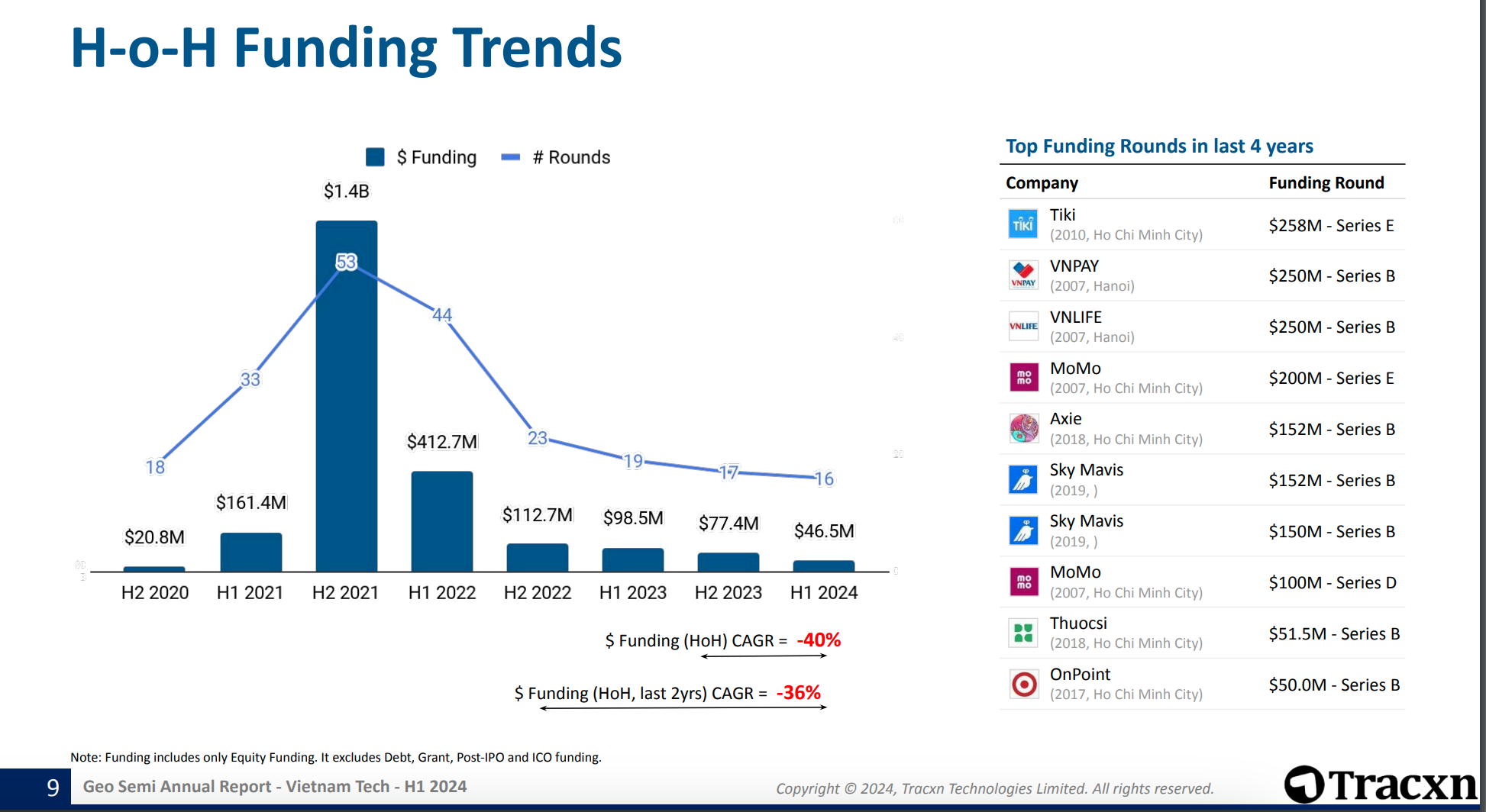

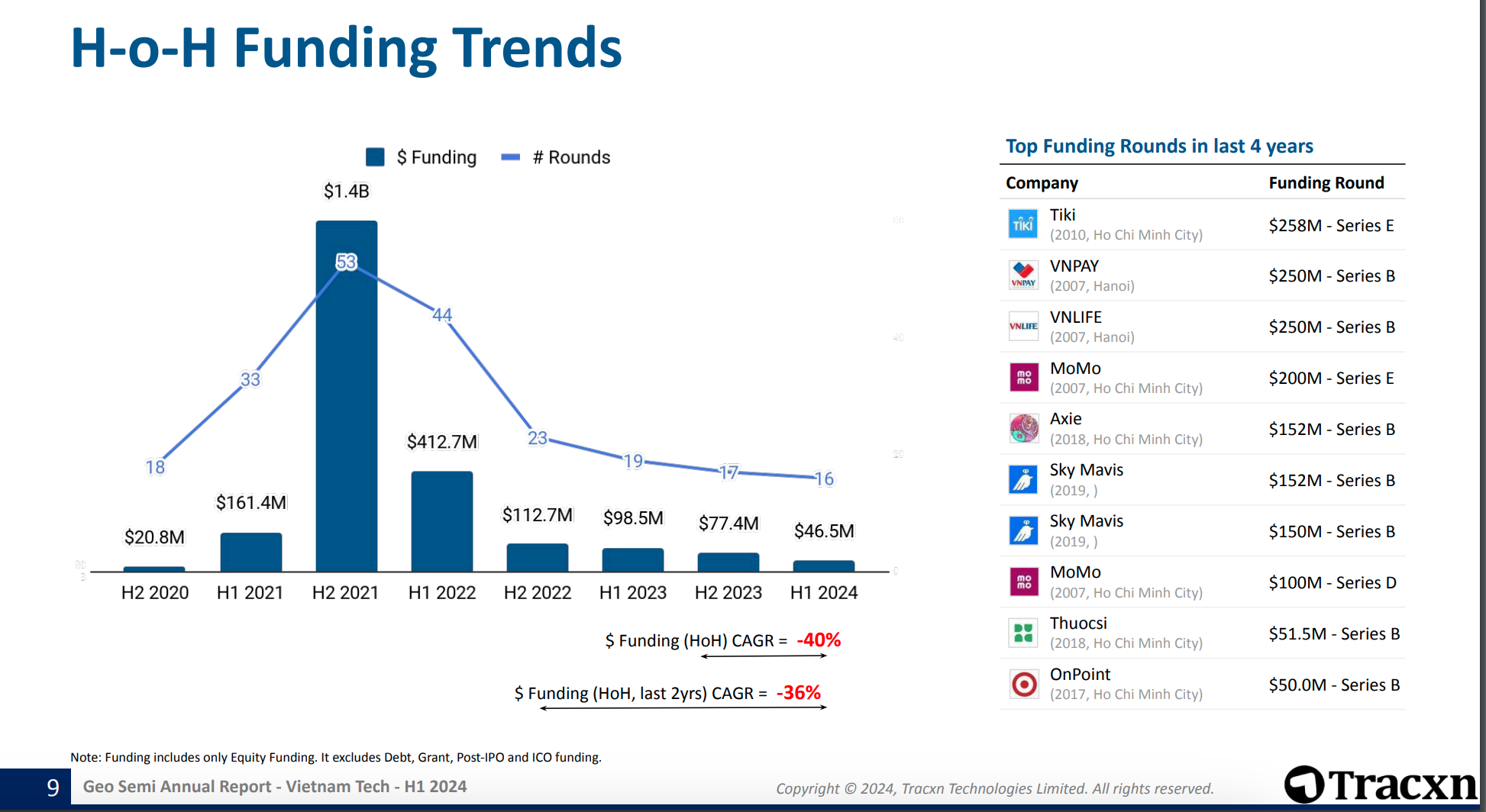

The state of startup funding in the first half of 2024 continued its downward trend since its peak in 2021, ushering in what is known as a “funding winter” for startups. However, Ms. Hoang Thi Kim Dung, Country Director at Genesia Ventures Vietnam, has a different perspective on the true meaning of this phenomenon.

In any market value chain, the supply of one side needs to match the demand of the other. In the startup capital market, from the perspective of two important stakeholders – startups and investors, supply can be understood as:

– Capital supply from investors to startups

– Supply of investment-worthy startups for investors

Meanwhile, demand can be understood as:

– Demand for investment capital from startups

– Demand for investing in startups from investors

PERSPECTIVES FROM BOTH SIDES

Interestingly, your perspective changes depending on whether you’re looking from the viewpoint of a startup founder or an investor. If you were to meet and ask startup founders who are seeking investment, you would find that the common challenge they face is a perceived reduction in capital supply due to venture capitalists becoming less adventurous.

On the other hand, if you were to meet and ask startup investors, especially venture capital funds that still have the resources to invest and are actively looking to invest in startups, you would find that their challenge lies in not finding enough suitable deals to present to their Investment Committees or having deals rejected by these committees.

In essence, they have the demand to invest but are faced with a lack of supply – startups that meet their investment criteria.

“Therefore, I observe that the current structure of the startup market is characterized by a supply shortage and demand surplus from the perspective of both startups and investors. Hence, if it’s a ‘funding winter’ for startups, then it’s undoubtedly a ‘winter of investment’ for startup investors,” notes Kim Dung.

WINTER OF INVESTMENT: WHEN INVESTORS BECOME MORE DISCERNING

This “winter of investment” has arrived at a time when venture capitalists have learned many expensive lessons from the peak years of 2021, making them more enlightened, discerning, and selective in their investments. As a result, they have become more cautious and raised their investment standards. So, what are these higher standards that are causing the current “mismatch between supply and demand”?

First, when considering investing in startups, especially early-stage startups, investors will gather information about the founders’ capabilities, the target market’s growth rate, and the nature of the startup’s products or services within that market. They will use this information to project the startup’s growth trajectory and its ability to reach important milestones that give it an advantage in both development and attracting further investment in subsequent rounds.

Given the economic challenges and the numerous micro and macro variables that can affect a startup’s ability to meet its business targets, or the additional time and resources required to do so, investors need to be prudent. This is especially true for early-stage startups that aim to achieve product-market fit (PMF) before the next funding round, as the path to this goal now seems longer.

As an investor, it’s crucial to have a realistic discussion with the startup founders about how much can be achieved with the current funding round. How many “experiments” can the startup realistically conduct to find its PMF? What will these experiments entail? Investors are looking for startups led by founders with a strong foundation, agility, and resilience—founders who can efficiently execute a series of experiments within limited resources to navigate their way to PMF and propel the startup’s growth despite the challenges.

Next, the issue of startup governance and financial misconduct cannot be overlooked. News of financial misconduct by startups has served as a wake-up call for everyone in the startup ecosystem, especially venture capitalists, making them more cautious and stringent in this regard. The failure of startups to uphold good governance and financial discipline has been a costly lesson for all.

We need startups with a long-term sustainable vision, strong corporate governance, and a commitment to ethical values and financial transparency. This is also essential to restoring and maintaining investor confidence, thereby attracting more investment and increasing the resources available for startup growth.

Lastly, we cannot ignore the challenge of exit strategies, which remain elusive for investors in Vietnamese startups. Our ecosystem currently lacks startups that meet the stringent requirements for IPOs, as well as large corporations making strategic acquisitions of Vietnamese startups. What our ecosystem is missing is not unicorns but successful exit stories.

Unicorns are meaningless if they are not profitable and if there is no clear exit strategy for ALL stakeholders, including founders, long-serving employees, and investors. We need startups with more sustainable and profitable business models and clearer exit pathways. This is crucial for building investor confidence in the potential of the Vietnamese startup ecosystem and encouraging future generations of founders to take the leap.

The current period is indeed a “winter of investment,” with the challenge of a “supply shortage and demand surplus.” Investment funds that still have resources to deploy are working tirelessly and are eager to invest in potential Vietnamese startups. As with all evolutionary processes, investors have become more disciplined and raised their investment standards after learning expensive lessons.

To match supply with demand, Vietnam’s startup ecosystem needs to improve both the quality and quantity of startups that demonstrate exceptional growth potential, strong governance for sustainable development, and clear exit strategies that benefit all stakeholders.