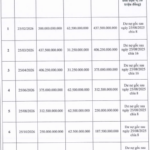

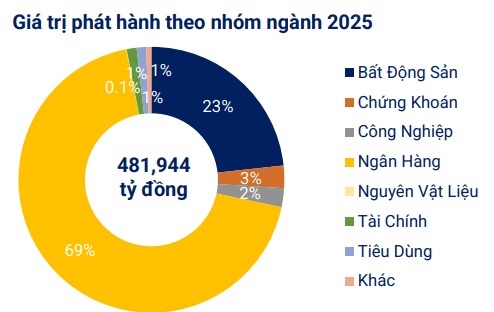

In the period under review, there were 38 private bond issuances totaling nearly VND 54.9 trillion, alongside 4 public issuances worth VND 2.3 trillion. The number of issuances surged by 68% year-on-year.

For the first 10 months of the year, cumulative private issuances reached over VND 431 trillion, while public issuances stood at nearly VND 50.6 trillion.

Source: VBMA

|

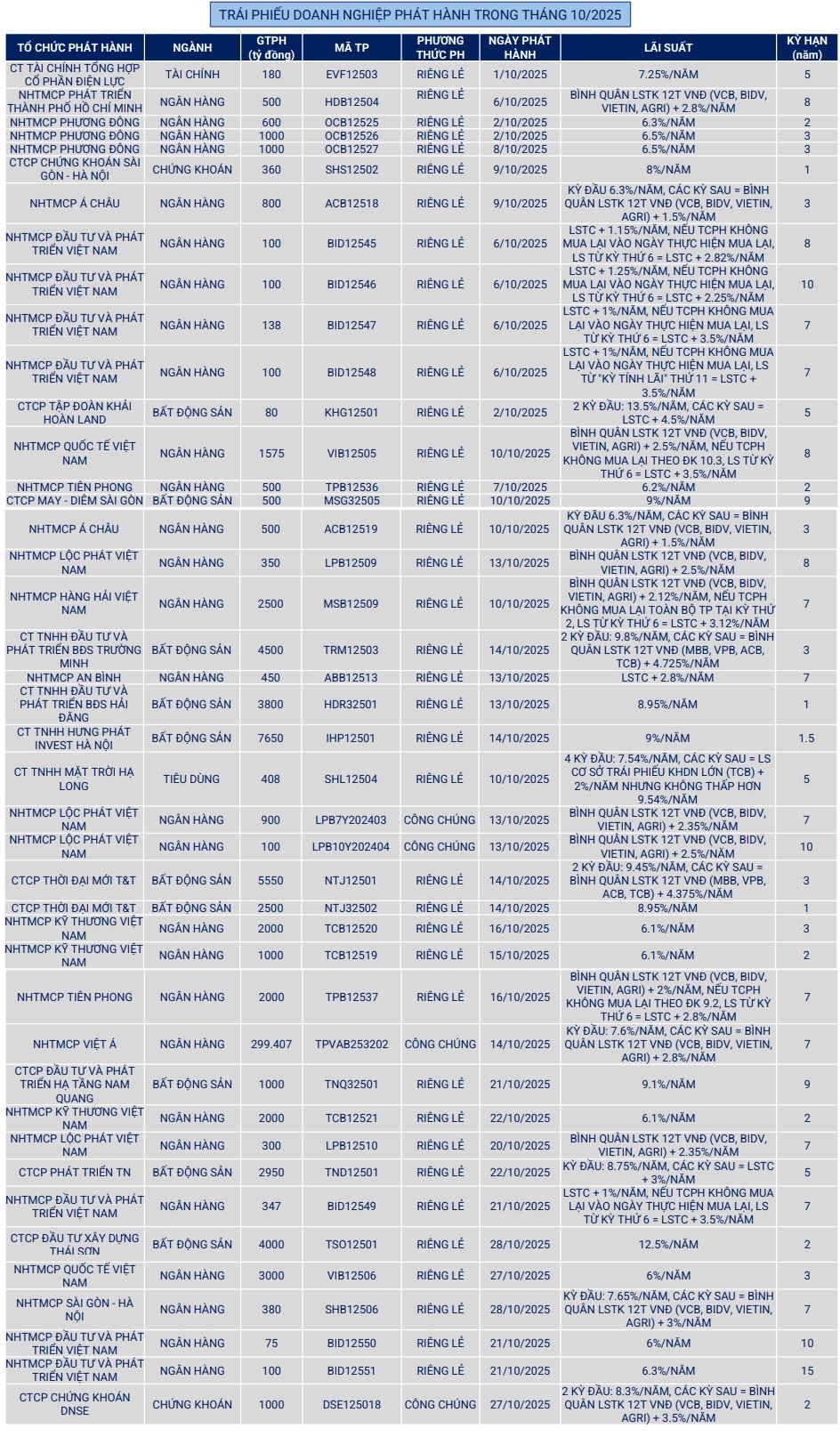

In October, companies repurchased over VND 9.9 trillion in bonds before maturity, a 44% decline compared to the same period in 2024. For the remaining two months of 2025, approximately VND 32.7 trillion in bonds are set to mature. In 2026, the maturity value is expected to reach nearly VND 213.6 trillion.

Source: VBMA

|

Source: VBMA

|

Regarding irregular disclosures, 5 bond codes experienced delayed interest and principal payments totaling VND 714 billion in October. On the secondary market, the total trading value of private corporate bonds in October 2025 reached nearly VND 102 trillion, averaging VND 4,424 billion per session, a 41% decrease from September’s average.

Looking ahead, two notable bond issuances are upcoming. First, BAF Vietnam Agriculture Corporation (BAF) has approved a public bond issuance plan for 2025, with a maximum value of VND 1,000 billion. These are “3 no” bonds: non-convertible, without warrants, and unsecured. The expected denomination is VND 100 million per bond, with a 3-year term and a 10% annual interest rate.

The proceeds will be allocated as follows: VND 670 billion to supplement capital for pig farming operations, and VND 330 billion to repay a portion of existing loan principals.

Next, BIDV (HOSE: BID) plans to issue bonds in Q4/2025, with a maximum value of VND 9,000 billion. These bonds are also non-convertible, without warrants, and unsecured, with an expected denomination of VND 100 million per bond. The bonds will have a minimum term of 5 years, featuring a combination of fixed and floating interest rates.

– 10:53 12/11/2025

The Housing Market: Riding High Despite Bond Maturity Pressures

In August, real estate bond maturities are set to reach a staggering VND 17.5 trillion ($743 million). Despite this, real estate companies are steadfast in their refusal to lower property prices, despite facing significant challenges with cash flow to service their debts.