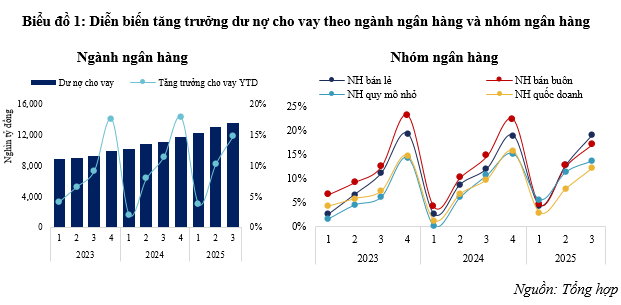

As of the end of September 2025, the credit growth across the entire banking system has surged by nearly 14% compared to the end of 2024, significantly outpacing the 9.11% recorded in the same period last year. This remarkable performance underscores a robust momentum in credit expansion, with the banking sector nearly achieving its annual target in just three quarters. According to the State Bank of Vietnam, given the current growth rate and capital absorption capacity, the full-year credit growth could reach 19–20%. If realized, this would mark the highest level in nearly 15 years, since 2011, significantly contributing to economic growth in the latter half of the year.

The banking sector is reaping substantial benefits from this credit expansion, despite lingering challenges related to net interest margins (NIM). The rapid credit growth has notably improved net interest income and third-quarter profits in 2025, laying a solid foundation for business performance during the period. However, the industry’s overall performance remains highly polarized. Based on third-quarter financial reports, changes in credit growth will become more apparent, offering clearer insights into year-end projections.

Industry-Wide Credit Growth

The banking system’s credit continues to surge, reflecting both ample capital supply from banks and increasing loan demand from the real economy. By sector, credit is primarily concentrated in production and trade services, with agriculture, forestry, and fisheries accounting for 6.23%, industry and construction at 23.97%, and trade and services at 69.8%. Notably, approximately 78% of total outstanding credit across the economy directly supports production and business activities, highlighting a strategic focus on value-creating sectors.

Alongside the broader trend, commercial banks have also reported impressive credit growth. According to third-quarter financial reports from 27 listed banks, total customer loans reached 13.63 million billion VND by the end of September, a 15% increase from the end of 2024—the highest since 2018. A notable shift in the third quarter is the reallocation of credit toward medium- and long-term loans, rather than short-term loans as previously observed. By the end of September, medium- and long-term credit grew by 17.32%, significantly outpacing the 12.65% growth in short-term credit.

The third-quarter credit growth landscape reveals notable shifts among bank groups. State-owned banks maintained a cautious stance, with growth rates 2–7% lower than private banks. Nonetheless, their cumulative growth by September reached 12.1%, an improvement from 9.7% in 2024. Private banks, meanwhile, demonstrated stronger growth momentum. A standout trend this year is the retail banking segment outperforming wholesale banking. By the end of the third quarter, retail credit grew by 19.0%, surpassing the 17.1% growth in wholesale credit. This shift raises questions about whether retail credit is regaining its role as a primary driver or if it reflects portfolio rebalancing.

Despite positive growth, wholesale banking’s expansion pace has slowed compared to the previous quarter, while smaller banks also experienced weaker growth, with a cumulative rate of approximately 13.6% in the third quarter. These developments align with earlier shareholder meeting directives, emphasizing credit allocation toward retail banking. This suggests a shift in credit focus to support domestic demand, sustaining economic recovery momentum.

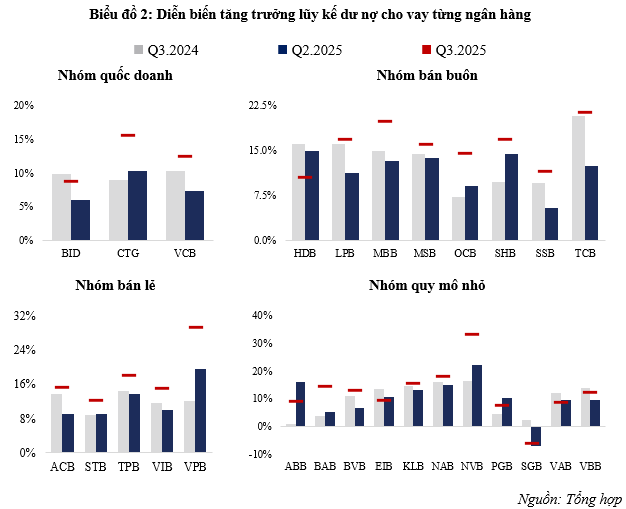

Bank-Specific Credit Growth

At the individual bank level, the third quarter of 2025 saw notable changes in credit growth. State-owned banks continued their cautious growth strategy, prioritizing risk management and non-performing loan resolution over credit expansion. Their growth rates hovered around the industry average. Among them, CTG stood out with a 15.6% increase, nearing its annual target. VCB improved its disbursement rate to 12.5%, up from the previous quarter. In contrast, BID achieved a modest 8.8% growth, significantly lower than the same period last year and only halfway to its annual goal. This indicates BID’s continued focus on addressing non-performing loans, particularly as on-balance-sheet bad debts surged in the first half of the year.

A key highlight this year is the rise of retail banks as the system’s growth leaders. VPB led with a 29.4% increase, solidifying its position among private banks. However, VPB’s growth structure shifted significantly, with retail lending (to businesses and individuals) declining from 44.54% at the end of 2024 to 38.37%, reflecting a strategic shift toward corporate clients to sustain growth. VPB also focused on trade and services while limiting real estate business loans. TPB, ACB, and VIB also recorded high growth rates. Although ACB did not disclose detailed debt structure, reports from TPB and VIB showed similar trends to VPB, reducing individual lending and increasing credit to trade and production sectors. Conversely, STB achieved a more modest 12.4% growth, reflecting challenges in maintaining momentum in individual and small business lending.

Wholesale banks exhibited clear differentiation. HDB grew below the industry average at 10.4%, having reduced real estate business loans by nearly 20% from the previous quarter and scaled back consumer lending. In contrast, TCB and MBB stood out with growth rates of 21.4% and 19.9%, respectively, a significant rebound from their sluggish second-quarter performance. Most other banks in this group also exceeded industry averages and improved year-over-year.

Smaller banks, however, experienced slower credit growth in the third quarter, highlighting competitive disparities and expansion limitations. Only 3 out of 11 banks in this group—NVB, KLB, and NAB—surpassed industry averages. Notably, KLB expanded its construction loan portfolio, which accounted for approximately 40% of its lending, nearly doubling from the previous year by the end of the third quarter.

Overall, third-quarter 2025 credit growth reflects a widespread recovery across the sector, albeit with lingering challenges. Some banks face pressure from non-performing loans and intense competition. Data also indicates that retail banks’ improved performance stems largely from portfolio restructuring, rather than a full recovery in individual loan demand. Moving forward, managing bad debt and directing capital toward production and trade sectors remain critical for the industry’s credit growth in the remainder of the year.

– 10:00 11/11/2025

Stock Market Liquidity Continues to Hit New Lows

Throughout today’s trading session (November 6th), the VN-Index predominantly fluctuated in negative territory. Despite briefly recovering to the reference level towards the close, the benchmark index struggled to maintain momentum. During the afternoon session, as T+ stocks became available for trading, sellers remained cautious, refraining from aggressive selling. This hesitation reflects the subdued sentiment surrounding short-term trading opportunities, which currently offer limited profit potential.