VPS Securities Corporation (VPS) has announced a resolution approving the purchase of shares in its initial public offering (IPO). The resolution allows Board Member Nguyen Thi Thu Hong to acquire 1 million shares at the IPO price of VND 60,000 per share, totaling VND 60 billion.

As of November 6, 2025, VPS’s IPO attracted 19,952 investors, who subscribed for 220,420,400 shares—surpassing the 202.31 million shares offered. Notably, individual investors accounted for 98.11% of the total subscription value.

Investors bidding above the offering price will receive their full requested allocation. Those bidding at the offering price will receive 83.73% of their requested shares.

VPS will notify investors of their allocation results. Payment for the shares must be completed between November 10 and 5 PM on November 14, 2025.

Upon successful completion of the IPO, VPS expects to raise VND 12,138.6 billion. Of this, VND 10,976.8 billion will fund margin lending, VND 900 billion will invest in IT infrastructure, and VND 270 billion will develop human resources. Disbursement will occur from 2025 to 2027.

Post-IPO, all shares will be registered and centrally depository at the Vietnam Securities Depository (VSDC) and listed on the Ho Chi Minh City Stock Exchange (HoSE). If VPS fails to meet listing requirements, shares will be traded on the Unlisted Public Company Market (UPCoM).

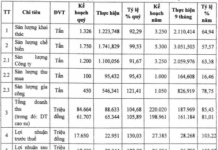

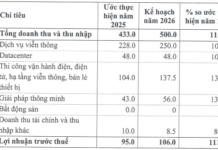

Prior to the IPO, VPS reported strong Q3 2025 results: pre-tax profit of VND 1,395 billion (up 70%) and post-tax profit of VND 1,126 billion (up 72%).

In the first nine months of 2025, VPS recorded VND 5,900 billion in revenue (up 20% YoY), VND 3,192 billion in pre-tax profit, and VND 2,564 billion in post-tax profit (both up 52%).

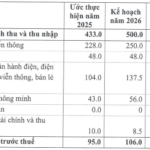

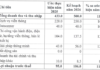

VPS’s Board recently revised its 2025 targets: VND 8,800 billion in revenue, VND 4,375 billion in pre-tax profit, and VND 3,500 billion in post-tax profit—a 3.5% revenue increase and 25% profit increase from the original plan.

As of Q3 2025, VPS achieved 67% of its revenue target and 73% of its pre and post-tax profit goals.

Stocks to Go Public 3-6 Times Faster Than Ever Before

Following an IPO, businesses now require just 30 days to complete financial report audits and officially list on the stock exchange, a dramatic reduction from the previous 3-6 month timeframe.

Unlocking Success: VinaCapital Expert Reveals 3 Core Factors for Vietnamese Startups to Triumph in IPOs

Vietnam’s stock market is entering a new phase of acceleration, fueled by FTSE Russell’s recent upgrade to “Secondary Emerging Market” status and liquidity levels that continue to lead the region. Amidst this wave of robust reform, the narrative of “going public – IPO” has emerged as a hot keyword among investors and Vietnam’s startup community.