Gain a comprehensive overview of the real estate market in 2025 and its prospects for 2026 through our insightful conversation with Dr. Nguyễn Văn Đính, Vice Chairman of the Vietnam Real Estate Association (VNREA) and Chairman of the Vietnam Real Estate Brokerage Association (VARS).

Sir, if you were to describe the real estate market in 2025 using three words, what would they be?

I would characterize the 2025 real estate market with three words: Recovery, Vibrancy, and Instability. Amidst a thriving economy, the real estate sector has witnessed positive growth in supply, transaction volume, and prices. Notably, the Vietnamese real estate market has undergone significant restructuring during its recovery and development phase.

Competent companies are proactively expanding their operations, capitalizing on the market recovery to increase their market share. Conversely, many entities lacking in management, financial, or legal capabilities have been forced to exit the market.

Alongside its growth, the market has exhibited signs of instability. This “instability” stems from the market being influenced by a segment of investors and speculators. Meanwhile, there is a shortage of products that align with market demands, leading to escalating property prices.

How have macroeconomic factors such as inflation, bank interest rates, and government policies impacted the 2025 real estate market, sir?

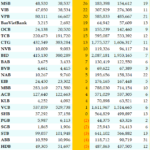

The real estate market currently enjoys attention not only from regulatory bodies but also from the banking system. As of the end of August 2025, real estate credit outstanding reached over 4 million billion VND, accounting for nearly 25% of the total credit in the economy. This also reflects the renewed confidence of the financial system in real estate, no longer viewing it as a risky channel but as a genuine growth driver.

This substantial capital flow has significantly stimulated the market, facilitating its recovery and opening up new development opportunities. Additionally, the historically low bank interest rates have been a crucial factor, boosting real estate liquidity and completely eradicating the “credit clot” situation observed in 2022.

What do you consider to be the most significant development in the Vietnamese real estate market in 2025?

The most notable highlight of the 2025 real estate market is the government’s vigorous efforts to resolve lingering issues and obstacles in various projects. As a result, numerous projects have been “revived,” contributing to increased market supply.

Simultaneously, robust economic growth, coupled with restored buyer confidence, has propelled real estate demand to unprecedented levels. Although supply has increased, it still falls short of meeting the soaring demand, causing property prices to surge rapidly.

It can be said that 2025 marks the year when the market regained its natural rhythm. Buyers are no longer hesitant, and project developers are actively seizing opportunities to expand.

Apartments emerged as the hottest segment in the 2025 market, while resort real estate remained sluggish. What distinguishes these contrasting extremes, sir?

The real estate market has rebounded due to strong demand for both living and investment purposes. Essentially, both apartments and resort properties can cater to investment needs.

Vietnam boasts significant tourism potential and is positioning tourism development as a key national strategy. Therefore, developing accommodation infrastructure is essential. Given this potential, investing in resort real estate is undoubtedly attractive.

However, this segment faces challenges due to incomplete legal frameworks. Moreover, the impact of COVID-19 has left many investors disillusioned. They remain skeptical about the safety and profitability of resort real estate, resulting in a sluggish market.

In contrast, the apartment segment benefits from a clear legal framework. Beyond sustainable price appreciation, apartments offer rental income potential. Furthermore, apartments have high liquidity due to substantial and consistently growing real demand. These factors have encouraged investors to purchase apartments despite rising prices.

In 2025, Vietnam implemented province and city mergers. How do you think this will impact the real estate market?

In the long term, administrative restructuring will unlock new and promising opportunities for the real estate market. The merger of provinces and cities is a strategic move that will spark a wave of urbanization nationwide.

We can anticipate the emergence of modern satellite cities and bustling twin cities, shaping a real estate market with new growth momentum. Numerous national infrastructure projects will be invested in, igniting an unprecedented urbanization trend, not limited to major cities but extending to various regions across the country.

With the development of transportation infrastructure, geographical distances will no longer be a significant barrier. Travel between provinces and cities, and between home and work, will become faster and more convenient, reshaping the real estate market landscape.

What notable aspects do you observe in the current mindset of real estate buyers?

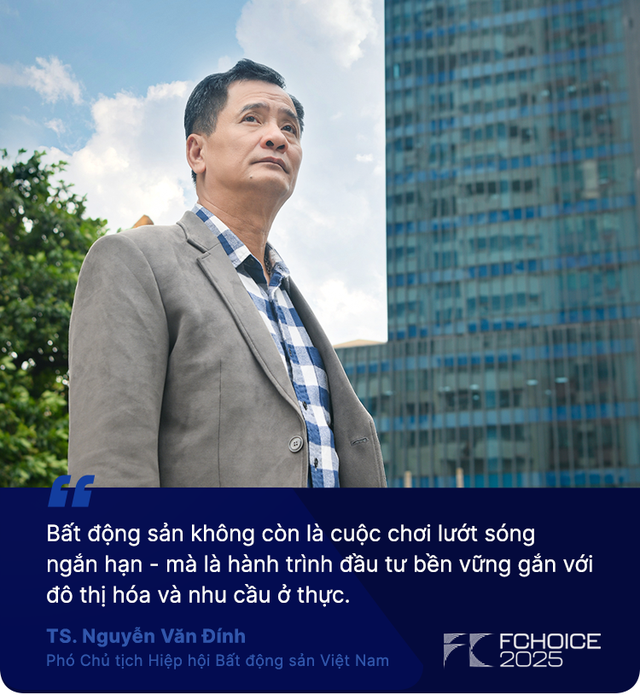

Currently, real estate buyers are in high spirits due to rising prices. However, I advise investors to remain level-headed in the present market conditions. As the market undergoes restructuring, following the crowd or expecting short-term “speculative” gains can be highly risky.

Investors should carefully assess their financial capabilities, choose segments with genuine growth potential, and prioritize medium to long-term strategies over quick profits. Most transactions are still driven by investment demand, while supply is recovering strongly. If investors employ high leverage or diversify excessively, liquidity risks may arise when interest rates adjust or the market slows down. In the worst-case scenario, a cash flow disruption could trigger a chain reaction, leading to project stagnation and weakened market sentiment.

The Vietnamese real estate market is in a phase of “separating the wheat from the chaff.” Companies and investors lacking financial strength or legal understanding will struggle to survive. Opportunities remain, but they are reserved for those with patience, long-term vision, and the ability to choose the right timing. Real estate is no longer a short-term speculative game but a sustainable investment journey aligned with urbanization and genuine housing needs.

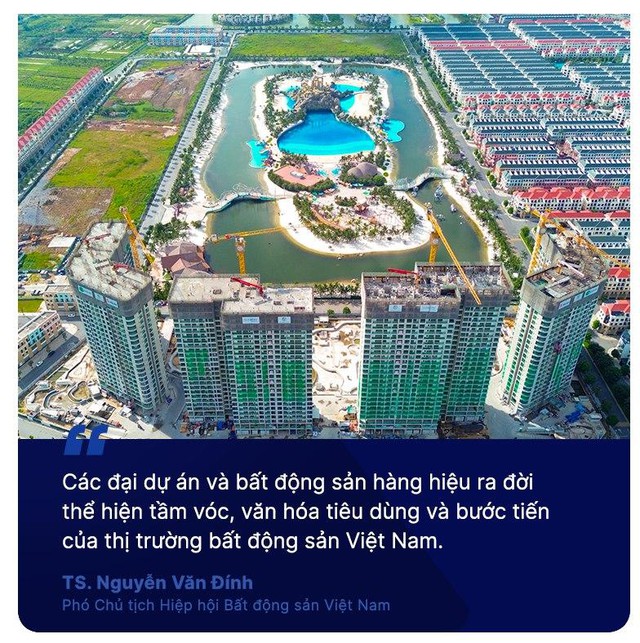

In 2025, large-scale real estate projects, even those of international caliber, were launched. How do you evaluate the development of these mega-projects?

The introduction of large-scale projects is an inevitable trend in real estate development. Traditional small-scale urban projects often lack quality and fail to meet residents’ living standards. Therefore, the development of large-scale urban projects aims to replace outdated models, striving for civilization, modernity, and improved quality of life.

Additionally, these mega-projects contribute to increasing the housing supply in the real estate market, offering buyers more choices and segments. Most importantly, creating world-class urban developments will attract foreign investment into the Vietnamese real estate market.

In the future, urban projects may not be limited to 500-1,000 hectares but could be much larger. However, developing such super-projects requires developers to have long-term vision and strong financial capabilities.

Luxury real estate is thriving, with developers investing heavily and meticulously. How do you assess the prospects of this segment?

Each real estate segment serves a distinct customer base and purpose. Currently, the number of wealthy individuals in Vietnam is growing rapidly, spanning various industries. Moreover, with increasing FDI inflows, many foreign experts will reside and work in Vietnam, bringing high living and consumption standards.

Therefore, developing luxury real estate to cater to the elite is essential. However, development should be reasonable, adequately scaled, and aligned with actual demand. Luxury real estate is not just about selling properties but also about offering experiences, uniqueness, and prestige. This segment reflects the sophistication, consumer culture, and advancement of the Vietnamese real estate market.

The government is promoting the digitalization of the real estate market. What significance does this hold?

The 2023 Real Estate Business Law includes an entire chapter on market regulation. We are actively working to control the real estate market in the right direction. However, we lack transaction and pricing data, which can lead to non-transparent real estate transactions.

To address this, applying technology to the real estate market is crucial. The government has initiated plans for a state-managed real estate trading platform. It’s essential to understand that this is not intended to stifle the market but to protect citizens’ rights and promote a transparent, sustainable market.

What is your outlook for the 2026 real estate market?

With the government’s determined efforts, I am confident that the 2026 real estate market will see a significant increase in supply, including more products tailored to people’s needs.

In terms of the overall economy, we are set to achieve an 8% growth rate this year, laying a solid foundation for double-digit growth in the coming years. Economic development will boost investor confidence in various investment channels, particularly real estate.

I believe the 2026 real estate market will continue to grow and introduce new dynamics. However, speculative activities will be curtailed. Property prices will not surge as they have recently but will exhibit stable growth.

Could you elaborate on the new dynamics you foresee in the 2026 market?

The market will transition from rapid growth to sustainable, transparent, and professional development, underpinned by a new legal framework and technology integration. Rising land costs present both challenges and opportunities, driving the market toward value-based operations.

I anticipate a rigorous market screening process in 2026. Long-term investment strategies tied to urbanization and genuine housing needs will prevail. Short-term speculators will face greater risks due to increased market transparency.

What do you consider to be the most significant challenges facing the Vietnamese real estate market in 2026?

The market will continue to face challenges, particularly in providing affordable housing for low-income earners (social housing, worker housing). Developing this segment comprehensively and systematically is not easy and requires collaboration between the government and businesses.

To address housing needs, the government should continue resolving legal issues for stalled projects. Additionally, planning more large-scale social housing projects is essential to alleviate the housing shortage.

Real estate development is truly successful when it fulfills the housing dreams of ordinary citizens, which is the ultimate measure of a sustainable market.

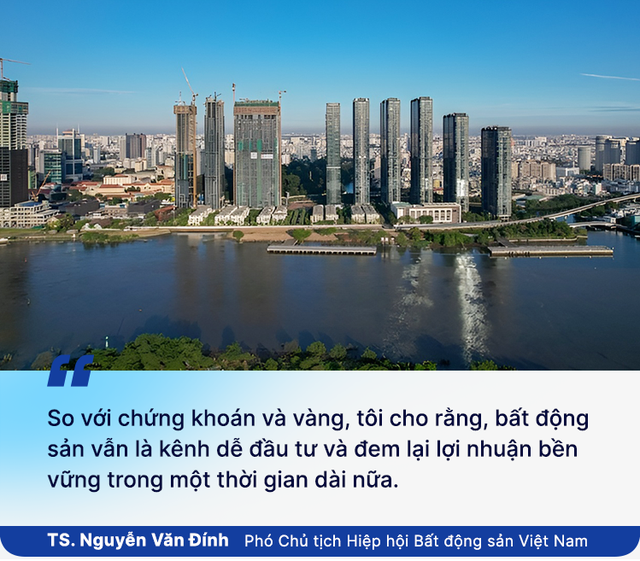

With gold, stocks, and real estate all surging, what investment advice would you offer for 2026?

Given Vietnam’s strong economic growth, real estate will remain an attractive investment channel. Economic development drives infrastructure investment, and real estate values rise alongside infrastructure. This relationship is a consistent rule.

Stock market investing can yield quick profits but carries higher risks, requiring investors to have expertise in macroeconomics and diverse industries. In comparison, real estate is a more accessible and sustainable investment option for the long term.

How do you think Fchoice 2025, with its focus on the 2025 real estate market, will contribute to industry development?

With the theme “Vietnam Rising,” I believe Fchoice 2025 is a significant event, especially as the real estate market undergoes restructuring and rigorous screening. In the broader context of economic and real estate development, recognizing the contributions of organizations and businesses is essential. This recognition motivates them to achieve even greater successes in the nation’s collective endeavor.

I am confident that Fchoice 2025 will identify worthy representatives, serving as a platform to showcase success stories and contribute to a prosperous Vietnam.

FChoice is an annual award organized by CafeF to honor outstanding events, individuals, policies, and businesses in Vietnam’s economy. Launched in 2021, FChoice is not just a typical award but a “map of achievements” highlighting breakthrough stories with significant national economic impact, especially in finance. FChoice does not have fixed categories but selects winners based on annual achievements and public interest.

As Vietnam’s economy embraces digitalization and sustainability, FChoice serves as a platform to showcase success stories, contributing to a prosperous nation. Join us in celebrating and voting for those shaping Vietnam’s economic landscape!

Massive Discounts on Xiaomi Smartphones, Home Appliances, and IoT Devices – Up to 14 Million VND Off

Xiaomi is thrilled to announce its “11.11 Mega Sale,” offering a massive 20% discount across a wide range of products within its ecosystem. Don’t miss this limited-time opportunity to upgrade your tech collection with Xiaomi’s innovative and high-quality devices at unbeatable prices. Shop now and experience the future of technology!

Is CASA Ratio Declining? Unraveling the Shifts in Cash Flow Trends

The decline in the CASA ratio remains moderate, showing no abrupt or alarming liquidity concerns within the economy. This shift likely reflects a temporary adjustment in cash flow, responding to prevailing interest rate conditions and investment opportunities. Further analysis of Q4 data is essential to determine if this trend will persist.

Prof. Dr. Vu Minh Khuong: If Hanoi and Ho Chi Minh City Develop Subway Systems Like China, They Will Achieve Robust Growth in Just 10-15 Years

Vietnam stands at the precipice of transformative growth, poised to surge ahead by strategically focusing on three critical pillars: robust institutional frameworks, cutting-edge urban infrastructure, and a highly skilled workforce. This vision, articulated by Prof. Dr. Vu Minh Khuong, underscores the nation’s potential to leapfrog developmental barriers and emerge as a regional powerhouse.