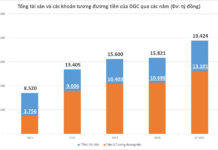

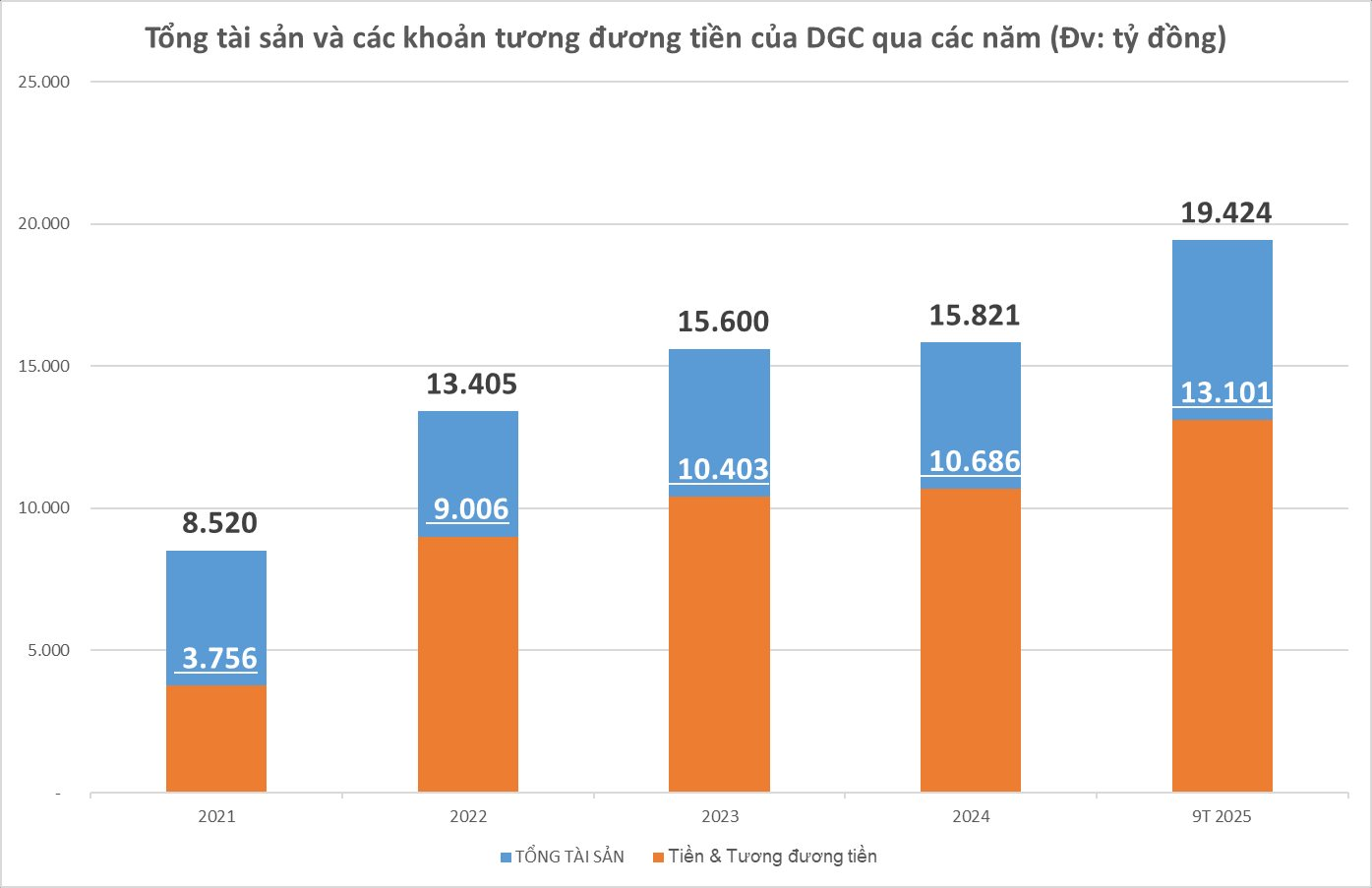

A closer look at the balance sheet reveals a strategic shift in the financial structure of this chemical industry giant. In just under five years, DGC’s total assets have more than doubled, surging from VND 8,520 billion in 2021 to a staggering VND 19,424 billion as of September 2025.

The most striking highlight is the massive cash reserves the company holds. From VND 3,632 billion in 2021, DGC’s cash and deposits have ballooned nearly fourfold, reaching a record-breaking VND 13,101 billion by the end of Q3/2025. Holding 67.4% of total assets in liquid form not only allows DGC to earn interest in a volatile market but also provides a robust liquidity shield for major investment ventures.

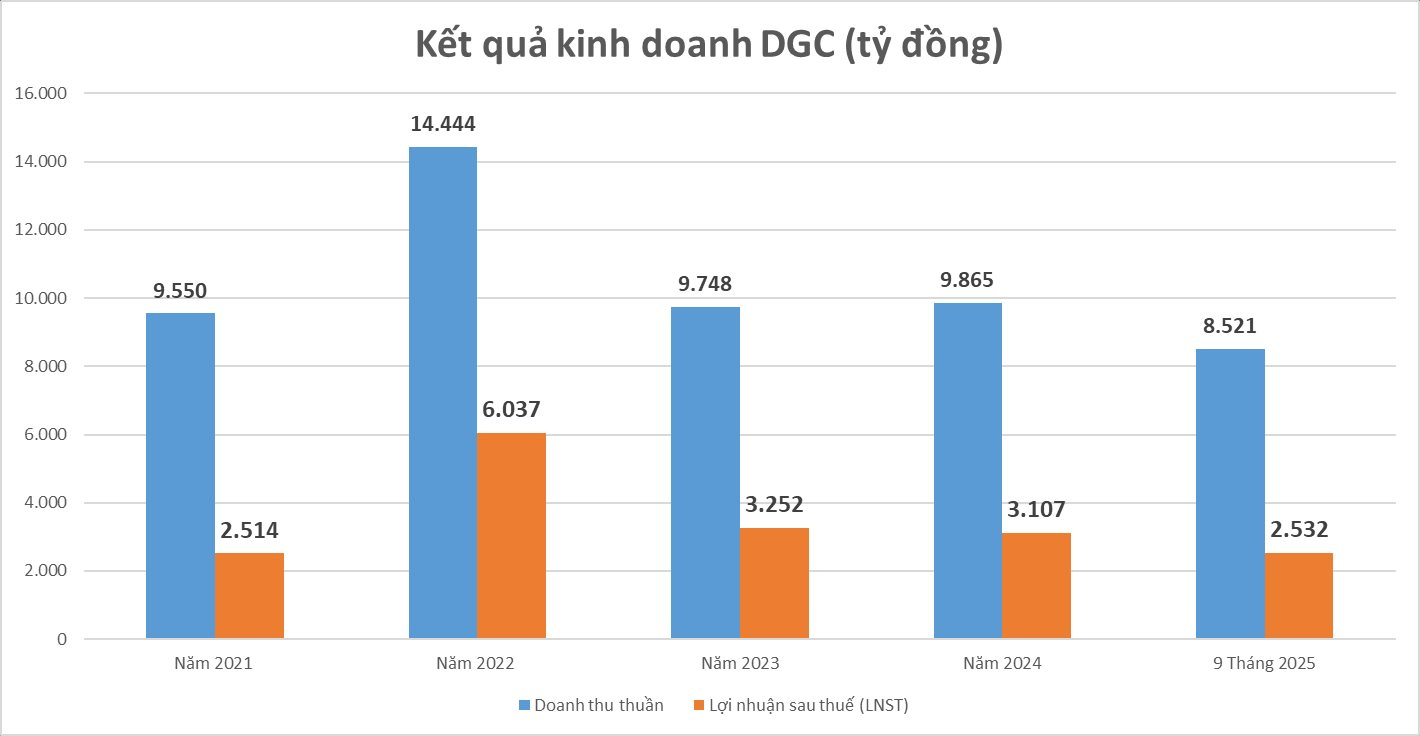

This substantial asset base is underpinned by the continued efficiency of its core business operations. In the first nine months of 2025, DGC reported net revenue of VND 8,521 billion (up 14% year-on-year) and post-tax profit of VND 2,532 billion (up 9%). Despite global market fluctuations, maintaining stable profit margins has ensured a steady cash flow from operations. However, for a manufacturing company, such large idle cash reserves also pose a challenge in capital efficiency, and DGC’s response emerged in late 2025.

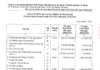

In terms of capital allocation, the latest move is the Hanoi People’s Committee’s approval of the investment plan for the Duc Giang Public Works, School, and Housing Complex in Long Bien District on November 12, 2025. Spanning over 47,470 m², the project has a total investment of approximately VND 4,500 billion. Notably, DGC plans to use 100% equity for this project, avoiding financial leverage. This is seen as a step to leverage the existing land of the old factory after relocation. The project is expected to contribute to the group’s revenue and profit in 2027–2028.

Alongside optimizing land assets, DGC’s long-term strategy remains focused on deep processing in the industrial sector. On October 12, 2025, the company signed an MoU to develop the Bauxite – Alumina – Aluminum Complex project in Lam Dong province, with a projected investment of VND 58,000 billion (USD 2.3 billion). In this context, the existing VND 13,000 billion in cash plays a crucial role as matching capital to mobilize domestic and international financing for the project.

In the short term (2025–2027), DGC’s investment cash flow is allocated to ongoing projects. The Ethanol plant in Dak Nong began commercial operations in Q1/2025 and is undergoing further upgrades. The Caustic Soda – Chlorine project in Nghi Son, after a capital increase to VND 2,900 billion for product expansion (Potassium Sulfate, batteries), is accelerating to meet its Q2/2026 deadline.

Moving forward, DGC’s challenge lies in transforming its abundant financial resources into productive assets with strong profit margins. Shifting from a defensive position with large cash reserves, DGC is entering a multi-sector expansion phase, encompassing both real estate and industrial materials.

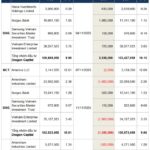

Becamex IJC Revises Capital Allocation for Recent 252 Million Share Issuance

Becamex IJC has recently announced an adjustment to the intended use of capital from its recent public issuance of nearly 252 million shares, aimed at increasing its chartered capital by 2025.

Investment Fund Trading: Selling Pressure Dominates

During the week of November 10–14, 2025, investment funds shifted to a net selling position as the VN-Index navigated a volatile trading period. The index faced significant downward pressure in the opening session, dipping below the 1,580-point support level, only to swiftly rebound to around 1,630 points later in the week.