A notable transaction at Hoang Anh Gia Lai (HAGL, stock code: HAG) has been made as

Currently, Ms. Hoang Anh holds 11 million HAG shares, equivalent to a 1.04% ownership stake. If this transaction is successful, her ownership will increase to 13 million shares, representing a 1.23% stake.

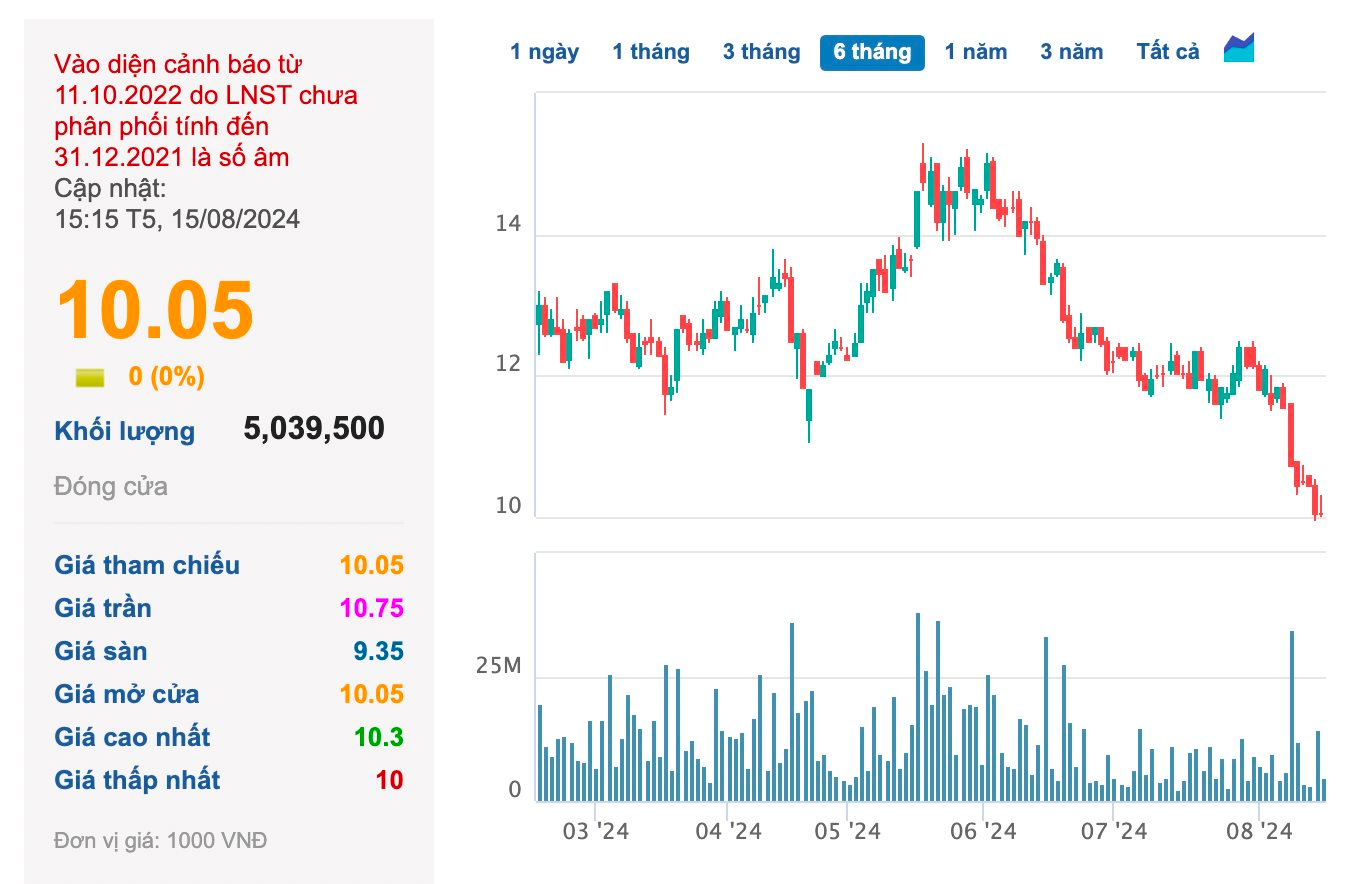

It is worth noting that Ms. Hoang Anh’s registration to buy HAG shares comes amid a significant drop in the share price. At the close of the trading session on August 15, HAG shares were priced at VND 10,050, a 32.7% decrease from their peak of VND 14,950 in May.

Based on the closing price of VND 10,050/share on August 15, Mr. Duc’s daughter would need to spend approximately VND 20 billion to purchase the aforementioned number of shares.

Figure: HAG Share Trading

Regarding HAGL’s recent performance, the company reported second-quarter 2024 financial results with net revenue of VND 1,518 billion, a 5% increase compared to the same period last year. A 19% decrease in cost of goods sold resulted in a gross profit of VND 488 billion, a 177% increase. The gross profit margin improved significantly to 32.1% from 12.2% in the second quarter of 2023.

After deducting expenses, HAGL reported a post-tax profit of VND 281 billion, 3.4 times higher than the same period last year.

For the first six months of 2024, the company’s revenue decreased by 12% year-on-year to VND 2,759 billion. Conversely, post-tax profit increased by 32% to VND 507 billion.

HAGL has successfully completed a private placement of shares, raising VND 1,300 billion and increasing its charter capital to VND 10,574 billion. The company has also repaid the principal and interest on a VND 300 billion bond issue dated June 18, 2012, due on September 30, 2025, and restructured its subsidiaries’ debts, reducing interest expenses.

As a result, HAGL narrowed its accumulated loss to VND 904 billion as of June 30, 2024.

In terms of investment in projects, HAGL has focused on pig farming and banana and durian cultivation. In the first six months of 2024, the company increased its durian area from 1,500 hectares to 1,947 hectares, an addition of 447 hectares, while maintaining its banana area at 7,000 hectares.

For the full year 2024, HAGL aims to achieve a record-high revenue of VND 7,750 billion, a 20% increase compared to 2023. The company has set a post-tax profit target of VND 1,320 billion, a 26% decrease from last year’s results. Thus, after six months, the company has achieved 36% of its revenue target and 38% of its profit target.

It is known that if HAGL accomplishes its goals, 2024 will mark the third consecutive year of achieving post-tax profits of thousands of billions of VND, supporting the reduction of accumulated losses. On multiple occasions, the Chairman, Mr. Doan Nguyen Duc, has shared with shareholders that accumulated losses are a personal concern of his.