Are Apartment Prices Really Dropping?

Hanoi apartment prices have continued to surge, setting new benchmarks in both the primary and secondary markets. According to CBRE, the average primary market asking price has surpassed 90 million VND/m² (excluding VAT, KPBT, and discounts), marking a 16% increase from the previous quarter and a 41% rise year-on-year.

In the secondary market, the average selling price reached 58 million VND/m² (excluding VAT & KPBT), a 19% annual increase. While this growth is slower than in 2024, it has accelerated compared to the first two quarters of the year.

Savills Vietnam reports that primary market prices have climbed to 101 million VND/m². Despite these record highs, the market continues to show strong absorption, indicating sustained urban housing demand.

Data from the Institute of Construction Economics (Ministry of Construction) reveals price fluctuations in Hanoi apartments during September and Q3 2025, with varying trends across projects.

In September 2025, several projects saw notable price increases: The K Park (+3.8% to 70.5 million VND/m²), Sky Park Residence (+4.5% to 108.9 million VND/m²), Imperia Garden (+3.8% to 95.2 million VND/m²), Feliz Homes (+3.7% to 68.8 million VND/m²), HPC Landmark 105 (+5.1% to 60.8 million VND/m²), Seasons Avenue (+4.9% to 76.6 million VND/m²), and HC Golden City (+4.7% to 83.2 million VND/m²).

Conversely, some projects experienced price declines: N01-T1 Ngoại Giao Đoàn (-3.9% to 90.9 million VND/m²), Green Park Tower (-3.6% to 87.8 million VND/m²), Anland Premium (-3.3% to 67.9 million VND/m²), An Bình Plaza (-3.2% to 63.8 million VND/m²), Tabudec Plaza (-3.2% to 47.7 million VND/m²), and Diamond Park Plaza (-3.4% to 138.2 million VND/m²).

| Project | Price Change (%) | New Price (million VND/m²) |

|---|---|---|

| The K Park | +3.8% | 70.5 |

| Sky Park Residence | +4.5% | 108.9 |

| Imperia Garden | +3.8% | 95.2 |

| Feliz Homes | +3.7% | 68.8 |

| HPC Landmark 105 | +5.1% | 60.8 |

| Seasons Avenue | +4.9% | 76.6 |

| HC Golden City | +4.7% | 83.2 |

| N01-T1 Ngoại Giao Đoàn | –3.9% | 90.9 |

| Green Park Tower | –3.6% | 87.8 |

| Anland Premium | –3.3% | 67.9 |

| An Bình Plaza | –3.2% | 63.8 |

| Tabudec Plaza | –3.2% | 47.7 |

| Diamond Park Plaza | –3.4% | 138.2 |

In Q3 2025, projects like The Zei Mỹ Đình (+5.7% to 94.5 million VND/m²), Bea Sky (+5.6% to 78.3 million VND/m²), Rice City Linh Đàm (+5.2% to 73.5 million VND/m²), Star Tower (+4.7% to 85.9 million VND/m²), and Hinode City (+4.9% to 102.3 million VND/m²) saw increases.

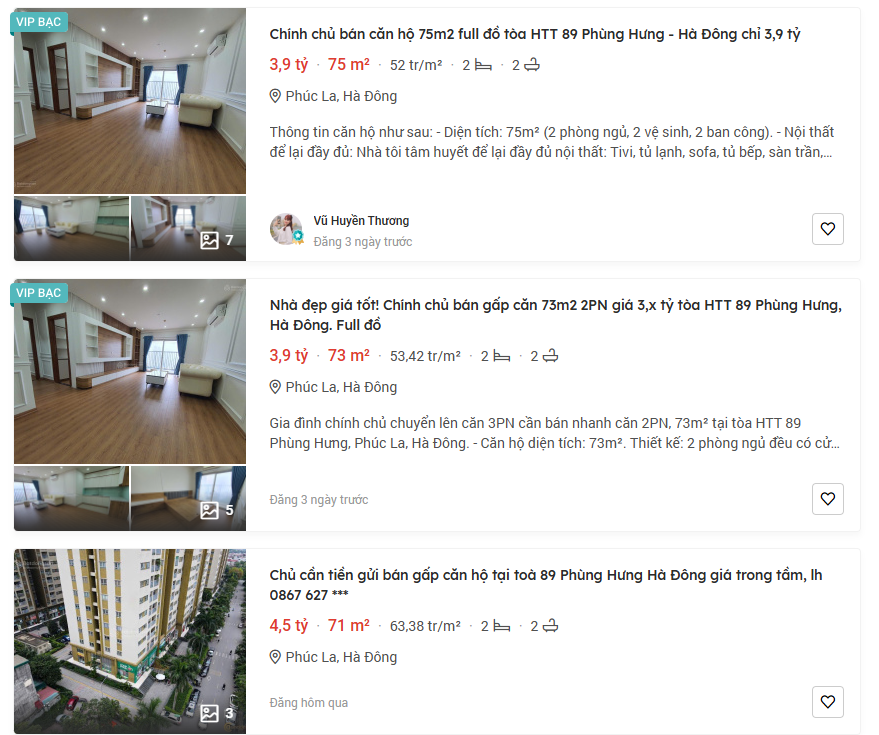

Meanwhile, projects such as Hanhomes Blue Star (-3.7% to 50.7 million VND/m²), N04A Ngoại Giao Đoàn (-4.5% to 91.2 million VND/m²), AZ Lâm Viên Complex (-3.8% to 79.7 million VND/m²), Chung cư 89 Phùng Hưng (-3.9% to 49.4 million VND/m²), and South Tower (-4.5% to 58.5 million VND/m²) experienced declines.

| Project | Price Change (%) | New Price (million VND/m²) |

|---|---|---|

| The Zei Mỹ Đình | +5.7% | 94.5 |

| Bea Sky | +5.6% | 78.3 |

| Rice City Linh Đàm | +5.2% | 73.5 |

| Star Tower | +4.7% | 85.9 |

| Hinode City | +4.9% | 102.3 |

| Hanhomes Blue Star | –3.7% | 50.7 |

| N04A Ngoại Giao Đoàn | –4.5% | 91.2 |

| AZ Lâm Viên Complex | –3.8% | 79.7 |

| Chung cư 89 Phùng Hưng | –3.9% | 49.4 |

| South Tower | –4.5% | 58.5 |

On November 14th, real estate agent Xuân Ngọc stated, “There’s no price reduction for N04A Ngoại Giao Đoàn apartments. Prices have slightly increased, ranging from 100 to 115 million VND/m².”

89 Phùng Hưng apartment prices range from 50 to 63 million VND/m².

At 89 Phùng Hưng (Phúc La, Hà Đông), prices range from 50 to 63 million VND/m², depending on floor, direction, and interior. Agents confirm no price reductions here either.

Surveys of secondary market projects like Hanhomes Blue Star, AZ Lâm Viên Complex, and South Tower also show no price declines. “Any reductions are due to urgent sales, not market trends,” notes Nam, a senior agent in West Hanoi.

Apartment Market Remains Vibrant in Final Months

The Vietnam Real Estate Brokerage Association reports that over the past three years, housing supply has surged but remains imbalanced. New supply focuses on high-end projects, catering to investment and speculation rather than affordable housing.

New supply focuses on high-end projects.

Even in suburban areas, prices remain significantly higher than average incomes, though slightly lower than central areas. The greatest demand is for affordable housing, creating a supply-demand mismatch.

This imbalance has driven up prices, especially in major cities, outpacing income growth. This not only limits housing access but also risks a price bubble.

CBRE forecasts that Hanoi’s apartment market will remain active in late 2025, with over 11,100 new units expected in Q4, bringing the annual total to over 32,300 units. Diversified supply will introduce more units priced at 50–60 million VND/m².

Secondary market prices are projected to rise by 20% year-on-year, though slower than in 2024. Sustained high price growth raises concerns about market sustainability, given diverging buyer demand and affordability.

NLG: Illuminating the Future (Part 1)

Vietnam’s real estate market is experiencing a robust recovery, with a surge in supply and capital flowing back into projects with clear legal frameworks. Supportive macroeconomic policies and a growing economy provide a solid foundation, unlocking numerous opportunities for development and profitability, particularly in major cities and surrounding areas benefiting from infrastructure investments.

Shocking Listing: Old Social Housing in Hanoi Offered at Nearly 90 Million VND per Square Meter

The cost of social housing in Hanoi is skyrocketing at an alarming rate. Even decades-old apartments are being listed at prices comparable to mid-range commercial condominiums. In some areas, asking prices have reached a staggering 90 million VND per square meter, a jaw-dropping 4–5 times higher than the original launch price.

Luxury Residences for International Professionals Launch in Phu My Market

The rapid industrialization of Phu My has sparked a surge in housing demand among professionals, yet the supply of urban-standard apartments remains scarce. This imbalance creates a significant opportunity for pioneering projects like Maison Grand to meet the growing needs of this discerning demographic.