**State Bank of Vietnam Adjusts Central Exchange Rate**

*The State Bank of Vietnam (SBV) has made a significant adjustment to the central exchange rate, marking a notable development in the country’s currency landscape.*

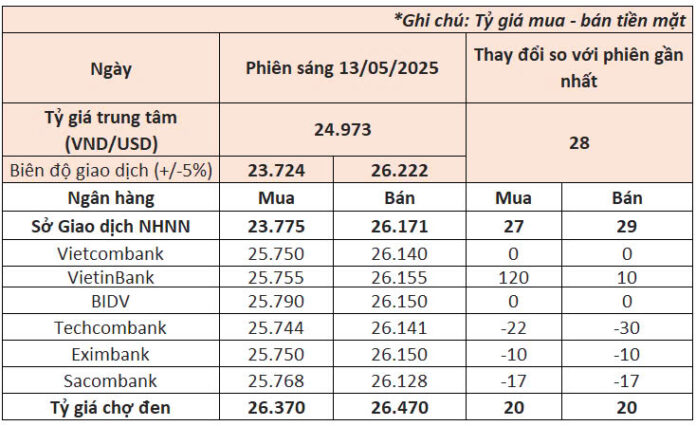

On the morning of May 13th, the SBV set the central exchange rate for the US dollar at 24,973 VND/USD, reflecting an increase of 28 dong from the previous day’s rate. This new rate stands as the highest since the inception of this exchange rate mechanism.

With a permitted fluctuation margin of 5%, the trading banks are now allowed to conduct transactions within the range of 23,724 – 26,222 VND/USD.

Consequently, the State Bank of Vietnam’s Trading Centre has also adjusted the buying and selling rates accordingly, raising them to 23,775 – 26,171 VND/USD.

Across commercial banks, the USD exchange rates exhibited mixed movements today, with a predominant downward trend. As of 11:00 am, Vietcombank, the system’s leader in foreign currency transactions, maintained its USD buying and selling rates at 25,750 and 26,140 VND/USD, respectively, unchanged from the previous day’s close. BIDV followed suit, while VietinBank witnessed a substantial increase of 120 dong in the buying rate and a 10 dong hike in the selling rate.

Among private banks, a decreasing trend was observed. Techcombank lowered its buying and selling rates by 22 dong and 30 dong, respectively, while Eximbank reduced both rates by 10 dong. Sacombank also joined the downward movement, decreasing both rates by 17 dong.

In the interbank market, the USD exchange rate concluded the May 12 session at 25,973 VND/USD, marking an 8-dong increase from the previous Friday’s close (May 9).

Turning to the black market, as of 10:00 am today, the USD was traded within a range of 26,370 – 26,470 VND/USD, with both buying and selling rates climbing by 20 dong compared to the previous day’s levels.

**US Dollar Surges in the Global Market**

*The US dollar index (DXY), a measure of the greenback’s strength against a basket of major currencies, hovers around the 101.5 mark.*

The US dollar witnessed a substantial surge of 1.5% during the previous trading session, bolstered by rising yields on US Treasury bonds. This upward momentum is attributed to investors’ optimism surrounding the US-China trade agreement.

Effective April 15, the overall tariff rate of 145% imposed by the US on Chinese goods will be reduced to 30%, including tariffs related to fentanyl drugs. Concurrently, the 125% tariff levied by China on American goods will also witness a decrease to 10%.

Addressing a press conference in Geneva, Switzerland, on May 12, US Secretary of the Treasury, Scott Bessent, affirmed that the world’s two largest economies have agreed to a 90-day truce in their trade tensions. He emphasized America’s aspiration for a more balanced trade relationship with China and its partners, vowing to continue negotiations with Beijing in the coming weeks to forge a more comprehensive agreement.

Apple’s Supplier in Ha Nam Plans to Boost Production by 30%, Hiring 3,000 Workers

Wistron is an esteemed ODM (Original Design Manufacturer) that crafts and creates products for an impressive roster of clients. With an enviable portfolio, Wistron has worked with industry giants such as Dell, Apple, Acer, HP, Lenovo, and Sony. They are a trusted partner for these renowned brands, designing and manufacturing innovative solutions that meet their exacting standards.