Recently, VPS Securities Joint Stock Company (VPS) issued Decision No. 28.11/2025/QĐ-CTHĐQT of the Board of Directors regarding a loan from Vietnam Technological and Commercial Joint Stock Bank (Techcombank, Stock Code: TCB).

Specifically, the VPS Board of Directors approved a maximum loan limit of VND 6,900 billion from Techcombank, including VND 3,000 billion for unsecured short-term loans and VND 3,900 billion for secured short-term loans.

The loan proceeds will be used for investing in and trading government bonds and government-guaranteed bonds, in compliance with legal regulations and TCB guidelines. Repayment will be sourced from VPS’s business operations and other revenue streams. The maximum loan term is 6 months per loan.

Illustrative image

The VPS Board of Directors also approved asset-backed security measures (mortgage/pledge/deposit…), including but not limited to: selecting legal assets owned by VPS and/or third-party assets as collateral (if applicable); fees for asset blocking, mortgaging, management, and disposal in accordance with VPS policies and legal requirements.

The Board approved the Credit Agreement, Security Agreement, Promissory Note, and/or any related documents for the credit facility between VPS and TCB, including but not limited to: loan amount decisions (within the total credit limit, loan term, capital usage plan, interest rate, and other associated costs).

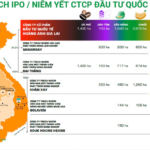

Previously, VPS successfully conducted an IPO of 202.3 million shares to 19,693 investors.

At an offering price of VND 60,000 per share, VPS raised VND 12,138.6 billion from the IPO. Of this amount, VND 10,888 billion will be allocated for margin lending; VND 900 billion for IT infrastructure investment; and VND 270 billion for human resource development. Disbursement will occur from 2025 to 2027.

Additionally, the securities company increased its charter capital to VND 14,823 billion.

Post-IPO, VPS has a total of 22,448 shareholders, including 22,424 domestic individual investors, 11 domestic institutions, and 23 foreign individuals.

Two major shareholders hold a combined 48.6% of VPS’s capital. Chairman Nguyen Lam Dung owns 8.7%, and Saigon Fund Management Joint Stock Company holds 39.9%.

Following the IPO, all shares will be registered and centrally depository at the Vietnam Securities Depository and Clearing Corporation (VSDC) and listed on the Ho Chi Minh City Stock Exchange (HoSE). The company is expected to officially list on HoSE in December 2025.

In other developments, the VPS Board of Directors signed a contract and appointed Mr. Le Minh Tai as CEO for a 5-year term starting November 19, 2025, succeeding Mr. Nguyen Lam Dung. Mr. Dung will remain with VPS as Chairman of the Board.

Currently, VPS’s executive board consists solely of the CEO, with no Deputy CEOs appointed.

On the same day, the VPS Board of Directors appointed Ms. Tran Khanh Tuyet as Head of Corporate Governance.

HAGL’s Most Valuable Asset Suddenly Focused on “Purely Commercial” Unit: Bầu Đức’s Undisclosed Reasons Revealed

Bầu Đức revealed that the most valuable land assets of HAGL are currently concentrated within Hoàng Anh Gia Lai International Investment (formerly known as Hưng Thắng Lợi).

Bầu Đức Lists Lao Subsidiary, Pledges 50% Cash Dividends for 3 Years, No Stock Dividends

At the investor meeting held on the afternoon of November 25th, HAGL Chairman Doan Nguyen Duc announced plans to list HAGL International Investment Joint Stock Company on the stock exchange in Q2 2026. He also committed to distributing cash dividends at a rate of 50% of profits for the first three years.

Bầu Đức’s IPO Pledge for Subsidiary: 30% Annual Growth, 50% Profit as Dividends

At the investor meeting held on the afternoon of November 25th, Mr. Doan Nguyen Duc (Bầu Đức), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG), unveiled preliminary details about the IPO plans for its subsidiary, HAGL International Investment Joint Stock Company, accompanied by impressive commitments.