On November 12th, the State Bank of Vietnam (SBV) significantly reduced its tender volume in the Open Market Operation (OMO) channel to VND 10,000 billion, down from VND 32,000 billion in the previous session on November 11th. Concurrently, the SBV continued to offer OMO tenders with a 105-day maturity.

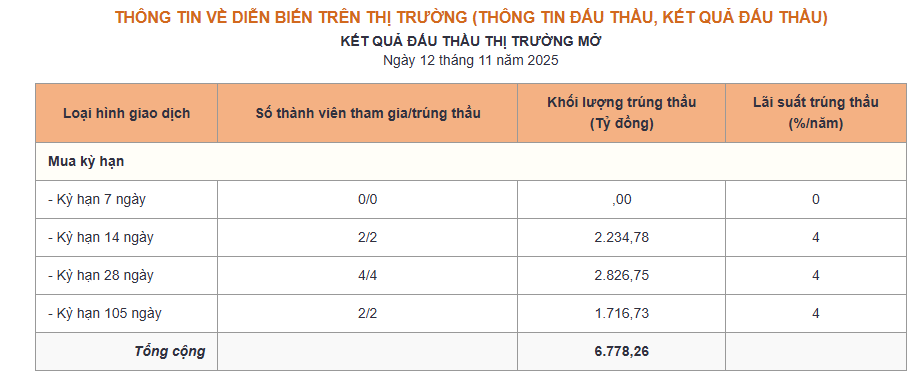

Specifically, the SBV tendered VND 1,000 billion at a 7-day maturity, VND 3,000 billion at each of the 14-day, 28-day, and 105-day maturities, all at an interest rate of 4.0%. The results showed no successful bids for the 7-day maturity, VND 2,235 billion for the 14-day maturity, VND 2,827 billion for the 28-day maturity, and VND 1,717 billion for the 105-day maturity. Meanwhile, VND 7,633.66 billion matured on November 11th.

Source: SBV

The SBV did not tender treasury bills. As a result, the SBV net absorbed over VND 855 billion from the market in yesterday’s session. The outstanding OMO volume decreased to VND 295,525 billion, reflecting the SBV’s ongoing support to the banking system.

As previously reported, starting from November 11th, the SBV unexpectedly offered OMO tenders with a maturity of up to 105 days. Prior to this, SBV’s OMO maturities typically ranged from 7 to 91 days.

According to analysts, the extension of OMO maturities indicates the SBV’s monetary policy focus on maintaining liquidity stability for the banking system in the final months of the year. By shifting to longer-term tenders, the SBV ensures prolonged liquidity support, stabilizing the liquidity landscape and minimizing interbank interest rate fluctuations in the near future.

Previously, when short-term OMO maturities expired, the withdrawal of funds from the system tended to tighten liquidity, pushing interbank VND interest rates higher. Although the SBV promptly supplemented tenders, these fluctuations caused some turbulence in the banking system’s cash flow.

The SBV’s move also comes amid persistently high interbank VND interest rates.

At the close of November 12th, the average interbank VND interest rates slightly decreased for overnight maturities while rising by 0.10–0.20 percentage points for other maturities compared to the previous session, trading at: overnight 6.10%/year; 1 week 6.30%/year; 2 weeks 6.20%/year; and 1 month 6.20%/year.

The SBV has consistently supported VND liquidity for the banking system since the beginning of 2025, with a significant expansion since late June. According to the SBV, implementing open market operations aims to lower interbank interest rates, ensuring timely and sufficient liquidity for banks. This enables banks to access low-cost capital from the SBV, facilitating further reductions in lending rates in line with government directives.

Despite ongoing VND liquidity support, the SBV has maintained the OMO winning interest rate at 4%/year. This measure prevents interbank VND rates from falling too low, which could exert pressure on the exchange rate.

Unlocking Capital Solutions for Year-End Import-Export Growth

International trade activities in the first 10 months of the year have maintained a robust growth rate, serving as a key driver of economic expansion. To support this momentum, policy mechanisms, including monetary and credit policies, have been strategically focused on facilitating the growth and development of import-export businesses.

Biometric Verification Mandatory for Digital Wallets Starting January 1, 2026

Under the new regulations, e-wallet service providers are required to conduct in-person meetings with e-wallet owners and perform thorough identity verification checks. This process includes cross-referencing official identification documents and confirming the biometric data of the e-wallet owner to ensure accuracy and security.

USD Free Market Rate Nears 28,000 VND: Experts Share Latest Forecasts

The USD exchange rate at banks has been on a steady rise, yet experts predict that Vietnam’s currency will soon stabilize, bringing much-needed relief to the market.