Vietnam’s stock market is experiencing significant volatility, with a widespread decline across most stock groups. From its recent peak, the VN-Index has lost over 200 points, equivalent to nearly 12%. In the first session of the week alone, the VN-Index dropped 18 points, retreating to around 1,580 points.

Amid weakening demand and escalating selling pressure, the market’s downward trajectory shows no signs of abating. Sessions with losses exceeding 1% are becoming increasingly frequent, reflecting the prevailing caution and concern among investors.

In his latest Facebook post, Mr. La Giang Trung, CEO of Passion Investment, notes that during market corrections, pessimism often takes hold, and numerous reasons are cited for the decline. However, the most critical question remains: does the current decline fully reflect these concerns?

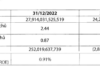

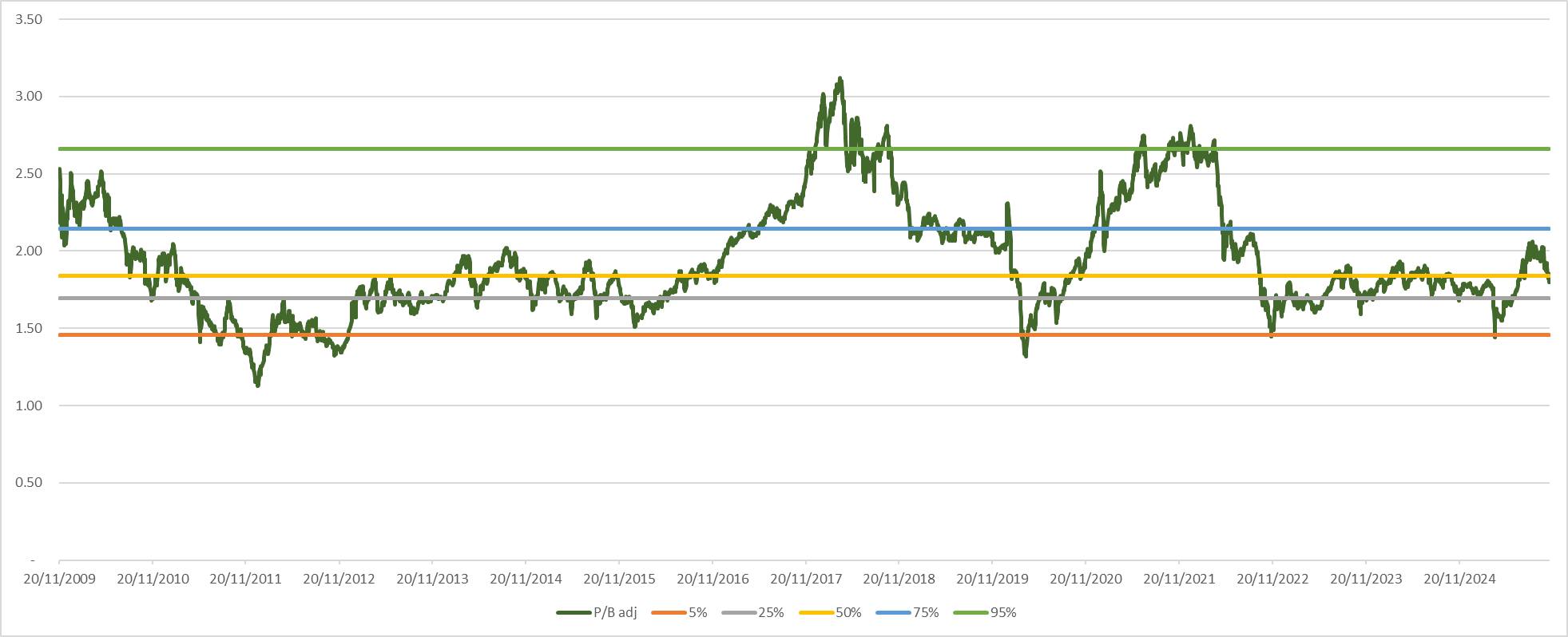

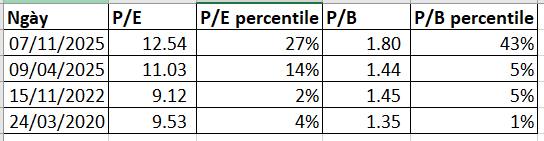

During downturns, the most reliable factor for investors to hold onto is valuation. As of November 7, 2025, the market’s average P/E (excluding the Vin group) stands at 12.54 times, 14% higher than the “tariff bottom.” Compared to valuations during the COVID-19 pandemic in 2020 and the 2022 crisis, current levels are still 32% higher.

This suggests that, assuming the market won’t worsen beyond the “tariff bottom” of April, current prices are already reasonable for any investor. A further 10% correction would bring the market close to “tariff” valuation levels. For those anticipating extreme scenarios like a repeat of COVID-19 or the 2022 crisis, waiting for a 20-25% discount before investing might be prudent.

However, there’s currently no substantial reason for pessimism. As the world gradually moves toward monetary policy easing, Vietnam is preparing its five-year plan with high expectations for economic growth and structural reforms.

“Betting against Vietnam’s stock market now is almost like betting that the economy won’t stay on track. Personally, I believe Vietnam will continue its successful economic development, as it has for over 30 years since the introduction of the Enterprise Law,” Mr. La Giang Trung stated.

In late August, the Passion Investment expert also expressed optimism about the stock market. He noted that global financial markets are in an easing cycle, with the Fed signaling rate cuts and a return to accommodative monetary policy. Domestically, the State Bank of Vietnam is actively facilitating growth through monetary measures, given clear growth objectives.

According to Mr. La Giang Trung, the principle of “Don’t fight the Fed” and the perspective of legendary investor Stanley Druckenmiller emphasize that monetary policy is the key market driver, even more so than corporate earnings. With the Fed and global central banks injecting liquidity, and domestic easing signals lasting at least another year, capital will continue flowing into assets like stocks.

The expert stresses the importance of focusing on the bigger picture and long-term trends. As liquidity remains robust, the market still has upward potential. Short-term fluctuations or individual stock movements won’t alter the long-term trajectory. Liquidity is 2-3 times higher than pre-2020 levels, and current valuations are only halfway through the previous cycle.

When asked how long the market can continue rising, the CEO of Passion Investment believes the “VN-Index will surpass even the most imaginative investor scenarios.”

Stock Market Slump Drags Down PYN Elite Fund’s Performance

The PYN Elite Fund’s investment performance continued its downward trajectory in October, experiencing a more significant decline compared to the VN-Index.

Stock Market Week 03-07/11/2025: VN-Index Plunges Below 1,600 Points – Is the Downtrend Far from Over?

The VN-Index plummeted sharply, shattering its August 2025 lows and breaching the psychological 1,600-point threshold in the final session of the week, extending its losing streak into the fourth consecutive week. Short-term risks are escalating amid weak liquidity and a lack of clear market catalysts.