Growing Concerns Over the Widening Wealth Gap

In a newly released report, the Vietnam Association of Realtors (VARS) highlights that the real estate market’s development is showing signs of unsustainability, particularly the mismatch between product structure and the actual affordability of the population.

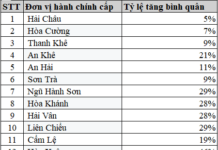

According to VARS, over the past three years, the housing supply has significantly increased, but the structure remains imbalanced. Most new supply is concentrated in the high-end segment, targeting investors or speculators rather than meeting actual housing needs.

Even in suburban areas, once expected to offer affordable options, actual prices remain significantly higher than the average income of residents, only slightly lower than central areas.

Meanwhile, the market’s greatest demand lies in affordable housing. This mismatch not only drives up property prices but also poses the risk of a price bubble.

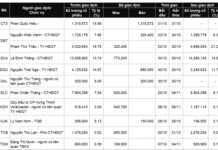

VARS estimates that, assuming property prices and incomes remain constant, the ability of residents to access housing is sharply declining. Surveys in major cities show that mid-range projects typically cost around VND 5 billion for a two-bedroom apartment. Even for urban residents with high incomes—approximately VND 50 million per month—it would take 8 years to save enough if they allocated their entire income.

Applying the principle that housing costs should not exceed one-third of income, the required time extends to about 25 years.

An upcoming social housing project in Hanoi. Photo: Hồng Khanh |

For low-income groups, the situation is even more concerning. Social housing, designed to support low-income earners, is no longer “affordable.”

With prices around VND 1.5 billion for a 60m² apartment, even families with the maximum income eligible for consideration—VND 40 million per month—would need to save for about 10 years. If additional loans are required, the saving period will be even longer.

Property prices are rising much faster than incomes, making homeownership increasingly out of reach for the majority. Meanwhile, those who already own property continue to benefit from rising real estate values. Financially advantaged groups hold multiple properties as investment assets, growing wealthier through land value appreciation.

Conversely, those without property must resort to long-term renting, despite efforts to increase income. A sense of “growing poorer” emerges even as the economy grows, as housing costs outpace income growth.

“Without timely interventions, the wealth gap will not only widen but also risk becoming entrenched across generations, posing a significant challenge to social welfare, urbanization strategies, and national sustainable growth,” VARS warns.

Curbing Price Growth, Boosting Affordable Supply

To ensure sustainable growth in the real estate market and prevent it from becoming an economic risk, VARS proposes systemic solutions to curb the rapid rise in property prices.

The most critical solution is to increase the supply of affordable housing. When supply is sufficient, market prices will naturally adjust based on real supply-demand dynamics.

The association recommends developing early warning criteria and indicators for real estate market trends. This system would help authorities promptly identify anomalies such as speculation, unusual price increases, supply-demand imbalances, or liquidity declines, enabling corrective actions before risks escalate.

Additionally, establishing a unified national database for land, housing, and real estate transactions is urgent. This would enhance effective management, curb price manipulation and speculation, and protect the legitimate interests of both citizens and businesses.

|

According to the Ministry of Construction, apartment prices in major cities like Hanoi and Ho Chi Minh City remain high. In Q3/2025, newly launched projects averaged VND 78 million/m², with over 30% of new supply priced above VND 100 million/m². In Hanoi, primary apartment prices surged to an average of VND 95 million/m², with over 43% of new supply exceeding VND 120 million/m². Ho Chi Minh City saw a similar price surge, averaging VND 91 million/m², with many central projects reaching VND 120-150 million/m². In response, the Ministry of Construction is researching mechanisms and policies to control and stabilize real estate prices, as directed by the Prime Minister. |

Hồng Khanh

– 19:30 10/11/2025

Hanoi, Ho Chi Minh City Apartment Prices Surge, Outpacing Real Income Growth: VARS Warns of Potential Housing Bubble Risk

VARS expresses concern that the sharp rise in housing prices not only limits access to affordable homes for the majority of the population but also heightens the risk of a price bubble forming.

Vitadairy Honored with International Award for Digital Transformation

With relentless efforts in applying 4.0 technology to streamline financial and cash flow management, VitaDairy was honored on October 30th at the CorporateTreasurer Awards 2025. The company received the prestigious Excellence in Cash Management award, selected by The CorporateTreasurer magazine (Hong Kong, China).