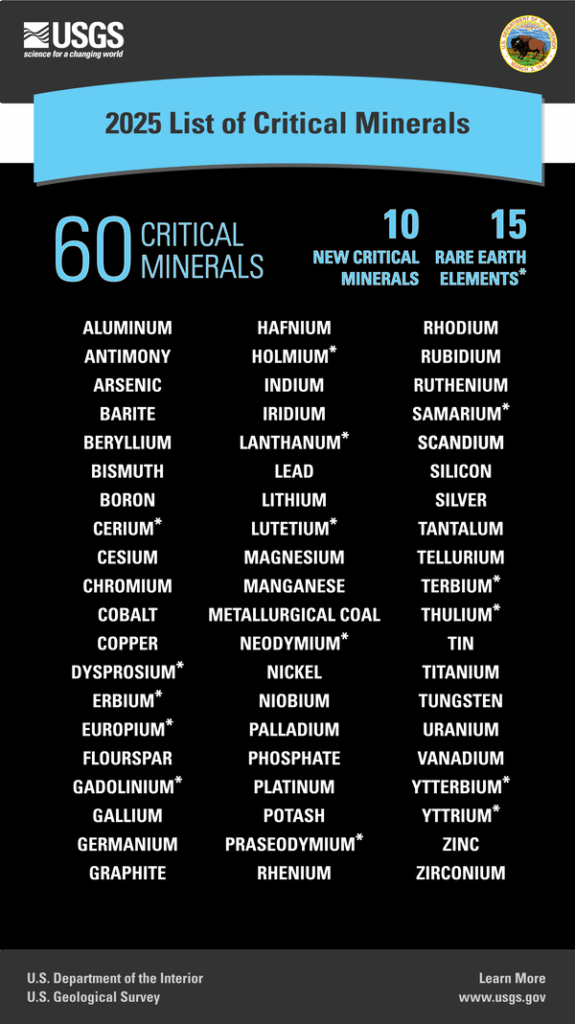

The U.S. Department of the Interior has recently added several minerals, including silver, copper, and coke, to its list of critical minerals. This move, as reported by the Financial Times, could pave the way for new tariffs on these commodities in the future.

The U.S. Geological Survey (USGS) updates this list every three years, guiding Washington’s trade policies and material security strategies. Inclusion in the list not only determines potential tariffs under Section 232 of the U.S. Trade Act but also influences eligibility for federal support for domestic mining projects.

The Trump administration has long prioritized securing critical mineral supply chains, especially for materials used in manufacturing, energy, and defense. The U.S. has expanded its definition of “critical minerals” to include materials it produces in abundance, such as coke and boron.

The addition of copper and coke was anticipated, but the inclusion of silver has drawn particular attention. Silver could become a focal point if the U.S. decides to impose import tariffs.

According to Suki Cooper, an analyst at Standard Chartered, while the imposition of tariffs on silver remains “ambiguous,” its inclusion in the list marks the first step in the tariff consideration process. She notes that certain silver customs codes have been excluded, meaning some refined or industrial silver forms may be exempt.

Although no specific decisions have been made, the global silver market has reacted strongly. Silver reserves in New York reached record levels last month, while London, the world’s largest silver trading hub, experienced a temporary shortage. The U.S. imports approximately two-thirds of its domestic silver consumption, primarily for electronics, solar panels, jewelry, and investment.

Silver prices surpassed $50/oz in October, the highest in years, driven by increased demand from renewable energy and risk-hedging investments.

Beyond silver, the inclusion of copper reflects U.S. efforts to strengthen supply chains for critical industries, including electricity, construction, and clean energy production. Copper is essential for manufacturing electrical wires, electric vehicles, and power transmission infrastructure.

According to the USGS, this move aims to reduce reliance on imports—particularly from China and Chile—while encouraging domestic mining and refining. Listing copper as a “critical mineral” also means mining projects can access federal financial support and incentives more quickly.

In addition to silver, copper, and coke, the updated list includes elements like lead, phosphate, silicon, uranium, and rhenium—used in jet engines. The USGS also flagged elements at high risk of supply chain disruption, including rhodium, gallium, germanium, tungsten, several rare earth elements, and potash, primarily imported from Canada.

The USGS defines critical minerals as “essential commodities for the economy or national security; with supply chains vulnerable to disruption; and vital for producing goods where shortages could severely impact the U.S.”

The U.S. Department of Energy (DOE) maintains a similar list of 41 elements, last updated in 2023. The parallel expansion of these lists underscores the U.S. acceleration in material self-sufficiency, a cornerstone of the Trump administration’s “Make it in America” industrial policy.

Source: FT