Leveraging a Distinctive Expanded Ecosystem

The competitive advantage and sustainable growth momentum in the new phase, according to the leadership of Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB), stem significantly from the strategy to build a comprehensive financial ecosystem—a key focus during the recent Q3 investor meeting.

“We had a successful Q3, marked by significant financial milestones and ecosystem achievements. Amidst a market full of opportunities, VPBank remains committed to its strategy of steadily building a robust ecosystem and maintaining flexible business operations,” stated Ms. Lưu Thị Thảo, Deputy CEO and Senior Executive Director of VPBank, and Vice Chairwoman of the Board of Directors at GPBank, during the investor meeting.

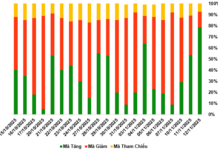

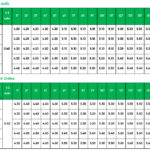

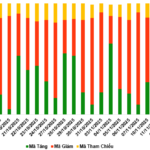

According to MB Securities (MBS), VPB is progressively refining its ecosystem, with FE CREDIT reporting profits for six consecutive quarters and VPBankS achieving a profit surge since Q4/2024.

“The IPO of VPBankS enhances its competitive edge as the stock market rebounds. The group’s synergy, coupled with strategic investors like SMBC, will bolster the competitiveness of the private bank with the largest total assets in the industry by the end of Q2/2025,” noted the MBS research team in their late October report.

Despite occurring during a volatile stock market period, the VPBankS IPO attracted over 13,000 successful registrations with a total value of 13.237 trillion VND, surpassing the offering value. Similarly, FE CREDIT has rebounded following a comprehensive restructuring led by its major shareholders, VPBank and SMBC Consumer Finance (SMBCCF). Since Q2/2024, FE CREDIT has returned to profitability, reporting six consecutive profitable quarters by Q3/2025.

These figures contributed to the Q3 and 9-month business results. By the end of Q3, VPBank’s consolidated total assets reached nearly 1.18 million billion VND, up over 27.5% year-to-date and exceeding the plan approved by the Annual General Meeting. Consolidated pre-tax profit for Q3 was 9.166 trillion VND, a 77% increase year-over-year and the second-highest in history.

The VPBank Securities (VPBankS) research team estimates that FE CREDIT, VPBankS, and OPES will contribute approximately 22.5% to VPBank’s consolidated pre-tax profit this year, with an average contribution of 23.8% during 2025-2027.

For Prosperity of the People Commercial Bank (GPBank), its 9-month pre-tax profit in 2025 reached nearly 400 billion VND, equivalent to 80% of the annual plan (500 billion VND). This not only marks a return to profitability after years of losses but also reflects the bank’s remarkable recovery in less than a year since joining the VPBank group.

Why is the ecosystem a differentiator?

In an era where global financial conglomerates are embracing “ecosystem banking”—where banks evolve beyond traditional financial services to become hubs connecting all customer needs—VPBank stands out as a pioneer in implementing this strategy systematically and consistently.

According to Ernst & Young (EY), banks adopting the ecosystem model not only offer individual financial products but also “bundle” multiple services, both financial and non-financial, to address customers’ comprehensive needs. McKinsey & Company’s report further highlights that ecosystems enable banks to expand into new services, leverage big data, and develop innovative business models beyond traditional lending and mobilization.

At VPBank, a distinctive expanded ecosystem is built with the parent bank overseeing strategy, technology platforms, and risk management systems, ensuring the entire ecosystem operates on a unified “digital infrastructure” and “data language.”

From this core, subsidiary companies develop specialized yet interconnected areas along the value chain: VPBank Securities (VPBankS) leads in investment banking and securities; FE CREDIT extends consumer finance, enabling millions of unbanked customers to access essential loans; OPES pioneers digital insurance with AI applications; and GPBank, after a comprehensive restructuring under VPBank’s guidance, is repositioned with a unique focus on technology, SMEs, and individual customers. Supporting this structure are platforms like LynkID, the digital bank CAKE, and Be, forming a unified, intelligent, and seamless service network.

The differentiator lies in how VPBank transforms diversity into focused strength. Instead of operating in silos, ecosystem units share data platforms and leverage technology infrastructure. This enables customers to access a tailored product ecosystem, “bespoke” from traditional services to investments and insurance.

This “synergistic” approach has made the VPBank ecosystem a flexible yet cohesive structure. By leveraging customer networks and technology platforms, member units move faster while contributing back to the shared ecosystem.

– 10:33 10/11/2025

VPBank Chairman Goes Big: Launching Spectacular Projects to Welcome K-Pop Icon G-DRAGON!

As the exclusive title sponsor of G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI, presented by VPBank, the bank is redefining the role of a Title Sponsor with a series of unparalleled privileges exclusively tailored for Vietnamese fans.

Win Gold, iPhone, or MacBook Air When You Purchase Fund Certificates at VPBank

With a mission to promote smart investing and show gratitude to our customers, VPBankS is launching the “Invest in Open-Ended Funds, Conquer Prosperity” program from November 1, 2025, to January 31, 2026. By investing in open-ended fund certificates distributed by VPBankS through the NEO Invest platform or the VPBank NEO digital banking platform, investors can not only build sustainable wealth but also enjoy the opportunity to receive valuable eVouchers for purchasing gold, iPhones, or MacBook Airs.

VPBankS Set to Raise Up to 1 Trillion VND Through Bond Issuance

VPBank Securities JSC (VPBankS) is set to raise up to VND 1,000 billion through the issuance of VPX32501 bonds in November 2025. This strategic move aims to restructure the company’s existing loan obligations.