Numerous real estate projects launched at high prices

According to the Ministry of Construction, in the first nine months of 2025, over 1,810 housing and new urban area projects were initiated nationwide. These included 1,071 commercial housing projects with nearly 400,000 units, 478 infrastructure development projects for land use rights transfer, and 312 social housing projects with approximately 245,469 units.

By September 2025, the total number of real estate transactions nationwide reached around 430,769, a slight 1% increase compared to the same period in 2024. In Hanoi and Ho Chi Minh City, apartment prices averaged between 70 and 80 million VND per square meter, with some luxury projects exceeding 150 million VND per square meter.

The economic recovery (Q3 2025 GDP growth of 8.23%) and increased public investment have been key drivers shaping and boosting the market.

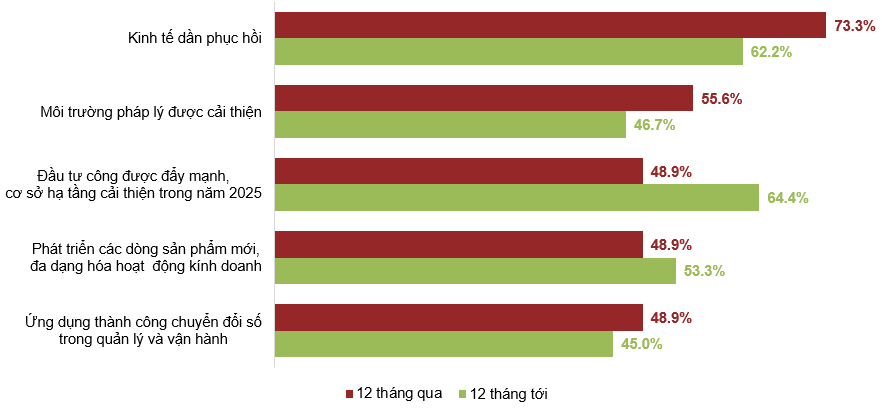

Key Drivers Shaping the Real Estate Sector in 2025

(Unit: Percentage)

Source: Vietnam Report

Optimistic outlook with supportive policies

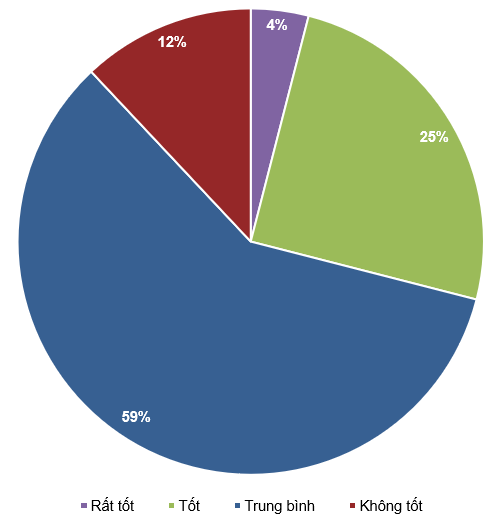

A Q3 2025 broker survey by Batdongsan.com.vn revealed that new supply absorption remains positive, with 88% of respondents rating it as average to good, while only 12% found it less favorable.

New Supply Absorption in Q3/2025

(Unit: Percentage)

Source: Batdongsan.com.vn

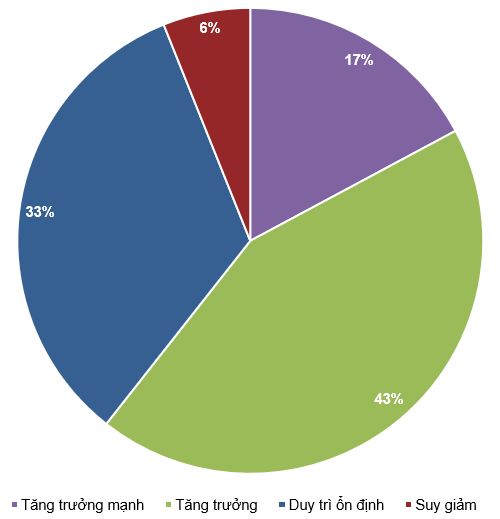

For Q4 2025, 60% of brokers anticipate continued market growth, with 17% expecting strong growth and only 6% concerned about a potential decline.

Market Outlook for Q4/2025

(Unit: Percentage)

Source: Batdongsan.com.vn

In summary, the real estate market is experiencing a sustainable recovery, supported by synchronized development policies and a return of investment to mid-range apartments and land plots with clear legal status.

Enterprise Analysis Department, Vietstock Advisory

– 09:42 12/11/2025

Exclusive Bond Offering: TNR Stars Vĩnh Bảo Secures Additional Investment Lot

Revised Introduction:

May – Diêm Sài Gòn, the developer behind TNR Stars Vĩnh Bảo, has recently launched the MSG32506 bond series, valued at 470 billion VND.

Ho Chi Minh City Real Estate: Scarce Supply Meets Dwindling Affordability

Residential real estate in Ho Chi Minh City faced continued challenges in Q3 and the first nine months of 2025, marked by persistent supply shortages and declining affordability. These pressures have accelerated a trend of homebuyers shifting their focus to neighboring provinces.

Why Do Many Businesses See Their Profits Vanish?

In this year’s third-quarter financial reporting season, numerous businesses have voiced concerns over significant disparities in their financial performance compared to the same period last year. Some companies have experienced near-total evaporation of sales revenue, resulting in a sharp decline in profits.