As electric vehicle showrooms in India witness a surge in visitors, two global brands—Tesla and VinFast—are adopting starkly different strategies as they enter the booming phase of the world’s third-largest auto market, reports ET Auto.

October 2025 marked a record-breaking month for electric vehicle sales across India, fueled by festive season demand, a slew of new model launches, and an expanding charging network. According to Vahan data, VinFast, the Vietnamese newcomer, is showing more impressive growth than Tesla, the cautious American giant, despite both entering this critical market.

Two Players, Two Strategies

Tesla has been planning its India entry for years, but after lengthy tariff negotiations, it only officially launched in mid-2025. The first batch of Model Y vehicles, imported and distributed through private channels, are priced between ₹59.89 lakh and ₹67.89 lakh (excluding taxes), equivalent to $75,000–$85,000. Tesla targets the premium segment, appealing to affluent buyers in major cities like Mumbai and Delhi.

However, market response has been muted. Vahan data reveals Tesla registered only 118 vehicles in 2025, with just 40 sold in October—a modest figure for a brand of its global stature.

In contrast, VinFast has had a more dynamic start. Launched at the Bharat Mobility Expo in January 2025, this marks the Vietnamese brand’s first international foray outside Southeast Asia. The VinFast VF 6 and VF 7, introduced in September, are priced between ₹16.49 lakh and ₹25.49 lakh ($20,000–$32,000), targeting the mid-range segment where demand is growing fastest.

In October alone, VinFast sold 131 units, bringing its total 2025 registrations to 204—a staggering 2,083% growth from the previous month. This early momentum has helped VinFast rapidly build brand recognition, bolstered by its Tamil Nadu factory project and plans to open 35 showrooms across 27 cities by year-end.

Market Growth Fueled by Festive Demand

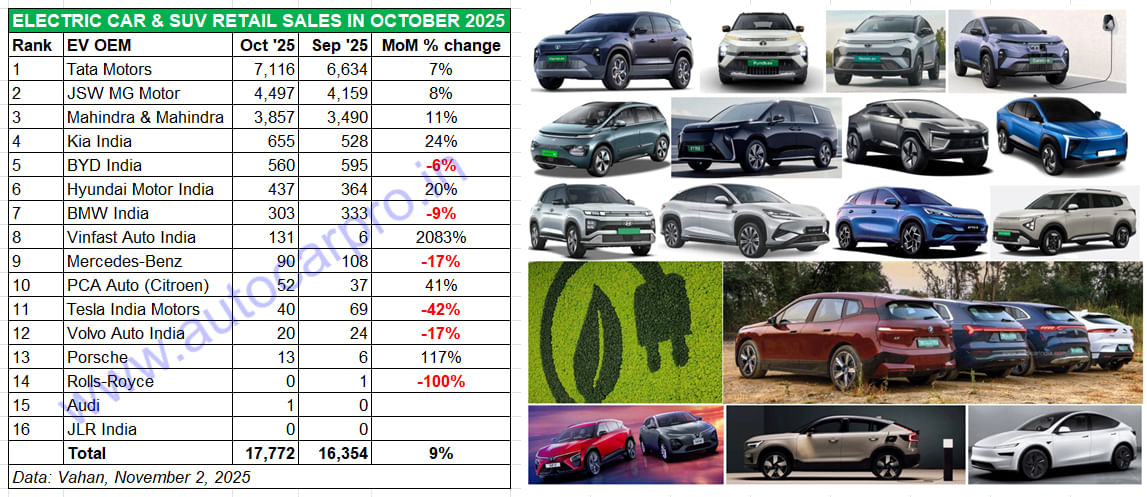

The Federation of Automobile Dealers Associations (FADA) reports that October 2025 saw a 57% year-on-year increase in passenger electric vehicle sales, reaching 17,772 units compared to 11,464 in 2023. Tata Motors led with 7,116 units, followed by JSW MG Motor (4,497) and Mahindra & Mahindra (3,857).

Commercial electric vehicles doubled to 1,767 units, while two- and three-wheelers saw modest growth. VinFast’s advantage lies in leveraging this festive shopping surge to boost brand visibility, while Tesla remains confined to two major cities.

India’s government confirms Tesla has no immediate plans for local production. Heavy Industries Minister Kumaraswamy stated, “Tesla only wants to open showrooms and sell imported vehicles.” This limits Tesla’s expansion due to 70% import taxes and a sparse service network.

Localization vs. Caution

Globally, Tesla remains an EV leader, delivering nearly 497,000 vehicles in Q3 2025, with revenue up 12% to $28.1 billion. However, its cautious India strategy is ceding ground to rivals with stronger local presence.

VinFast views India as a global acceleration hub, with a factory under construction and a rapidly expanding dealership network. It focuses on the mid-range segment, where consumers seek a balance of price, performance, and charging convenience.

Currently, VinFast enjoys localization advantages, while Tesla remains a cautious observer.

Other manufacturers are also accelerating. Hyundai Motor India is expanding its supply chain with an 80% localized factory and plans to increase charging stations from 100 to 600 over seven years. Maruti Suzuki, India’s largest automaker, is launching the e-Vitara and investing heavily in production lines. Brands like Kia, Mercedes-Benz, and JSW Group are also finalizing plans under the government’s EV incentive policy.

Since September 22, 2025, India’s GST reforms have significantly reduced taxes on internal combustion vehicles, narrowing the price gap with EVs. While EVs still enjoy a 5% tax rate, the shrinking price advantage signals fiercer competition ahead.

Source: ET Auto

VinFast to Potentially Launch Hybrid Vehicles

This information is revealed through the promotional images of Sailun’s tire line for VinFast’s new vehicle range, which includes a brand-new hybrid model.

Can the Tet Season Boost Vietnam’s Automotive Market?

As the Vietnamese automotive market enters Q4 2025, the peak shopping season is in full swing with a slew of new models either launched or on the horizon, including the Lynk & Co 08, Mitsubishi Destinator, and Jaecoo J7 AWD. However, many experts predict that the year-end car market in 2025 may not be as vibrant as it was in 2024.

Affordable Sodium-Ion Batteries with Enhanced Safety Soon to Power Electric Motorcycles in Vietnam: How Do They Compare to LFP Batteries?

What is a Sodium-Ion Battery?

Sodium-ion batteries are a cutting-edge energy storage solution that leverages sodium ions as charge carriers, offering a sustainable and cost-effective alternative to traditional lithium-ion batteries. Designed to address resource scarcity and environmental concerns, these batteries utilize abundant sodium, making them a promising option for large-scale energy applications, grid storage, and renewable integration. With advancements in technology, sodium-ion batteries are poised to revolutionize the energy landscape, delivering reliable performance while minimizing ecological impact.