Proceeding with Caution in Business Plans

As Vietnam and the US engage in negotiations over tariff rates, banks have been formulating contingency plans to address potential new US tariffs on Vietnamese goods.

Eximbank, a leading bank in trade finance for import and export activities, has shared its focus on potential and safe customer segments, leveraging its strengths in retail and foreign trade.

“Eximbank will carefully assess the situation to maintain asset quality, given our expertise in import-export lending,” said Mr. Nguyen Canh Anh, Chairman of Eximbank’s Board of Directors.

According to Mr. Nguyen Thanh Tung, Chairman of Vietcombank’s Board of Directors, the bank could be significantly impacted due to its 20% market share in international payments and domestic trade finance.

Vietcombank has proactively engaged with its customers, diversified export markets, and collaborated with relevant authorities to propose appropriate response strategies based on different industries.

On May 1st, a technical delegation from Vietnam visited the US and worked with American agencies on bilateral trade negotiations. This demonstrates the importance the US places on Vietnam as a trading partner and reflects their sincerity and willingness to address Vietnam’s concerns.

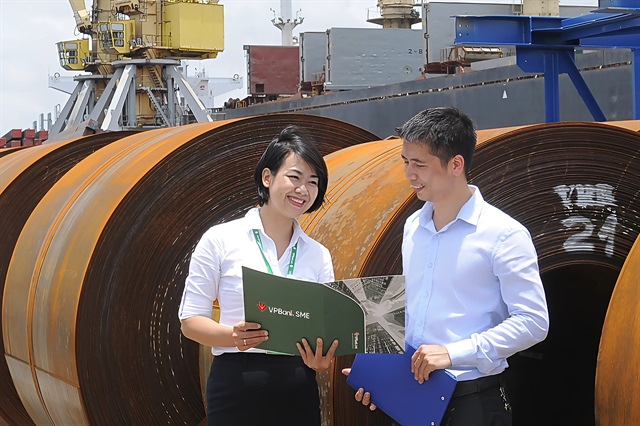

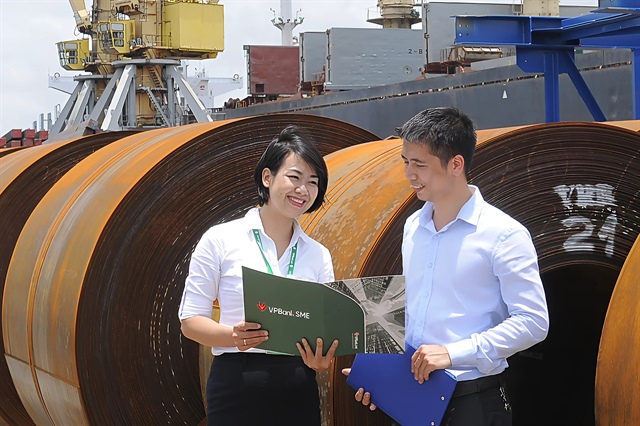

Banks develop support plans for customers affected by new US tariff policies. Image: VPBank. |

Mr. Luu Trung Thai, Chairman of MB Bank’s Board of Directors, emphasized Vietnam’s proactive and flexible approach, along with its advantages in labor, resources, and economic openness. He believes that Vietnam will navigate through potential risks to the economy and maintain its growth trajectory.

Meanwhile, General Director Pham Nhu Anh shared that MB Bank has set a modest 10% profit growth target for the year due to declining lending rates and expectations of challenges arising from global trade tensions.

The bank will adjust its profit plans upwards when conditions allow and will continue to support businesses impacted by US tariffs on Vietnamese goods.

Potential Impact on Industrial Real Estate Businesses

At VPBank, General Director Nguyen Duc Vinh expressed confidence in a favorable outcome for Vietnam in the negotiations but anticipated an increase in tariffs, affecting both FDI enterprises and traditional Vietnamese exporters.

Mr. Vinh noted that credit for exporters to the US accounts for only 3% of their portfolio, so any impact would be limited.

VPBank serves approximately 500 FDI companies through its strategic partnership with SMBC, with FDI outstanding loans exceeding VND 10,000 billion. However, actual new lending is over VND 6,000 billion, and their customers have not yet been directly impacted.

However, Mr. Vinh cautioned about the potential impact on industrial real estate businesses. “Most of the enterprises in the import-export sector are small and medium-sized. Our primary concern is consumer purchasing power. If industrial parks are affected, it will impact employment and, consequently, reduce consumer spending,” he said.

At the HDBank Annual General Meeting of Shareholders, Mr. Pham Quoc Thanh, Acting General Director of HDBank, stated that the bank had reviewed its portfolio and identified customers who might be affected.

The direct impact is expected to be minimal, as HDBank’s customers exporting goods to the US market account for less than 1.5% of their total outstanding loans. The bank will also implement support policies for affected customers.

Mr. Tran Hong Minh, Acting General Director of KienlongBank, shared that the bank focuses on providing credit to customers in the Mekong Delta region, especially those in rice production and trading.

To address the new tariff policies, KienlongBank is shifting its support for this customer segment towards green credit, thereby minimizing the impact of US tariff measures.

At LPBank, Mr. Bui Thai Ha, Vice Chairman of the Board of Directors, stated that the bank has conducted a thorough assessment and developed response strategies for the new tariff policies.

“Only 0.3% of LPBank’s total credit portfolio is exposed to the impact of US tariff policies. Therefore, we believe it will not affect our credit quality. Moreover, the positive signals from the tariff negotiations between Vietnam and the US give us confidence in a favorable outcome for Vietnam,” said Mr. Bui Thai Ha.

Tuân Nguyễn

– 05:45 08/05/2025

Why is the US Dollar Weakening Globally Yet Appreciating Against the VND?

According to MBS, the increase in foreign currency purchases by the State Treasury, coupled with heightened foreign currency demands from businesses amid global trade uncertainties and a significant negative shift in VND-USD interest rate differentials, contributed to the appreciation of the USD/VND exchange rate in April, despite the greenback’s weakness in the international market.