According to a recent announcement by the Hanoi Stock Exchange (HNX), Mr. Le Minh Hung, Chairman of the Board of Directors of Du Fat Joint Stock Company, had 10,000 DFF shares sold for debt settlement on July 25. Following this transaction, Mr. Hung’s ownership decreased from 37.98 million units to 37.97 million units (equivalent to 47.47% of charter capital).

This is not the first time this year that Mr. Le Duy Hung and his family have had their DFF shares sold for debt settlement. Mr. Hung has been subject to such sales since May 2, with only a few thousand shares sold each time. In total, approximately 30,000 shares of the Chairman of Du Fat have been sold by securities companies for debt settlement.

The context of the sale is noteworthy, as DFF shares have declined for 24 consecutive sessions, with numerous sessions hitting the daily limit down. Since the beginning of July, the market price of DFF has dropped by 46%. Due to the low liquidity of DFF shares, with only a few thousand units traded each session, the continued forced sale by Mr. Le Minh Hung’s family has contributed to the stock’s continuous downward trend.

Previously, on May 2, Bao Viet Securities (BVSC) announced the sale of 40.08 million DFF shares through either order matching or negotiated trading. These shares were used by the leaders of Du Fat Company and their relatives as collateral for the DFFH2123001 bond issued by Du Fat.

Of the 40.08 million DFF shares sold by BVSC, 28.2 million shares belonged to Mr. Le Duy Hung, Chairman of Du Fat’s Board of Directors, 6.8 million shares belonged to Mr. Le Van Thinh (Mr. Hung’s brother), and 5.08 million shares were owned by Mrs. Tran Hong Nhung (Mr. Hung’s wife).

The case of DFF shares is similar to that of HPX, NVL, and PDR in the past. The market prices of these stocks plummeted, triggering forced sales of the shares held by the companies’ leaders.

According to our sources, Mr. Le Duy Hung, born in 1979, specialized in Drilling at the Oil and Gas Faculty of the University of Mining and Geology. Prior to establishing and leading Du Fat Group in 2009, he worked as a construction supervisor at Licogi 20 from 2002 to 2009.

Mr. Le Duy Hung, Chairman of the Board of Directors of Du Fat.

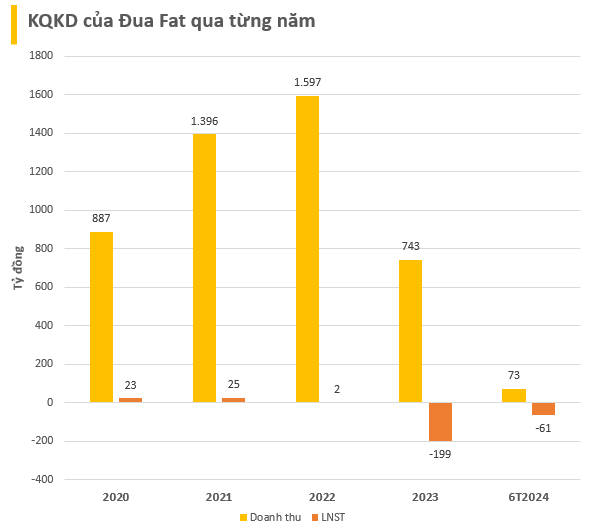

Mr. Hung founded Du Fat in 2009, primarily focusing on land leveling, foundation treatment for works, demolition of structures and construction components, etc. The company began trading its shares on UPCoM in mid-2021. In March 2022, Du Fat doubled its charter capital from 400 billion VND to 800 billion VND.

In recent years, Du Fat’s business performance has been declining. In 2023, the company reported a significant drop in revenue compared to the previous year, resulting in a substantial loss of nearly 200 billion VND. This negative trend continued into the first half of 2024, with the company reporting further losses.

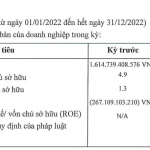

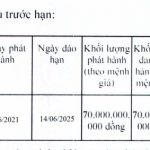

In addition to business challenges, Du Fat is also grappling with significant debt obligations. Firstly, the company issued the DFFH2123001 bond on September 1, 2021, with a maturity date of March 1, 2023, and an interest rate of 11.75% per annum. However, as of the maturity date, there was still an outstanding debt of 89.52 billion VND owed to bondholders.

According to a resolution passed by the bondholders on March 2, 2023, and published by Du Fat, the Group, along with the bondholders, agreed to a repayment schedule that extended the maturity date to July 14, 2023, a delay of four months. The interest rate during the overdue period was set at 17.625% per annum, a significant increase from the initial rate.

According to Du Fat’s Q2 2024 financial statements, the outstanding balance of the DFFH2123001 bond was approximately 81.3 billion VND. Additionally, the company also has another bond, DFFH2124002, worth 299.8 billion VND, which will mature on December 31, 2024.

As of the end of Q2 2024, Du Fat’s total liabilities stood at 3,248 billion VND (82.7%), approximately five times its owner’s equity. The company’s financial borrowings alone amounted to nearly 2,300 billion VND.

Du Fat has significant loans from various financial institutions, including a 980 billion VND loan from SHB Bank – Thang Long Branch, a 334 billion VND loan from Agribank – Tay Ho Branch, and a 160.8 billion VND loan from TPBank – Son Tay Branch. These loans are secured by real estate, future receivables from construction contracts, machinery, and equipment, among other assets.

The company has taken on these loans to purchase machinery and equipment for construction, as well as to invest in the Du Fat Kim Son Multi-Purpose Port Project (Ninh Binh), which is still in the process of land leveling.

“The King of Catfish” Hùng Vương seeks to sell a series of subsidiary companies to repay debts.

Hùng Vương Corporation’s Board of Directors (UPCoM: HVG) has recently approved a resolution to compile a shareholder list and request written feedback on the proposed debt restructuring plan. The final registration date is March 5th. Shareholders are given the opportunity to provide their responses from March 11th to April 11th. The voting and result announcement will take place from April 12th to April 19th.

Introducing a New Subsidiary of CII Issuing 550 Billion Dong Bonds

Following the success of BOT Binh Thuan, it is now the turn of the investor of the BOT project to expand Ha Noi Boulevard to issue a successful bond issue worth 550 billion VND. This is also a subsidiary of Ho Chi Minh City Infrastructure Investment JSC (CII).

Compassionate Food settles 70 billion VND bond ahead of schedule

On February 23, 2024, Huu Nghi Food successfully settled the bond batch HNFH2125002, which was issued on June 14, 2021, with a face value of 70 billion VND.