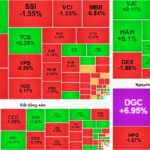

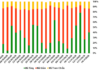

The afternoon recovery of large-cap stocks boosted market sentiment. Within the VN30 basket, LPB led the gains with a 2% increase. MWG and VNM followed closely with a 1.6% rise, while HPG and FPT climbed over 1%. VHM, VRE, VCB, VPB, BID, and VJC saw modest gains. Despite more stocks declining than advancing, the VN30-Index still rose by over 7 points, as the declines were mostly marginal, under 1%.

Real estate stocks took center stage today, attracting significant investor interest. NVL continued its rally, closing with a ceiling price and a remaining buy order of nearly 2.7 million units. Other real estate stocks like DIG, NLG, HDC, DXG, CEO, HDG, SCR, TCH, HTN, and PDR also ended in the green. While trading in this sector was more vibrant than the broader market, liquidity and influence remained insufficient to significantly lift the VN-Index.

Following real estate, steel stocks also saw positive trading. POM hit its ceiling price, while HPG, NKG, VGS, and SMC advanced.

Meanwhile, the market remained relatively divided. Declining stocks outnumbered advancers on HoSE, with many sectors experiencing similar trends. In the securities group, trading was mixed, but smaller and mid-cap stocks dominated the gains. PHS surged 14.1%, HAC rose 4%, and HBS climbed 3.7%.

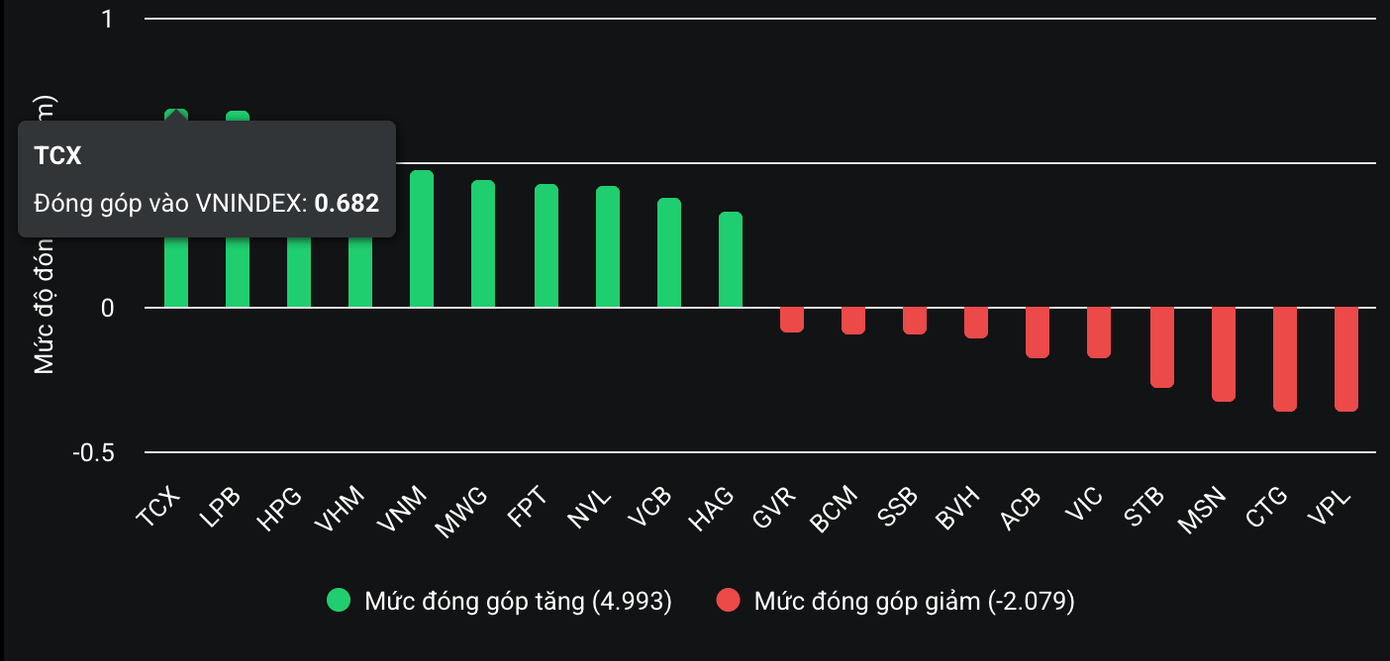

TCX made the most significant contribution to the VN-Index on November 14th.

Notably, VIX topped the market’s liquidity with 1.213 trillion VND, rising 3.2%. TCX, from Techcombank Securities, also gained 3%, marking a rare positive session since its listing. TCX was the largest contributor to the VN-Index’s gain, adding nearly 0.7 points.

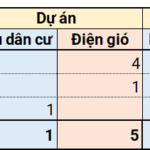

Despite the overall market’s subdued tone, a highlight was the stock of Bầu Đức’s HAG, which hit its ceiling price at 17,650 VND per share, surpassing its historical peak. The surge followed the Gia Lai Provincial People’s Committee’s decision to add the Phù Đổng high-rise residential and commercial complex project (Pleiku City) to the housing development list. The project spans nearly 7,000 m² with a total investment of 400 billion VND, marking HAGL’s return to real estate after previously announcing its exit from the sector.

At the close, the VN-Index gained 4.02 points (0.25%) to 1,635.46. The HNX-Index rose 1.32 points (0.5%) to 267.61, and the UPCoM-Index added 0.05 points (0.04%) to 120.09.

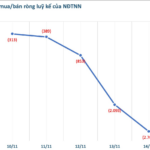

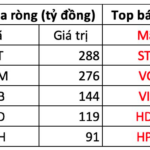

Foreign Investors Net Sell VND 1.5 Trillion in Two Bank Stocks During November 10-14, While Steel Shares See Strong Accumulation

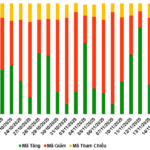

Foreign investors continued their net selling streak, with pressure intensifying towards the end of the week.

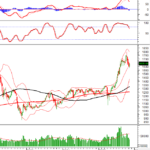

Vietstock Weekly 17-21/11/2025: Does the Recovery Momentum Need Further Validation?

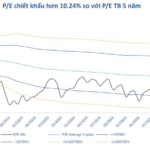

The VN-Index has rebounded after four consecutive weeks of adjustment, signaling a resurgence in bottom-fishing demand around the 1,580-1,600 support zone. However, sustaining this recovery will hinge on a significant improvement in liquidity in the coming period. Meanwhile, volatility risks are likely to persist as key indicators like the Stochastic Oscillator and MACD continue to weaken following sell signals.

Market Update: VN-Index Requires More Time for a Breakthrough on November 14th

Capital flows are currently concentrated in select stock groups, necessitating additional time for the market to establish a sustainable upward trajectory.