During the government’s regular press conference this weekend, Deputy Minister of Finance Nguyen Duc Chi stated that businesses are now in a favorable position to conduct initial public offerings (IPOs). Specifically, Decree 245/2025, which has recently been issued, facilitates a smoother process for companies to go public and list their shares.

According to the Deputy Minister, previously, after an IPO, companies typically required 3 to 6 months to complete the financial report audit. However, under the new regulations, this timeframe has been significantly reduced to approximately 30 days.

“The updated regulations streamline administrative procedures, enabling businesses to raise capital more swiftly, participate in listings, and attract investors,” he remarked.

With these more flexible mechanisms, the Ministry of Finance anticipates an increase in investment capital flowing into IPO stocks. This, in turn, will provide businesses with additional resources for production and operations, fostering greater confidence in the stock market.

Stock trading at Rong Viet Securities Corporation (Ho Chi Minh City) in October 2024. Photo: An Khuong |

In reality, 2025’s stable macroeconomic foundation has set the stage for a new wave of IPOs across various sectors. Notable deals include consumer sector companies like Highlands and Golden Gate; financial services firms such as TCBS, VPBankS, VPS, and F88; entertainment companies like DatvietVAC; technology firms including Misa and VNLife; and real estate companies such as VPL, TAL, Viettel IDC.

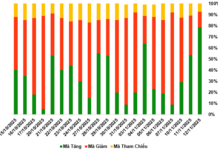

In a recent report, VNDirect Securities assessed that Vietnam’s IPO market is regaining momentum due to several favorable factors. The stable macroeconomic environment, both domestic and international monetary policy easing, and FTSE Russell’s upgrade of Vietnam to “secondary emerging market” status have expanded opportunities to attract foreign capital.

Additionally, the legal framework and corporate governance are increasingly robust, with more flexible regulations on foreign ownership and free-float ratios. The divestment of state-owned enterprises, administrative reforms, enhanced investor protection, and new technical infrastructure like the KRX system have laid a solid foundation for a booming IPO wave.

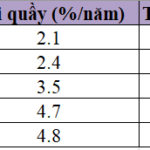

Beyond equities, the bond market also presents numerous opportunities during this period. This year, the issuance scale of government bonds is estimated at around 500 trillion VND, while corporate bonds—both public and private—are expected to reach approximately 500 trillion VND.

“The total bond market size of about 1,000 trillion VND reflects a clear recovery after a period of stagnation,” Deputy Minister Nguyen Duc Chi noted.

However, the Ministry of Finance acknowledges that this scale does not yet match the potential and capital mobilization needs of the government and businesses in the coming period. Therefore, the Ministry is developing solutions to enhance the bond market, facilitating stable long-term capital mobilization.

The 2024 Securities Law introduces new provisions on corporate bond issuance and investor criteria. Currently, the Ministry of Finance is finalizing a draft decree to guide these regulations, expected to take effect from January 1, 2026. According to the Deputy Minister, this draft will be widely consulted. The Ministry will incorporate feedback to refine processes, clarify issuer responsibilities, and enhance bond quality. The decree will also establish specific criteria for investors participating in different bond types, with strengthened oversight to ensure a safe and transparent market.

“We anticipate that 2026 will be a period of robust growth for both the stock and bond markets, helping to share the burden of capital mobilization with the banking credit system,” Mr. Chi added.

Phuong Dung

– 20:26 09/11/2025

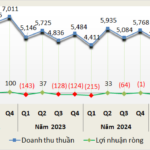

Cement Industry Profits Surge in Q3, Anticipating Strong Year-End Growth

Third-quarter revenue for 17 listed cement companies rose 6%, with industry-wide profits surpassing 70 billion VND, a stark reversal from the 60 billion VND loss incurred in the same period last year. This marks the second consecutive profitable quarter. Fueled by increased public investment disbursement and a gradually recovering real estate market, the sector is poised for accelerated growth in the final months of the year.

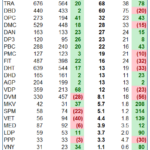

Q3 Pharmaceutical Sector: Sustaining Growth Momentum

The strategic restructuring of product portfolios, coupled with the advantages gained from the 2024 year-end policies, has significantly bolstered the performance of most pharmaceutical companies in Q3 2025.