According to the newly released FAQ document on November 10th, the upgrade process will unfold in multiple phases, contingent upon Vietnam successfully passing an interim assessment in March 2026. This assessment will focus on the progress made in enhancing global broker accessibility—a critical factor for efficient index replication.

“The global broker accessibility model refers to enabling Foreign Institutional Investors (FIIs) to trade directly with international brokers. This initiative is expected to align Vietnam with international standards, reduce counterparty risks, and bolster investor confidence through established relationships with trusted intermediaries,” the document states.

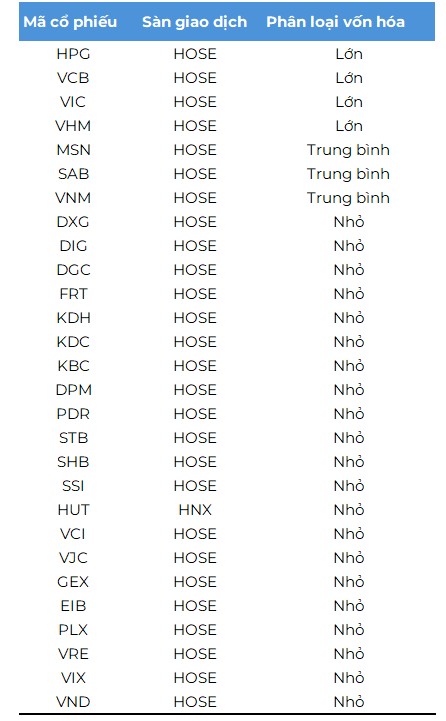

28 Vietnamese stocks poised for inclusion

FTSE Russell has unveiled a preliminary list of 28 Vietnamese stocks meeting the criteria for the FTSE Global All Cap Index, based on data as of December 31, 2024.

This list features prominent companies such as Hoa Phat (HPG), Vietcombank (VCB), Vingroup (VIC), and Vinhomes (VHM) in the large-cap category; Masan Group (MSN), Sabeco (SAB), and Vinamilk (VNM) in the mid-cap segment; along with 20 other firms in the small-cap category.

Source: FTSE Russell.

Note: This portfolio will be updated prior to the semi-annual market review in September 2026. |

Projections based on data as of October 31, 2025, indicate that Vietnam will represent approximately 0.04% of the FTSE Global All Cap, 0.34% of the FTSE Emerging All Cap, 0.02% of the FTSE All-World, and 0.22% of the FTSE Emerging.

Implementation roadmap

The upgrade process will proceed in two main stages. Removal from the FTSE Frontier Index Series will occur in a single step in September 2026, coinciding with the annual review of the FTSE Frontier. Meanwhile, inclusion in the FTSE Global Equity Index Series will be phased, with details announced in March 2026 following consultations with the Advisory Committee and market participants.

Starting September 2026, Vietnamese stocks will be classified under the “FTSE Asia-Pacific ex-Japan and China” region.

This upgrade will unlock opportunities to attract new capital flows from major global index funds and ETFs, while reinforcing Vietnam’s financial market development and integration with international standards.

– 11:50 11/11/2025

Ford Ranger Slashes Prices at Dealerships: Wildtrak, Raptor Models Drop by Up to $5,000, Base Variant Now Cheaper Than Hilux

The best-selling Ford Ranger pickup truck is now available with dealer discounts ranging from $19,000 to $51,000, depending on the version.

Prime Minister: Ensuring Citizens Don’t Face Delays or Extra Costs When Accessing Social Housing

The Prime Minister emphasized three critical objectives in social housing development: streamlining procedures to eliminate bureaucratic hurdles; ensuring citizens can access social housing swiftly, affordably, and conveniently, without unnecessary delays, complications, or additional costs, and with protection against fraud; and fostering a safe, healthy, and sustainable real estate market that stabilizes the macroeconomy, controls inflation, drives growth, and maintains the economy’s key balances for rapid and sustainable development.