I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On November 12, 2025, VN30 futures contracts saw a unanimous surge. Specifically, 41I1FB000 (I1FB000) rose by 3.06%, closing at 1,870.6 points; VN30F2512 (F2512) increased by 3.31%, reaching 1,870 points; 41I1G3000 (G3000) climbed 3.3%, ending at 1,867.6 points; and 41I1G6000 (I1G6000) gained 2.96%, closing at 1,855.9 points. The underlying index, VN30-Index, concluded the session at 1,872.27 points.

Additionally, VN100 futures contracts also experienced a collective rise on the same day. Notably, 41I2FB000 (I2FB000) advanced by 3.01%, hitting 1,783.7 points; 41I2FC000 (I2FC000) rose by 2.89%, reaching 1,780 points; 41I2G3000 (I2G3000) increased by 3.25%, closing at 1,780 points; and 41I2G6000 (I2G6000) gained 2.55%, ending at 1,756.6 points. The underlying index, VN100-Index, finished at 1,779.78 points.

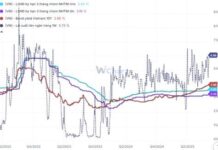

During the November 12, 2025 session, 41I1FB000 rebounded and exhibited a tug-of-war dynamic, with buyers gaining the upper hand in the first half. The Long side gradually dominated, propelling I1FB000 to a robust rally for the remainder of the morning session. In the afternoon, selling pressure virtually disappeared, allowing buyers to effortlessly drive the contract higher until the close, ending the day in positive territory with a 55.6-point gain.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

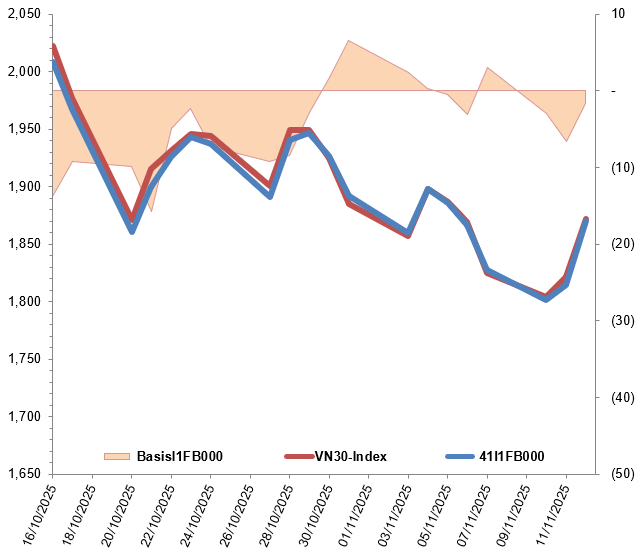

At the close, the basis of the 41I1FB000 contract narrowed compared to the previous session, settling at -1.67 points. This indicates a less pessimistic sentiment among investors.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

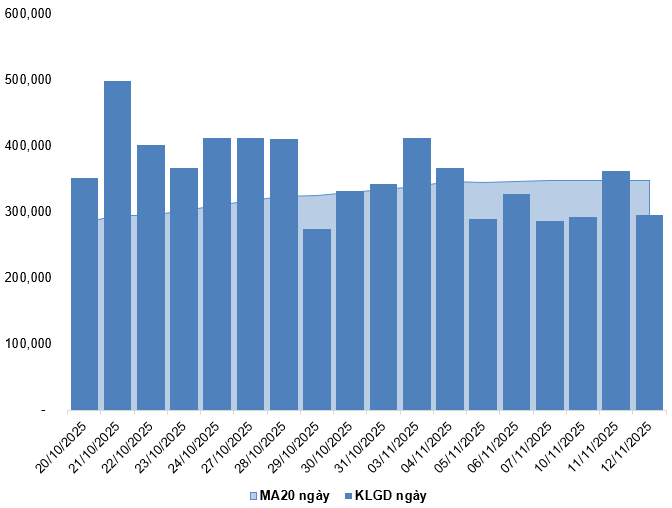

Trading volume and value in the derivatives market decreased by 18.35% and 17.16%, respectively, compared to the November 11, 2025 session. Specifically, I1FB000 trading volume dropped by 18.51%, with 294,289 contracts matched. I2FB000 trading volume fell to 78 contracts, a 14.29% decline.

Foreign investors continued to buy net, with a total net purchase volume of 1,296 contracts on November 12, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

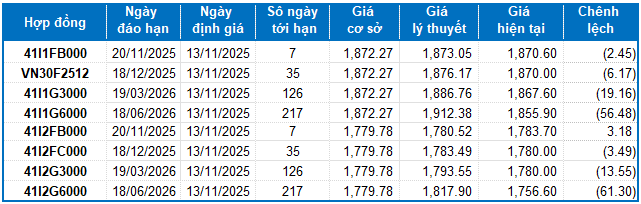

I.2. Futures Contract Valuation

Based on the fair pricing method as of November 13, 2025, the fair price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

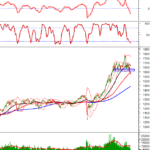

I.3. Technical Analysis of VN30-Index

On November 12, 2025, the VN30-Index extended its rally for the second consecutive session, forming a White Marubozu candlestick pattern. Trading volume increased compared to the previous session, suggesting reduced investor pessimism.

However, the index remains below the Middle line of the Bollinger Bands, and the MACD indicator still signals a sell. This indicates a bearish short-term outlook.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

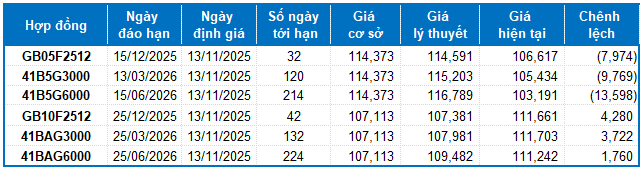

Based on the fair pricing method as of November 13, 2025, the fair price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

According to the above valuation, the GB05F2512, 41B5G3000, and 41B5G6000 contracts are currently attractively priced. Investors may focus on and consider buying these futures contracts in the near term, as they present a favorable market opportunity.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:28 12/11/2025

Technical Analysis for the Afternoon Session of November 11: A Mild Recovery

The VN-Index staged a modest recovery, forming a candle with a long upper shadow and low trading volume, indicating investor caution. Similarly, the HNX-Index reflects a comparable sentiment of hesitation among market participants.

Derivatives Market on November 11, 2025: Pessimism Prevails

On November 10, 2025, most VN30 and VN100 futures contracts declined during the trading session. The VN30-Index marked its fourth consecutive losing session, revisiting its August 2025 lows (around 1,770–1,800 points), reflecting persistent investor pessimism.