In early November 2025, a bombshell announcement shook Wall Street: Michael Burry, the Scion fund manager famously portrayed in “The Big Short,” had shorted a staggering $1.1 billion against two of the world’s hottest tech stocks—Nvidia ($187 million) and Palantir ($912 million).

Nvidia is a household name by now—the world’s most valuable company, with a market cap surpassing $4.5 trillion at its peak, supplying 90% of the globe’s AI chips, and at the heart of the US-China AI arms race.

But Palantir, the focal point of Burry’s short strategy, remains more enigmatic to global investors. What exactly does Palantir do? Is it a bubble waiting to burst? And has the legendary short-seller Michael Burry miscalculated by betting against this shadowy powerhouse?

The Palantír from “The Lord of the Rings,” a magical orb capable of seeing across vast distances. Image: New Line Cinema.

|

From PayPal to the Pentagon: The Birth of a Data Empire

To understand Palantir, we must trace its origins to billionaire Peter Thiel and the “PayPal Mafia.” This group of PayPal’s early founders and executives went on to create tech giants like YouTube, LinkedIn, Yelp, and Tesla.

At PayPal, Thiel witnessed firsthand the power of data analytics in combating payment fraud. He had an epiphany: if this technology could catch financial scammers, why not terrorists?

In 2003, with America still reeling from 9/11, Thiel teamed up with Alex Karp, an eccentric philosophy PhD, and a band of brilliant engineers to found Palantir. The name, inspired by the all-seeing orbs in “The Lord of the Rings,” perfectly encapsulates the company’s mission: to reveal hidden connections within vast oceans of data.

Palantir’s first outside investor was none other than the CIA, through its venture fund In-Q-Tel. This fateful partnership embedded Palantir into the heart of America’s national security apparatus from day one.

The Operating System of Power

Palantir doesn’t sell off-the-shelf software. It builds data “operating systems” deeply embedded into its clients’ operations. Its core products include:

Gotham: Designed for intelligence and defense agencies like the CIA, FBI, and NSA. Gotham fuses data from wiretaps, bank records, and satellite imagery to create a “panoramic view,” helping the US military map bomb networks in Afghanistan or law enforcement track criminals.

Foundry: Gotham’s corporate twin. Giants like JPMorgan Chase use it to detect fraud, Airbus to optimize supply chains, BP to model oil rigs, and Merck to manage clinical trials.

Apollo: The backend engine ensuring Gotham and Foundry stay updated and secure, even on classified government networks.

Most recently, Palantir launched AIP (Artificial Intelligence Platform), enabling organizations to integrate generative AI into internal data. This lets a general predict enemy attacks or a manager foresee supply chain risks.

An Empire Under Fire

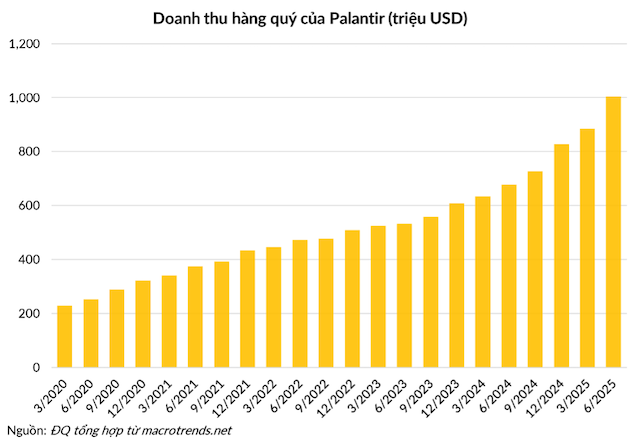

From a secretive startup, Palantir has grown into a $461 billion behemoth (as of November 10, 2025). But its success is mired in controversy.

First, its role in immigration enforcement. Palantir’s platforms help US Immigration and Customs Enforcement (ICE) identify deportation targets, fueling mass raids and humanitarian crises like family separations.

Second, concerns over privacy and “predictive policing.” Palantir’s tools let police predict crime hotspots and even flag individuals as future offenders. Critics warn this risks entrenching racial bias, as algorithms trained on skewed data create a self-fulfilling prophecy: more policing in minority areas leads to more arrests, feeding the system and reinforcing stereotypes.

Third, its creeping reach into sensitive civilian domains. In the UK, Palantir won a £330 million contract to manage the entire NHS patient database. Entrusting the health records of 68 million Britons to a CIA-backed defense contractor has sparked grave concerns about data sovereignty and privacy.

Bubble or Market Manipulation?

After Burry’s massive short position was disclosed, Palantir CEO Alex Karp called it “ludicrous” and “market manipulation.” Karp argued that Palantir’s record earnings left no justification for shorting.

Burry fired back on X: “No surprise Karp and his ‘ontology’ can’t decipher a simple 13F.” (Referring to Karp’s philosophy PhD and frequent mentions of “ontology” in interviews, implying Karp misinterprets his short thesis.)

Being Right Too Soon Is Still Being Wrong

In “The Big Short,” Burry began shorting mortgage-backed securities (MBS) in 2005 via credit default swaps (CDS). The housing market showed no cracks yet. Until it collapsed, his fund bled CDS premiums, hurting performance.

When a major investor threatened to pull out, Burry famously said, “I may be early, but I’m not wrong.” The investor replied, “Being early is the same as being wrong.” This exchange perfectly captures the risk in Burry’s current bet.

Wall Street history is littered with traders who correctly called a bubble, went all-in short, but were crushed as the bubble irrationally expanded. They scramble for margin, eventually capitulate, and go bust—only for the bubble to pop shortly after.

As economist John Maynard Keynes observed in the 1930s, “The market can remain irrational longer than you can remain solvent.”

Burry may be right that Palantir is overvalued. But in a market intoxicated by AI’s limitless potential, irrationality can persist for years. Palantir’s power lies not just in financials but in its irreplaceability—its deep integration into the data “nervous systems” of governments and corporations.

Once you’re the operating system for the Pentagon or NHS, replacement becomes nearly impossible due to the complexity of Palantir’s systems. This economic moat may be what Burry underestimates.

The battle between these titans remains undecided, but it’s shown the world this: in the AI era, the line between tech visionary and dangerous bubble is thinner than ever.

By Đức Quyền

– 19:00 11/11/2025

Market Upgrade Initiative: Ministry of Finance Outlines Pilot Roadmap for Short Selling and Day Trading

The Ministry of Finance has officially issued Decision No. 3761/QĐ-BTC dated November 6, 2025, outlining the implementation plan for Decision No. 2014/QĐ-TTg, which approves the project to upgrade Vietnam’s stock market.

How a $5 Trillion CEO Closes Deals: Beer, Fried Chicken, and a 50,000 GPU Deal with Samsung’s Chairman

Samsung is set to acquire 50,000 Nvidia graphics processors to enhance its chip manufacturing capabilities for mobile devices and robotics.