Market liquidity surged compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 682 million shares, equivalent to a value of more than 19.4 trillion VND; the HNX-Index recorded over 65.9 million shares, equivalent to a value of over 1.4 trillion VND.

The VN-Index opened the afternoon session on a positive note, with buyers maintaining dominance, driving the index upward despite some selling pressure. It closed the session in the green. The most influential stocks were VIC, VHM, TCB, and FPT, contributing over 16.9 points to the index. Conversely, BHN, TCX, BCM, and ACG faced selling pressure, but their impact was negligible.

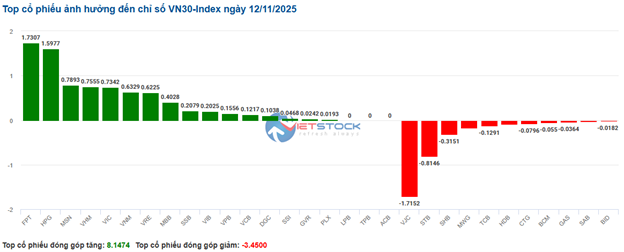

| Top 10 Stocks Influencing VN-Index on November 12, 2025 (in points) |

Similarly, the HNX-Index showed optimism, influenced positively by stocks like CEO (+5.31%), SHS (+2.25%), HUT (+2.37%), and KSV (+1.19%).

| Top 10 Stocks Influencing HNX-Index on November 12, 2025 (in points) |

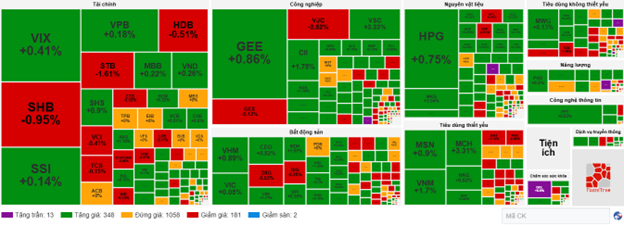

At the close, the market rallied strongly, with green dominating all sectors. The information technology sector led with a 4.51% gain, primarily driven by FPT (+4.68%), CMG (+2.39%), ELC (+0.48%), and DLG (+2.33%). Real estate and non-essential consumer goods followed with gains of 3.93% and 2.1%, respectively. The industrial sector also rebounded strongly, with stocks like GEE, CII, and VSC hitting their upper limits, and others like GEX (+4.28%), CTD (+4.58%), and HAH (+2.45%) posting significant gains.

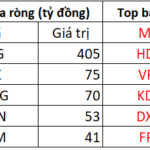

Foreign investors continued to net sell over 387 billion VND on the HOSE, focusing on VCI (197.48 billion), HDB (170.74 billion), VIX (150.19 billion), and STB (134.26 billion). On the HNX, they net sold over 77 billion VND, concentrating on SHS (28.49 billion), CEO (28.04 billion), MBS (7.77 billion), and IDC (6.34 billion).

| Foreign Net Buying/Selling Activity |

Morning Session: Extending Gains

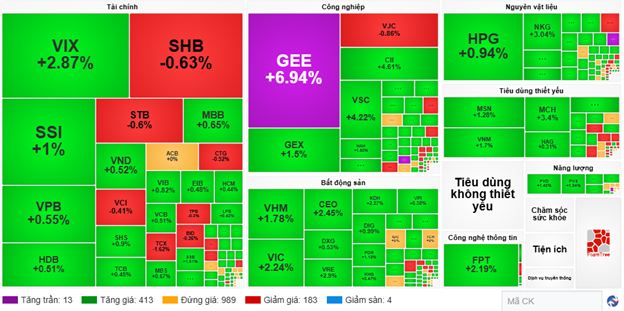

The upward trend continued across all major indices in the late morning session. At the midday break, the VN-Index rose 13.8 points (+0.87%) to 1,607.41 points, while the HNX-Index gained 0.72% to 262.96 points. Market breadth showed 426 gainers, 187 losers, and 989 unchanged stocks.

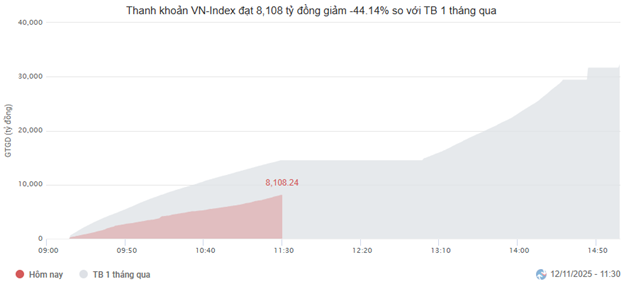

Market liquidity remained subdued. The HOSE traded nearly 275 million units, valued at 8.1 trillion VND, down 44.14% from the one-month average. The HNX recorded over 22 million units, valued at over 474 billion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing 4 points. VHM, GEE, and FPT added a combined 3.2 points. Conversely, TCX, CTG, and BCM had the most negative impact, but their effect was less than 1 point.

Most sectors were in the green, with information technology leading at +2.16%, driven by FPT (+2.19%), CMG (+1.06%), VEC (+10.42%), DLG (+1.16%), and HPT (+7.92%).

Real estate and industrial sectors also traded positively, with standout performers including GEE (upper limit), CII (+4.61%), GEX (+1.5%), VSC (+4.22%), HAH (+1.63%), CTD (+1.88%), VCG (+1.06%), GMD (+1.97%), PC1 (+2.63%), VHM (+1.78%), VIC (+2.24%), VRE (+2.9%), CEO (+2.45%), KDH (+2.27%), KHG (+3.47%), and HDC (+2.97%).

Source: VietstockFinance

|

Foreign investors continued to net sell over 556.11 billion VND across all three exchanges. Selling pressure was concentrated in HDB (92.05 billion VND), while VIC led the net buying with 84.49 billion VND.

| Top 10 Stocks with Strongest Foreign Net Buying/Selling in the Morning Session of November 12, 2025 |

10:30 AM: Early Gains Wane

Buyers lost momentum, causing major indices to retreat near the reference level. By 10:30 AM, the VN-Index was up 3.87 points, trading around 1,597 points, while the HNX-Index gained 1.74 points, trading around 262 points.

Most VN30 stocks rose, with FPT contributing 1.73 points, HPG 1.59 points, MSN 0.79 points, and VHM 0.75 points. However, VJC, STB, SHB, and MWG faced selling pressure.

Source: VietstockFinance

|

Essential consumer goods led the market with strong buying, notably MCH (+3.31%), VNM (+1.02%), MSN (+0.77%), and BAF (+0.93%).

The materials sector also performed well, with HPG (+0.94%), NKG (+3.04%), HSG (+1.48%), KSB (+1.93%), and PHR (+1.3%) leading the gains.

The financial sector showed mixed performance, with VIX (+0.41%), VPB (+0.18%), and SSI (+0.14%) gaining, while STB (-1.61%), HDB (-0.51%), and SHB (-1.27%) faced selling pressure.

Buyers remained dominant, with 348 gainers and 181 losers.

Source: VietstockFinance

|

Opening: Sustaining Early Recovery

At 9:30 AM on November 13, the VN-Index continued its recovery, rising over 8 points to 1,601 points. The HNX-Index also edged higher, reaching 262 points.

Green dominated the morning session, with financial stocks like VIX (+2.05%), VND (+1.03%), and SSI (+0.86%) leading the gains.

Large-cap stocks such as VHM, VCB, and VPL drove the VN-Index up by nearly 2.6 points. Conversely, VIC, VJC, and SHB weighed on the market, pulling it down by nearly 1 point.

Several sector leaders opened in the green, including VSC (+5.96%), CII (+1.54%), VCG (+1.08%) in industrials; MCH (+3.36%), MSN (+0.64%), BAF (+0.77%) in essential consumer goods; MWG (+0.13%), MSH (+0.89%) in non-essential consumer goods; and HPG (+0.56%), NKG (+2.13%) in materials.

Real estate stocks also performed well, with CEO (+1.22%), KBC (+1.24%), KHG (+2.22%), PDR (+0.24%), and DXG (+0.53%) in the green.

– 15:35 12/11/2025

Why We Rush to Buy a 50% Discounted Shirt but Panic Sell Stocks at a 5% Drop: Insights from Dragon Capital

In terms of investment prospects, Dragon Capital believes that the Vietnamese market currently possesses numerous fundamental factors to sustain a positive growth trajectory in 2025–2026.

Vietstock Daily November 13, 2025: Recovery Momentum Continues

The VN-Index has surged, decisively breaking above its 100-day SMA. The Stochastic Oscillator is poised to generate a buy signal from oversold territory. Should this signal materialize in upcoming sessions, accompanied by trading volume surpassing the 20-day average, the index’s recovery prospects would be significantly strengthened.

Market Plunge Explained: Experts Uncover Reasons Behind Late-Session Stock Market Decline

The VN-Index plunged sharply at the close of the session, erasing all intraday gains and retreating well below the 1,600-point threshold.