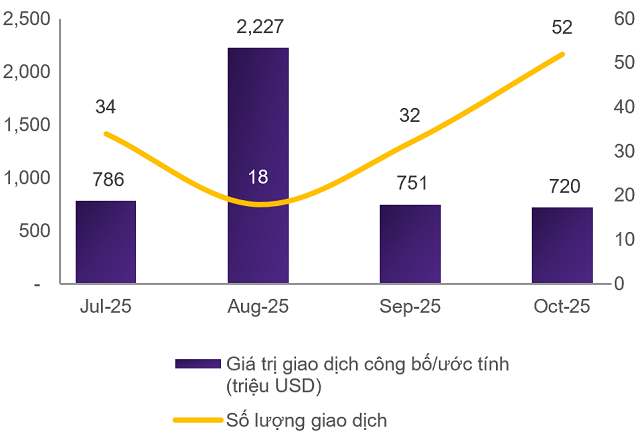

October’s total transaction value mirrored September’s, yet the volume and structure of deals signaled a clear recovery, predominantly driven by strategic M&A led by foreign investors, alongside the return of private equity (PE) funds and several “first-time” deals by foreign funds in Vietnam, according to a recent Grant Thornton report.

Real estate, energy, industrial manufacturing, and financial services continued to lead in transaction value, while investor interest is gradually expanding to other sectors with sustainable growth potential.

In terms of announced and estimated value, real estate and industrial manufacturing remained the largest sectors, with estimated values of approximately USD 225 million and USD 109 million, respectively. Energy saw a significant surge in both volume and value compared to previous months, reaching USD 115 million in transaction value.

Completed deals in October were primarily strategic M&A led by foreign investors, such as OCI Holdings acquiring 65% of Elite Solar Power Wafer, and Sumitomo Corporation (Japan) completing the purchase of 49% of Cuu Long Electrical Consulting and Development JSC, rather than restructuring deals by domestic conglomerates.

Capital from PE funds also began to return after a prolonged cautious period, with October witnessing several “first-time” deals by foreign funds in Vietnam, such as Ares Asia Private Equity investing in MEDLATEC and EMIA injecting capital into MyStorage.

Source: Grant Thornton

|

Notable M&A Deals in October

Real Estate Sector

Vincom Retail JSC (HOSE: VRE) transferred 99.99% of its equity in Vincom Real Estate LLC, owner of Vincom Center Nguyen Chi Thanh, to Bao Quan Trading Investment and Services LLC. The transfer value was approximately USD 133 million. Recently, VRE launched Vincom Mega Mall Ocean City (nearly 70,000 m²) and Vincom Mega Mall Royal Island (over 55,000 m²), and is planning to invest in shopping centers within the 2,870-hectare Can Gio coastal tourism urban area.

Manufacturing & Industrial Sector

OCI Holdings, a leading South Korean energy and chemicals conglomerate, through OCI ONE, a subsidiary of OCI TerraSus, acquired 65% of Elite Solar Power Wafer, a solar wafer manufacturing plant under construction in Vietnam. The project has an initial capacity of 2.7GW and a total investment of USD 120 million, with OCI ONE’s portion valued at approximately USD 78 million. The plant can be expanded to 5.4GW within six months with an additional USD 40 million investment, potentially doubling revenue in the near future.

Logistics & Infrastructure Sector

MyStorage, a tech-integrated self-storage provider established in 2019 in Vietnam, received a multi-million-dollar investment from Emerging Markets Investment Advisers (EMIA), a Singapore-based private equity firm. MyStorage currently operates four storage facilities in Ho Chi Minh City and Dong Nai. The investment aims to support MyStorage’s domestic and international expansion, as well as upgrade its digital platform to enhance customer experience.

Energy Sector

Sumitomo Corporation (Japan) completed the acquisition of 49% of Cuu Long Electrical Consulting and Development JSC (MEE JSC) from GreenSpark Group. MEE JSC owns the Dak Di 1 & 2 hydropower plants in Nam Tra My (Quang Nam) with a total capacity of 48MW, operational since 2022 and under a 20-year power purchase agreement with Vietnam Electricity (EVN). This marks Sumitomo’s first investment in Vietnam’s hydropower sector. Previously, Sumitomo was a major investor in industrial parks, with projects like Thang Long IP (Hanoi, 1997), Thang Long II (Hung Yen, 2006), Thang Long III (Vinh Phuc, 2015), and the upcoming Thang Long IV in Thanh Hoa in 2025.

Levanta Holding Pte. Ltd. acquired 80% of HBRE Gia Lai Wind Power JSC from Super Energy Group and Super Wind Energy for USD 33.1 million. HBRE Gia Lai is the developer of the 50MW HBRE Chu Prong wind power project in Gia Lai, operational since 2021.

Verdant Energy Pte. Ltd. completed the acquisition of a 11MW rooftop solar portfolio in Vietnam. The portfolio includes systems installed across 10 shopping centers, expected to generate over 11,700 MWh of clean energy annually, reducing emissions by approximately 8,100 tons of CO₂ per year. Verdant Energy, backed by global investor AP Moller Capital, specializes in renewable energy projects across the Asia-Pacific region.

Platinum Victory PTE, Ltd., the largest shareholder of Refrigeration Engineering Corporation (HOSE: REE), registered to purchase an additional 18.1 million REE shares. The expected transaction value is USD 43.6 million, from October 13 to November 11, 2025. If successful, Platinum Victory’s ownership in REE will increase from 41.64% to nearly 45% of the charter capital.

Agriculture & Livestock Sector

Dabaco Group JSC (HOSE: DBC) acquired an additional 2.5 million shares, equivalent to 41.67% of Thinh Phat Kim Son 1 JSC, to increase its charter capital for investing in a high-tech pig farming project in Bao Ha, Lao Cai. The total investment is approximately VND 560 billion, with implementation from 2025 to 2027. Post-transaction, Dabaco will own 88.18% of Thinh Phat Kim Son 1’s charter capital.

Consumer Sector

Coolmate, a Vietnamese D2C men’s brand, announced the completion of its Series C funding round. The deal was led by Vertex Growth Fund (backed by Temasek), with participation from Cool Japan Fund (backed by the Japanese Government), Youngone CVC (a South Korean top-3 apparel group’s investment arm), and existing investors Vertex Ventures SEA & India and Kairous Capital. The investment will be used to expand into the women’s market (Go Women), develop offline sales channels (Go Offline), and pursue international expansion (Go Global).

Healthcare Sector

On October 23, 2025, MEDLATEC Healthcare Corporation announced that Ares Asia Private Equity, part of Ares Management Corporation (NYSE: ARES), a leading global asset manager, became its strategic investor. This marks Ares Asia Private Equity’s first healthcare investment in Vietnam. Founded in 1996, MEDLATEC operates a network of general hospitals, clinics, and diagnostic services.

VIDIPHA Central Pharmaceutical JSC (HOSE: VDP) announced that DSC Securities JSC (HOSE: DSC) became a major shareholder. The transaction occurred on October 8, with an estimated value of VND 214 billion (approximately USD 8 million). Post-transaction, DSC’s ownership increased from 4.923% to 19.77% of VDP’s charter capital.

Utilities Sector

Private Infrastructure Development Group (PIDG), through its member InfraCo, invested VND 218.6 billion (USD 8.68 million) in Hoa Binh – Xuan Mai Clean Water LLC, a project under AquaOne Group. The investment will fund the construction of a 150,000 m³/day water treatment plant, including raw water intake, treatment, storage, and distribution facilities, to supply clean water to rural and suburban areas in Phu Tho Province. Previously, GuarantCo, another PIDG entity, guaranteed VND 875.1 billion (USD 34.5 million) for a 20-year green bond issued by Hoa Binh-Xuan Mai in 2024. This is the first phase of the Xuan Mai Water Complex, with the second phase, Xuan Mai-Hanoi, receiving a VND 317.2 billion (USD 12.5 million) guarantee and equity commitment from PIDG. AquaOne, founded by Do Thi Kim Lien (Shark Lien), owns several large-scale water plants nationwide, including Song Duong, Phu Yen, and Vam Co Dong.

Financial Sector

TPBank (HOSE: TPB) will acquire additional shares in Tien Phong Securities JSC (TPS, HOSE: ORS) through a private placement of 287.9 million shares at VND 12,500 per share, totaling nearly VND 3,600 billion (approximately USD 137 million). Post-transaction, TPBank’s ownership in TPS will increase from 9.01% to 51% of the charter capital, while TPS’s charter capital will rise from VND 3,340 billion to over VND 6,239 billion.

Other Notable Information

On October 1, 2025, in Hanoi, De Heus Group, a leading animal feed producer, signed an agreement to acquire 100% of CJ Feed & Care Group (South Korea) for approximately USD 852.27 million.

Under the agreement, De Heus will take over all of CJ Feed & Care’s operations in Vietnam, Indonesia, South Korea, Cambodia, and the Philippines, including 17 feed production plants, with 7 plants in Vietnam having a total capacity of over 1 million tons/year.

Since entering Vietnam in 2008, De Heus has expanded through M&A. Notably, in 2021, the group acquired Masan’s entire animal feed division (Proconco/Cam Con Co and ANCO), becoming Vietnam’s largest animal feed producer.

– 09:49 10/11/2025

The New “Promised Land” Revealed: Massive Investment Floods into a Central Province

As of May 10, 2025, 85 new projects have been approved, with a total registered capital of 114.356 trillion VND. This marks a 93.2% increase in the number of projects and a 347.5% surge in capital compared to the same period in 2024.