Established in 2008, VNTT primarily operates in the telecommunications and information technology sectors, providing network infrastructure and digital services to industrial zones.

According to VNPT, the capital transfer transaction aims to implement the Prime Minister’s Decision (620/QĐ-TTg dated 10/07/2024), which approves the restructuring plan for VNPT until the end of 2025. This is further supported by Document No. 1944/UBQLV-CNHT dated 28/08/2024 from the State Capital Management Commission, outlining the divestment from 24 enterprises as per the approved list under Decision 620/QĐ-TTg.

At the time of the transaction announcement, VNTT’s Board of Directors still includes a representative of VNPT’s capital contribution, Ms. Nguyễn Thị Thanh Hương, serving as a non-executive member.

Currently, the largest shareholder at VNTT is Becamex IDC, holding 48.6% of the shares, followed by VNPT with a 5.45% ownership stake.

This is not the first time VNPT has registered to sell its stake in VNTT. In October of this year, the state-owned conglomerate made a similar move. However, the transaction did not proceed due to insufficient conditions for organizing a stock auction.

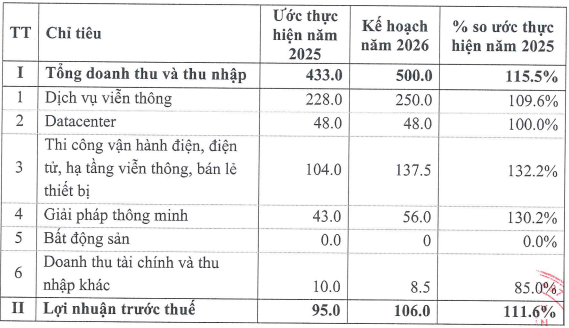

Regarding business performance, VNTT recently announced its estimated results for 2025, with revenue of 433 billion VND and pre-tax profit of 95 billion VND, representing increases of 20% and 25% respectively compared to the previous year. For 2026, the company anticipates slower but still double-digit percentage growth.

|

VNTT’s 2026 Business Plan

Unit: Billion VND

Source: VNTT Board of Directors Resolution

|

– 09:58 11/11/2025

Heaven’s Fortune Cycles Internally to Sustain Operations

Amidst delayed financial report disclosures and restricted stock trading, Loc Troi Group Corporation (UPCoM: LTG) continues to recycle internal capital. The Board of Directors has approved a series of loans totaling VND 250 billion from subsidiaries and related entities, while simultaneously maintaining large-scale asset leasing and goods processing contracts.

Deputy Prime Minister Hồ Đức Phớc Meets with Viettel Group

On the afternoon of November 11th, Deputy Prime Minister Hồ Đức Phớc, Head of the Steering Committee for Enterprise Innovation and Development, held a working session on the implementation of restructuring, innovation, and efficiency enhancement at the Military Industry and Telecoms Group (Viettel).

PVN Fully Divests from Petrosetco (PET), Offering 21% Premium Over Market Price, Targeting Minimum Proceeds of VND 909 Billion

PVN is set to auction its entire 23.2% stake in Petrosetco (PET) at a starting price 21% above the market rate. This move comes as the company reports a 95% surge in Q3 profits, already surpassing its full-year profit target.