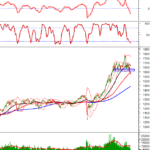

Technical Signals of VN-Index

During the morning trading session on November 12, 2025, the VN-Index saw a slight recovery with a small-bodied candle and low trading volume, indicating investor caution.

Currently, the index is testing the 100-day SMA as the MACD indicator continues to decline after issuing a sell signal. Without improvement in upcoming sessions, a bearish outlook persists.

Technical Signals of HNX-Index

In the morning session on November 12, 2025, the HNX-Index continued its recovery, forming a small-bodied candle with unchanged low trading volume, reflecting investor hesitation.

Recent trading volumes remain below the 20-day average, signaling caution as the Stochastic Oscillator and MACD have yet to provide buy signals.

CII – Ho Chi Minh City Infrastructure Investment Joint Stock Company

In the morning session on November 12, 2025, CII shares rose for the second consecutive day after retesting the 38.2% Fibonacci Retracement level (22,300-23,600), easing investor pessimism.

The Stochastic Oscillator has issued a buy signal from the oversold region, though volume remains below the 20-session average.

Improved liquidity and sustained technical signals could strengthen the recovery trend.

HDC – Ba Ria – Vung Tau Housing Development Corporation

In the morning session on November 12, 2025, HDC shares rebounded after three consecutive declines, easing investor pessimism.

The MACD continues to decline post-sell signal, and HDC prices remain below the Bollinger Bands’ Middle Line, indicating a bearish mid-term outlook.

However, the Stochastic Oscillator shows bullish divergence in the oversold region. A buy signal and breakout above this zone could trigger a recovery.

(*) Note: This analysis is based on real-time data as of the morning session’s close. Signals and conclusions are for reference only and may change by session end.

Technical Analysis Department, Vietstock Advisory Division

– 12:03 November 12, 2025

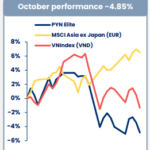

Stock Market Slump Drags Down PYN Elite Fund’s Performance

The PYN Elite Fund’s investment performance continued its downward trajectory in October, experiencing a more significant decline compared to the VN-Index.

Vietstock Daily 12/11/2025: Market Pulls Back from Decline

The VN-Index has rebounded, yet trading volume remains below its 20-day average, indicating lingering investor caution following the recent sharp decline. The Stochastic Oscillator continues to weaken in oversold territory. Should buy signals reemerge in upcoming sessions, the recovery outlook may strengthen.

Derivatives Market on November 12, 2025: Uncertainty Takes Hold

On November 11, 2025, most VN30 and VN100 futures contracts closed higher. The VN30-Index reversed its trend, forming a small-bodied candlestick pattern, while trading volume remained below the 20-session average, indicating investor hesitation.