Ho Chi Minh City Infrastructure Investment Joint Stock Company (Stock Code: CII, HoSE) has registered to sell 4.49 million shares of Nam Bay Bay Investment Corporation (NBB) from November 19 to December 18, 2025.

The recipient of this share transfer is CII Trading and Investment LLC (CII Invest), a subsidiary of CII. The transaction will be conducted through a negotiated agreement on the HoSE platform.

Upon completion, CII’s ownership will decrease from 26.5 million NBB shares (26.43%) to 21.98 million shares (21.95%). Conversely, CII Invest’s holdings will increase from 50.5 million shares (50.47%) to 55.03 million shares (54.95%).

Additionally, Mrs. Nguyen Quynh Huong, Deputy General Director of CII and a Board Member of NBB, holds 19,200 NBB shares, equivalent to 0.02%.

Collectively, the CII group holds over 77 million NBB shares, representing 76.92% of Nam Bay Bay’s charter capital.

Previously, from October 13-15, 2025, CII Invest acquired 2 million NBB shares through a negotiated purchase from Mrs. Nguyen Thi Kim Thao on the Ho Chi Minh City Stock Exchange (HoSE).

In other developments, NBB’s first extraordinary General Meeting of Shareholders in 2025, held on October 7, 2025, approved the resignation of Mrs. Le Thi Kieu Diem from the Supervisory Board for the 2025-2030 term and elected Mr. Le Thanh Hung as her successor.

NBB also approved investments in the NBB High-Rise Apartment Project (Tan Nhut Commune, Ho Chi Minh City) with a total investment of approximately VND 4,678 billion, expected to complete by September 30, 2029, and the NBB Garden III Residential Project (Phu Dinh Ward, Ho Chi Minh City) with a total investment of approximately VND 5,845 billion.

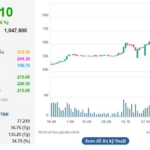

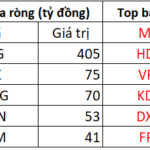

For CII, in the first nine months of 2025, the company generated net revenue of over VND 2,141 billion, a 6% decrease year-on-year. The core traffic fee segment remained stable, accounting for about 88% of revenue. Real estate, construction, and infrastructure maintenance revenues declined by 67% and 21%, respectively.

Financial revenue also dropped by 38% to over VND 583 billion, due to a VND 430 billion gain from the fair value revaluation of investments in Nam Bay Bay Investment Corporation in the same period last year.

Additionally, CII incurred VND 84 billion in other losses from increased contract penalties and VND 13 billion in expenses from suspended projects.

Despite cost reductions, CII’s after-tax profit fell by 55% to VND 241 billion. Profit after tax attributable to the parent company’s shareholders decreased by 78% compared to the first nine months of 2024, totaling nearly VND 58 billion.

Dofico to Auction Off Entire Stake in Dong Nai Food Processing

Dong Nai Food Industry Corporation (Dofico) is set to auction off its entire 29% stake in Dong Nai Food Processing Co., Ltd. (D&F), with a starting price of 72.5 billion VND. The auction is scheduled to take place on December 15th.

Board Member of VPS Registers to Purchase 1 Million Shares in Upcoming IPO

The Board of Directors has approved the acquisition of 1 million shares by Ms. Nguyễn Thị Thu Hồng during the company’s IPO, with an offering price set at 60,000 VND per share.