During a discussion on certain contents of the draft Law on Management and Investment of State Capital in Enterprises on the morning of May 13th, delegate Pham Van Hoa of Dong Thap expressed his opinion: Currently, there are 88 enterprises with state capital elements, including state-owned enterprises, enterprises with two or more members, enterprises with material elements of the State or state capital in enterprises with foreign elements.

“I believe that all enterprises with state capital contributions should fall under the management of the State. When the State invests in an enterprise, the investor and the representative of the owner need to be clearly and transparently identified, while also being accountable for the efficiency of state capital usage,” said delegate Hoa.

Delegate Pham Van Hoa. (Photo: Media Congress)

In the enterprise’s investment and production and business strategy, it is necessary to clarify the timing of when the enterprise is allowed to invest and when it is granted such rights, as well as who is responsible for the allocated state capital.

In addition, it is essential to review the management mechanism for the investment activities of state-owned enterprises. Without stringent regulations, enterprises may utilize state capital to invest in high-risk, non-core sectors. It is imperative to delineate which sectors are permissible for enterprise investment and which are not, along with designating the approving and supervising authorities.

“For instance, in the banking sector, should commercial banks with state capital be allowed to invest in real estate? This requires thorough evaluation and explicit regulations,” informed delegate Hoa.

However, according to Mr. Hoa, not all enterprises are prohibited from investing in real estate – it depends on specific cases and the particular enterprise model. “For enterprises that possess the requisite conditions and capabilities, permission may be granted; however, for those lacking such conditions, it is best to refrain from doing so to prevent state capital loss,” added delegate Hoa.

Regarding investment principles, there are opinions suggesting that if the State invests in an enterprise, it is considered the “actual owner” and has the right to manage it as the legal entity of the enterprise. Nonetheless, Mr. Hoa disagreed with this perspective. He asserted that state investment does not imply absolute management authority but should instead be based on clear contractual terms and legal mechanisms. The investment must distinguish between capital and management rights to avert conflicts of interest and abuse of power.

“Hence, it is imperative to demarcate that state capital is the property of the people and not of any organization or individual. Investments must be grounded in policies and national development goals. The responsibility for managing state capital rests with the representative agencies of the owner, and they must be accountable to the State and the people, especially for enterprises with a dominant or substantial state capital presence,” emphasized the delegate.

According to delegate Hoa, the current law, such as the Enterprise Law, should delineate the scope of 100% state-owned enterprises. Additionally, it should clarify that the State should only invest in sectors that private enterprises are unable or unwilling to undertake due to low profitability but are essential for society, ensuring the security and welfare of the people.

For instance, public healthcare, basic education, or major infrastructure projects that contribute to national development.

Presently, there are sectors that private enterprises are reluctant to invest in, such as construction, expressways, and national highways. These sectors demand substantial capital investment and entail lengthy capital recovery periods, resulting in low economic efficiency. Therefore, the State needs to take the initiative to invest while also ensuring its leading role in infrastructure development.

However, to excel in investment, a clear strategy is imperative. State-capital enterprises ought to be empowered to mobilize capital, borrow funds, and execute investment projects with agility. Simultaneously, it is essential to delegate authority explicitly to the Members’ Council and the Company Chairman concerning the approval of projects and investment activities in production and business operations.

“I propose that the roles, tasks, and authority of the Members’ Council and the Company Chairman be clearly defined to avert overlaps, dependencies, or a lack of independence in decision-making,” suggested delegate Hoa.

Delegate Nguyen Duy Thanh’s opinion: Allow private enterprises to engage in sectors where state-owned enterprises are permitted to operate

Expressing his agreement, delegate Nguyen Duy Thanh from Ca Mau province remarked that numerous state-owned enterprises had been perpetually loss-making, whereas if the State promulgated mechanisms and policies enabling private economic components to participate, private enterprises would turn a profit and significantly contribute to the state budget.

Delegate Nguyen Duy Thanh. (Photo: Media Congress)

“The chronic losses incurred by many state-owned enterprises are partly attributable to the exclusion of private enterprises, resulting in monopolies. This is highly inappropriate, and it is imperative to enable private enterprises to partake in sectors where state-owned enterprises operate,” emphasized delegate Thanh.

Echoing this sentiment, delegate Nguyen Van Than of Thai Binh, who is also the President of the Association of Small and Medium Enterprises in Vietnam, proposed that state-owned enterprises must fulfill their functions and tasks and, more importantly, prioritize efficiency. Meanwhile, private enterprises should be facilitated and not impeded by administrative barriers or unfair competition.

“For projects with substantial potential and far-reaching impact, there should be no distinction between state-owned and private enterprises. Let them participate, invest, and develop together for mutual benefit. We need a robust business community, not only for economic growth but also to build a fair, modern, and sustainable society,” asserted delegate Than.

Delegate Nguyen Van Than. (Photo: Media Congress)

“Recently, Resolution 68 and new orientations on technology and digital transformation are crucial directives. However, they need to be materialized through explicit mechanisms and policies for effective implementation. Merely remaining at the orientation stage will hinder concrete actions,” added delegate Than.

Elevating the Cam Lo – La Son Highway

The Ho Chi Minh Road Project Management Unit is expediting the completion of necessary legal procedures to commence the construction of the Cam Lo – La Son Highway expansion project by August.

The Billionaire’s Vision: Revolutionizing Vietnam’s Transport with High-Speed Rail

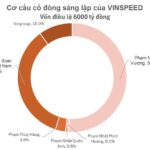

The North-South high-speed rail project is a massive undertaking with an investment of over VND 1,560 trillion. VinSpeed, a prominent entity, takes on the role of arranging 20% of the total project investment, amounting to more than VND 312 trillion. For the remaining 80% of the required funds, VinSpeed proposes an interest-free state loan with a repayment period of 35 years from the date of disbursement.

Vietnam Airlines Proposes a Capital Increase and a Narrow-Body Aircraft Project at an Extraordinary General Meeting

The meeting was convened to approve the proposal to issue shares and increase the charter capital, along with the investment in narrow-body aircraft.