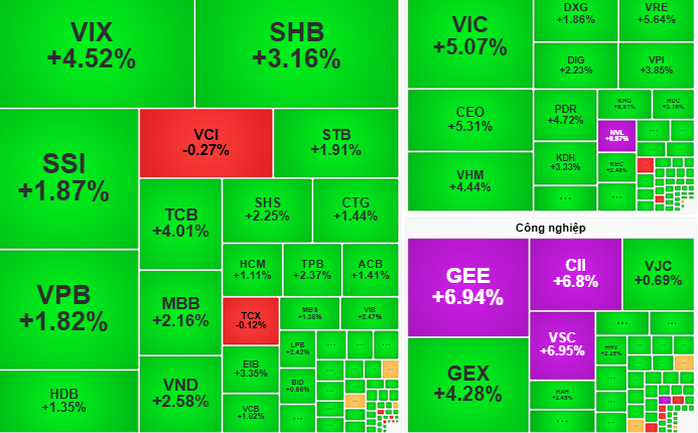

On January 12th, the VN-Index closed at 1,642 points, up 10 points (+0.63%) from the previous session.

The trading day on November 12th saw the VN-Index continue its upward trajectory from the opening bell, fueled by widespread gains in banking stocks (VCB +2.1%, BID +1.8%, CTG +2.3%) and retail sector leaders (MWG +3.2%, PNJ +2.7%). The index swiftly surpassed the 1,640-point mark within the first 30 minutes of trading.

Notably, the Vingroup conglomerate maintained its leadership position, with VIC (+4.1%), VHM (+2.9%), and VRE (+3.5%) all posting significant gains. Essential consumer goods stocks also played a crucial role, as VNM (+2.6%) and MSN (+1.9%) attracted substantial investment inflows.

In the afternoon session, profit-taking pressure on major banking stocks caused the VN-Index to retreat slightly to the 1,635-point level. However, bargain hunters quickly stepped in, driving the index back up to close at 1,642 points, a 10-point (+0.63%) increase.

According to the Vietnam Commercial Bank Securities Company (VCBS), the current uptrend is being supported by large-cap stocks. The VN-Index is expected to challenge the 1,650-point resistance level within the next 1-2 trading sessions, provided that banking and Vingroup stocks maintain their momentum.

The research team at the Securities Company highlights that retail and consumer stocks are in a breakout phase. Investors are advised to consider strategic purchases during pullbacks, focusing on stocks with improving liquidity.

However, MB Securities cautions about short-term risks stemming from profit-taking activities and exchange rate fluctuations. Investors should carefully manage their portfolio allocations and avoid excessive margin usage.

VN30 Stock Surges to Daily Limit as $190 Million Real Estate Project Takes Unexpected Turn

As a result, the stock price surged to its highest level in two months, with its market capitalization climbing to nearly 38 trillion VND.

Vietstock Daily 14/11/2025: Is Market Polarization Returning?

The VN-Index experienced a minor adjustment, forming a small-bodied candlestick pattern with trading volume remaining below the 20-day average, reflecting investor hesitation. The Stochastic Oscillator has signaled a buy opportunity from the oversold territory. Should this buying momentum persist and exit the oversold region in upcoming sessions, the short-term outlook may turn more favorable.

Newcomer in the Plastics Industry Surges 300% Following 7-Session Limit-Up Streak

In just over a week since its listing, Binh Thuan High-Quality Plastics JSC (UPCoM: BQP) has seen a remarkable streak of consecutive ceiling price increases, surging close to 32,000 VND per share. The company’s recently released explanation confirms that it has taken no actions to manipulate the stock price, and its business operations remain stable.

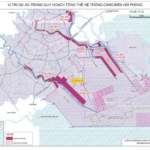

Billionaire Pham Nhat Vuong’s Vingroup to Commence Vietnam’s Largest Mega Port Project with $14.2 Billion Investment in Hai Phong by Early 2027

Unveiling the Nam Đồ Sơn Port and Logistics Hub, a mega-project spanning over 4,300 hectares, poised to redefine the region’s logistics landscape. This transformative development promises to be a game-changer, offering unparalleled connectivity and efficiency in cargo handling and transportation.