I. MARKET DYNAMICS OF WARRANT CERTIFICATES

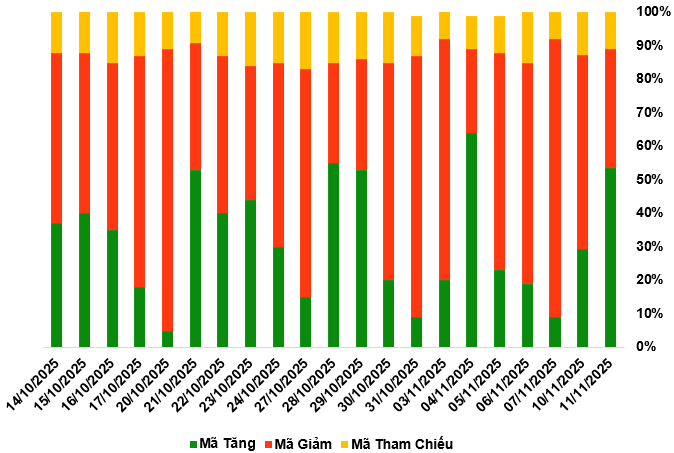

By the close of the trading session on November 11, 2025, the market recorded 161 gainers, 107 decliners, and 33 unchanged securities.

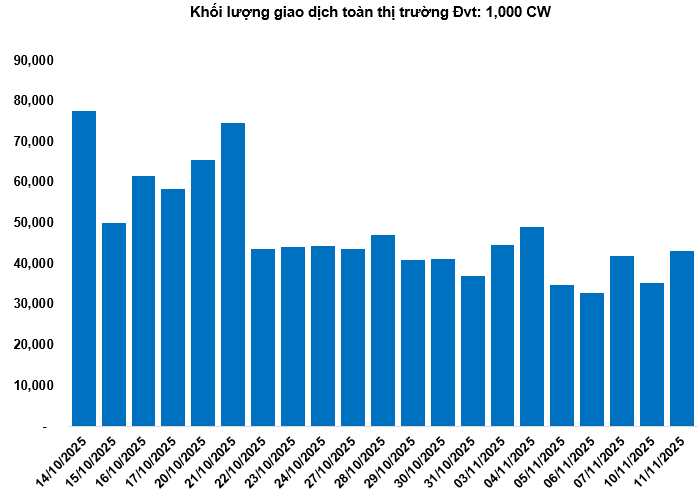

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

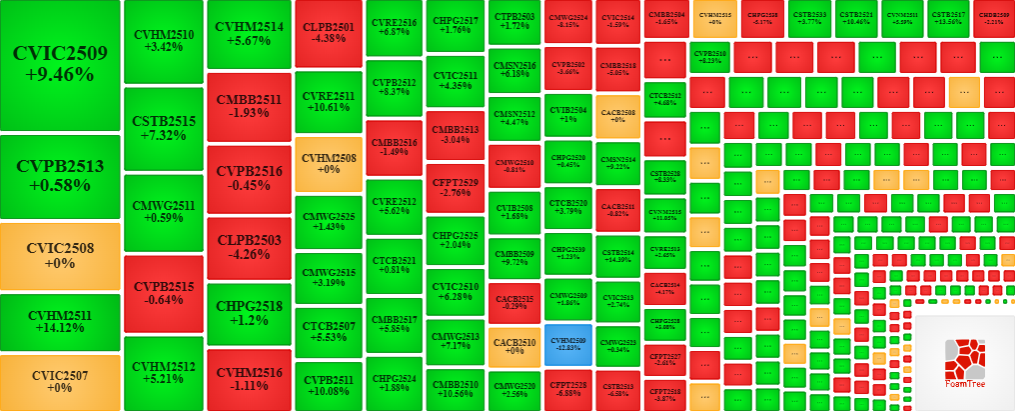

During the November 11, 2025 trading session, buyers regained control, driving prices higher for most warrant certificates. Notable gainers included CVIC2509, CVPB2513, CVHM2511, and CSTB2515.

Source: VietstockFinance

Total market volume on November 11 reached 42.97 million CW, up 21.95%; trading value hit VND 84.01 billion, a 31.15% increase from November 10. CMBB2518 led in both volume and value, with 3.92 million CW traded, equivalent to VND 7.27 billion.

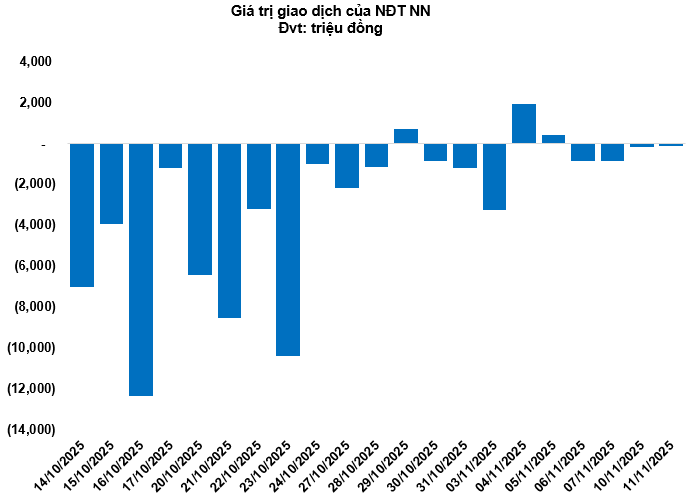

Foreign investors continued net selling on November 11, totaling VND 109.66 million. CSHB2505 and CSHB2513 saw the highest net outflows.

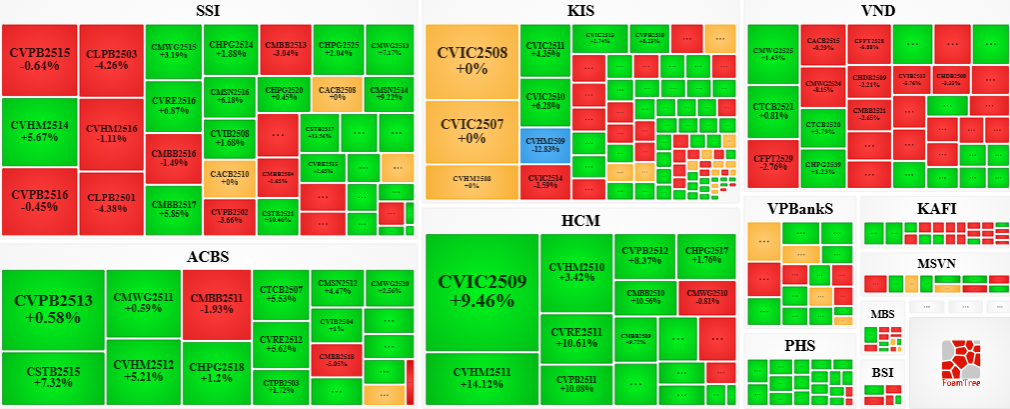

Securities firms SSI, KIS, VND, and ACBS are the leading issuers of warrant certificates in the market.

Source: VietstockFinance

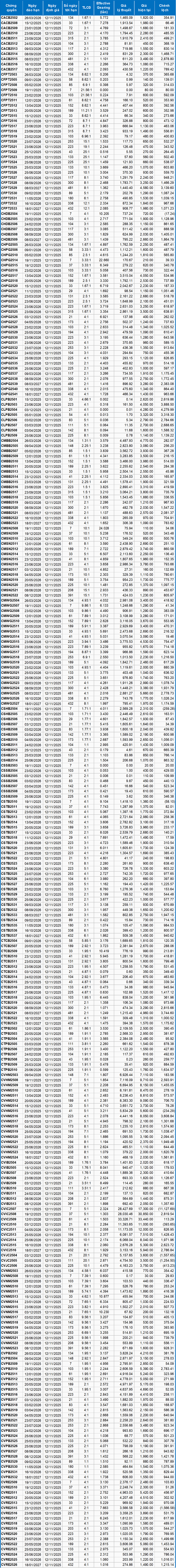

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from November 12, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each warrant type.

According to the valuation, CVIC2507 and CVRE2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CMSN2508 and CHPG2514 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 November 11, 2025

Central Bank Maintains Net Injection in Open Market Operations

During the week of November 3–10, the State Bank of Vietnam (SBV) continued its fourth consecutive week of net injection into the open market operations (OMO), with a total value exceeding 39 trillion VND, significantly higher than the 854 billion VND recorded in the previous week.

Banking Sector Profits Surge with Double-Digit Growth in First Nine Months of the Year

After the first nine months of 2025, most banks reported significant profit increases, even surpassing their targets, despite the pressure of narrowing net interest margins due to persistently low interest rates.