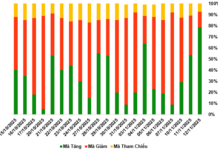

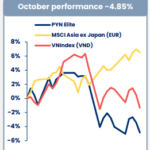

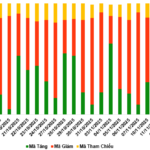

The market has maintained a steady upward trend since April, consistently reaching new all-time highs. However, from mid-October onwards, the VN-Index has experienced several strong correction sessions, reflecting increased profit-taking pressure and a more cautious investor sentiment. The widespread adjustment across most sectors suggests that the market is likely entering a phase of correction and reaccumulation.

Market Continues to Adjust and Accumulate Before Entering a New Wave

In a recent report, VNDirect noted that the strong and continuous rise over the past five months has significantly increased the valuation levels of the stock market compared to the beginning of the year.

However, following the positive Q3/2025 earnings season and the short-term correction in the latter half of October, the trailing P/E ratio of the VN-Index has decreased to 14.3 times, lower than the 5-year average of 15.3 times. While not yet cheap, the market valuation is supported by a robust macroeconomic foundation, prospects of market upgrades, and positive earnings expectations for listed companies.

Projections indicate that companies on the HoSE could achieve EPS growth of approximately 20–22% in 2025. This keeps the forward P/E of the VN-Index around 14 times, maintaining the Vietnamese stock market’s valuation at a relatively attractive level. This attractiveness forms a basis for drawing additional capital from both domestic and foreign investors. Additionally, in terms of P/B, the VN-Index is currently at a reasonable valuation level with a P/B ratio of 2.0 times, 8.9% lower than the 5-year average.

In the base scenario,

the VN-Index is expected to adjust and trade in an accumulation range over the next 1–2 months before resuming its upward trend.

The index may retest the 1,600-point region (±20 points) to absorb low-priced supply before targeting the 1,720-point resistance level in Q1/2026.

Risks for Investors Trading Out of Sync

During the correction and reaccumulation phase following a prolonged rally, the index’s narrow trading range poses risks for investors who trade out of sync. Therefore, analysts recommend that investors focus on risk management by restructuring their portfolios and maintaining leverage ratios at safe levels.

Simultaneously, investors should prioritize holding and seeking opportunities in fundamentally strong stocks with positive Q3/2025 results and clear growth potential—especially those directly benefiting from market upgrade prospects—to prepare for the next VN-Index rally.

Over the next 6–9 months, VNDirect maintains a positive outlook on the Vietnamese stock market. In the base scenario, the brokerage firm expects the VN-Index to target the 1,850–1,900 point range, supported by multiple strong catalysts.

The macroeconomic environment is projected to remain stable and favorable, with high economic growth sustained by proactive and effective fiscal policies. Additionally, foreign capital is expected to return soon after Vietnam is officially upgraded to “secondary emerging market” status by FTSE Russell. The Federal Reserve’s anticipated monetary policy easing, including interest rate cuts, will further create a conducive environment for global capital flows.

Moreover, listed companies’ earnings are forecast to remain positive, bolstering investor sentiment and providing room for market re-rating in the coming period.

Afternoon Technical Analysis, November 12: Cautious Sentiment Persists

The VN-Index and HNX-Index experienced a modest recovery, marked by small-bodied candles and subdued trading volumes in the morning session, indicating investor caution.

Market Pulse 11/11: Blue-Chip Stocks Return, VN-Index Sustains Uptrend

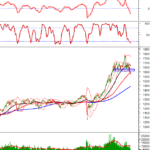

Despite a period of intra-session volatility, the market demonstrated robust momentum in the afternoon session, closing predominantly in the green. The VN-Index surged by over 13 points to reach 1,593.61, while the HNX-Index climbed 3 points, settling at 261.08.

Vietstock Daily 12/11/2025: Market Pulls Back from Decline

The VN-Index has rebounded, yet trading volume remains below its 20-day average, indicating lingering investor caution following the recent sharp decline. The Stochastic Oscillator continues to weaken in oversold territory. Should buy signals reemerge in upcoming sessions, the recovery outlook may strengthen.