Boba Tea: A Cultural Phenomenon Surpassing Coffee

“Boba tea brands now have better brand awareness than coffee chains. It’s become not merely a beverage, but a cultural symbol,” said Jason Yu, director of Kantar Worldpanel.

Many experts agree that while Starbucks has created a coffee culture with endless variations, boba tea with its similar customization potential is now eating into its market share. The allure of RMB 100,000 fancy coffee experiences has given way to the affordability of boba tea at less than RMB 50, or Mixue’s RMB 10 soft-serve ice cream.

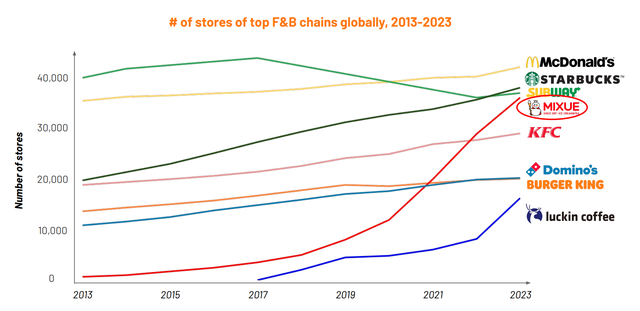

According to Momentum Works, Mixue has risen to become the world’s fourth largest F&B chain. With around 36,000 stores worldwide, Mixue has surpassed KFC (29,000), trailing only McDonald’s (42,175), Starbucks (38,038), and Subway (36,592).

Mixue also stands out as the first Chinese brand to enter the top five largest F&B chains, a space traditionally dominated by American brands.

Over the past decade, particularly since 2017, while Subway has witnessed a decline in store count and Starbucks, McDonald’s, Domino’s, and Burger King have maintained relatively stable store growth, Mixue’s growth trajectory has been unmatched. At its current expansion pace, Mixue may overtake McDonald’s within the next year or two.

Forgoing Food for Boba Tea

At an intersection in Shanghai, China, new boba tea shops continue to sprout up despite economic headwinds. Names like ChaPanda, Heytea, and Mixue compete fiercely for space, following the strategy of “if our competitor is there, so are we.”

The trend is understandable, as boba tea steadily gains dominance in China and expands globally, becoming an indispensable part of culture. Many have even become “addicted” to boba tea, willing to forgo food but not their fix of the beverage.

“Every demographic—from students and office workers to young and middle-aged people—frequently purchases boba tea. They can’t live without it,” said a ChaPanda employee.

Originating in the 1980s as a simple thirst-quencher, this beverage has spread worldwide and gained popularity despite economic downturns.

Today, thousands of boba tea brands operate globally. Even in the West, where major Chinese boba tea chains have yet to arrive, countless independent brands have emerged.

In China especially, after becoming an indispensable part of society, boba tea brands are now looking to expand overseas with unique strategies.

“The overseas market has enormous potential,” said ChaPanda CEO Wang Hongxue during a press conference announcing the company’s plans to list shares in Hong Kong, with hopes of raising USD 330 million.

While ChaPanda has opened its first store in South Korea and has set its sights on Southeast Asia, rival Heytea is targeting the United States, with its first branch in New York City opening in December 2023.

The two industry giants, Mixue and Guming, are also planning their initial public offerings in Hong Kong while simultaneously expanding their international presence.

Since its first franchise store in Hanoi in 2018, Mixue now has over 32,000 stores in China and 4,000 in 11 other countries and territories.

Its affordable treats like RMB 10 soft-serve ice cream have made the brand a household name.

With approximately 1,000 stores across its provinces, Vietnam is Mixue’s second-largest market in Southeast Asia, behind only Indonesia (approximately 2,800 locations).

After receiving investments from Meituan and Hillhouse Investment Management in 2020, Mixue was valued at RMB 23.3 billion, boosting the net worths of its two founders to USD 1.5 billion.

More Appealing Than Coffee

On April 23, 2024, Baicha Baidao, China’s third-largest boba tea chain, launched its initial public offering (IPO) on the Hong Kong Stock Exchange, seeking to raise over USD 300 million.

The move has propelled the net worth of founding couple Wang Xiaokun and Liu Weihong to USD 2.7 billion, creating new boba tea millionaires in China.

In fact, the Wang and Liu couple are just two of dozens of millionaires who have made their fortunes from boba tea in China.

Baicha Baidao now operates over 8,000 stores across China, opened its first outlet in Seoul, South Korea in January 2024, and recently launched its first coffee shop chain named Coffre.

Unsurprisingly, Starbucks was not pleased with Baidao’s move, but the coffee giant had little recourse as its rival chain sold half-liter cups of boba tea for less than USD 2. The average price of a boba tea in China hovers around USD 5, significantly cheaper than Starbucks offerings.

Baidao’s sales increased by over 56% between 2021 and 2023, reaching RMB 5.7 billion, or USD 787 million.

Despite efforts to cultivate an upscale coffee culture, Starbucks has faced challenges as the economy slows and consumers tighten their spending. Affordable boba tea shops like Mixue, with their ubiquitous presence, have become the preferred choice for young people over flashy Starbucks locations.

Data from China Chain Store & Franchise Association (CCSFA) shows that the boba tea market in China reached a total value of RMB 104 billion in 2022, equivalent to USD 14 billion, and doubled since 2018. This figure is projected to hit RMB 150 billion in 2023.

For brands like ChaPanda, franchise store sales increased from RMB 10 billion in 2021 to RMB 17 billion in 2023 despite weak post-pandemic consumer demand.

Boba Tea Culture

The FT notes that the boba tea market is demonstrating remarkable resilience as consumer demand for the product shows no signs of slowing despite Chinese consumers saving more.

A cup of boba tea in Shanghai goes for about RMB 15-20, yet people of all ages