Technical Signals of VN-Index

During the morning trading session on November 11, 2025, the VN-Index saw a slight recovery with a long upper shadow candlestick and low trading volume, indicating investor caution.

The previous low from August 2025 (equivalent to the 1,605–1,630 point range) has been breached, transforming it from a support to a strong resistance level in the near future.

Technical Signals of HNX-Index

During the morning trading session on November 11, 2025, the HNX-Index halted its decline, forming an Inverted Hammer candlestick pattern.

Recent trading volumes have remained below the 20-day average, reflecting investor caution as the Stochastic Oscillator and MACD indicators have yet to signal a buying opportunity.

DCM – Petrovietnam Fertilizer and Chemicals Corporation (PVFCCo)

During the morning trading session on November 11, 2025, DCM shares exhibited sideways movement, forming a Doji candlestick after three consecutive declining sessions. Reduced trading volume in the morning session underscores investor caution.

Currently, the stock price remains below the Middle line of the Bollinger Bands, while the Stochastic Oscillator continues to decline after issuing a sell signal. This suggests a bearish short-term outlook.

Additionally, the death cross between the 50-day SMA and 100-day SMA has formed, with the price staying below the 200-day SMA, further supporting a negative mid-term scenario for DCM.

VJC – Vietjet Aviation Joint Stock Company

During the morning trading session on November 11, 2025, VJC shares declined for the fifth consecutive session, remaining below the Middle line of the Bollinger Bands, reflecting persistent investor pessimism.

Furthermore, the MACD and Stochastic Oscillator indicators continue to decline after issuing sell signals, indicating a bearish short-term outlook.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:05 November 11, 2025

Vietstock Daily 12/11/2025: Market Pulls Back from Decline

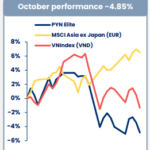

The VN-Index has rebounded, yet trading volume remains below its 20-day average, indicating lingering investor caution following the recent sharp decline. The Stochastic Oscillator continues to weaken in oversold territory. Should buy signals reemerge in upcoming sessions, the recovery outlook may strengthen.

Market Pressures Mount: What Lies Ahead for Stocks Next Week?

Last week, the VN-Index fell below the 1,600-point mark amid mounting pressure from a strengthening USD/VND exchange rate and heavy net selling by foreign investors. Despite positive macroeconomic data and third-quarter corporate earnings, analysts predict that the stock market may shift toward a consolidation phase next week, testing the support range of 1,550–1,580 points in the short term.