A subdued ICT and electronics market

The consumer ICT (mobile phones, laptops, etc.) and electronics market in Vietnam witnessed a low growth trend in the first few months of the year, with an approximate increase of only 4-5%. This information was shared by Vu Dang Linh, CEO of Mobile World Investment Corporation (HOSE: MWG), during an investor meeting on the evening of May 22. Mr. Linh also predicted that the situation is unlikely to improve significantly in the near future.

However, Mobile World and Dien May Xanh, which are part of the MWG group, achieved an 11% growth in revenue during the first four months of 2025 compared to the same period last year. This growth was attributed to their closer collaboration with suppliers, which helped them gain market share.

In the wholesale channel, Digiworld, a market developer, reported an 11% growth in revenue in the first quarter, mainly due to the introduction of higher-end laptops and new household appliances. The positive performance in these product categories offset the 8% decline in revenue from the phone distribution business.

In the first quarter of 2025, Petrosetco (HOSE: PET), a major distributor in the ICT industry, reported a 6% decrease in revenue, while FPT Shop, a retailer, experienced a modest 2.7% increase in revenue, falling below the market average.

During the annual general meetings held at the end of April 2025, representatives from both MWG and Digiworld acknowledged the indirect impact of the trade war on the retail and distribution industries. While export issues may affect consumer spending in the economy, this could be offset by investment spending and a relaxed monetary policy.

The record-high number of international tourists in the first four months of the year has also provided a boost to the domestic consumer market.

Nevertheless, given the potential for significant business environment fluctuations, MWG‘s CEO, Vu Dang Linh, stated that the company will exercise caution in its decisions, especially regarding long-term investments.

|

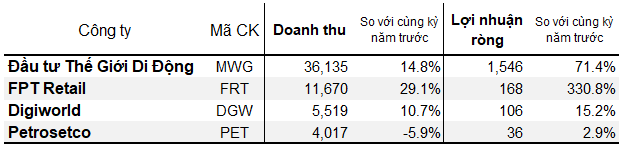

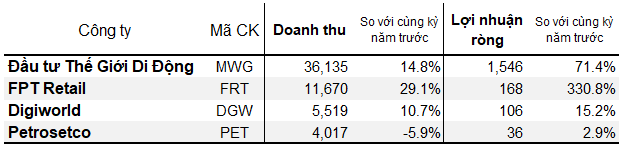

Large retailers and distributors continue to grow their businesses

But they remain cautious about economic demand Unit: VND billion

Note: The growth of FPT Retail comes from the Long Chau pharmacy chain, while the FPT Shop segment remains almost unchanged

Source: Consolidated financial statements for Q1/2025 of the companies, VietstockFinance |

The modern market race

In contrast to the calm ICT market, the food and consumer goods sector is experiencing a rapid expansion of modern retail systems by domestic giants such as Bach Hoa Xanh and WinCommerce (WinMart), especially in areas where modern retail has not yet made significant inroads.

Bach Hoa Xanh, currently Vietnam’s leading food retailer in terms of revenue, opened 359 new stores in just the first four months of the year, with half of them located in the central provinces.

With over 2,100 stores and an internal logistics system, Bach Hoa Xanh also aims to boost its online revenue by 300% this year compared to the 925 billion VND achieved in 2024. In the first quarter of 2025, their online channel witnessed a remarkable 364% increase in revenue, reaching 627 billion VND.

Following a similar trend, WinCommerce, the retail arm of the Masan Group, opened 212 new stores by the end of April, mainly in the North and Central regions. This expansion brought their total store count to 4,035, including 1,500 WinMart+ stores in rural areas. The company reported a 13.5% growth in sales from these rural stores, outperforming the average growth rate of the entire chain.

Meanwhile, Central Retail Vietnam seems to be falling behind in the race for market share. The Thai retail giant’s focus on opening larger-scale supermarkets has resulted in a slower expansion compared to its more agile competitors, Bach Hoa Xanh and Wincommerce.

In the first quarter of 2025, Central Retail experienced a 2.5% decline in food sales in Vietnam, amounting to 12.78 billion Baht, despite having more sales outlets than the previous year. However, this reported revenue figure may be influenced by the recent depreciation of the VND against the Baht.

|

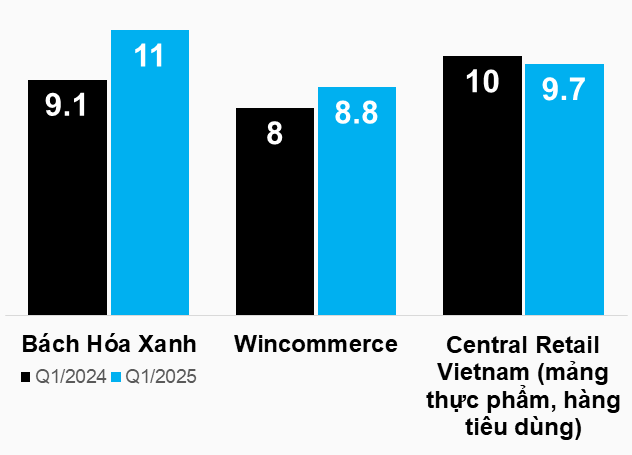

Bach Hoa Xanh & Wincommerce gain market share

(Comparing revenue of the chains in the first quarter) Unit: Thousand billion VND

Note: Central Retail’s revenue is hypothetically converted assuming an exchange rate of 1 Baht to 760 VND for both reporting periods

Source: Financial data released by MWG, Masan, and Central Retail Corporation |

– 10:00 30/05/2025

“Rapid Retail Expansion: MWG’s Impressive Growth with 359 New Stores in 4 Months, Achieving 32% of Revenue Target”

In April 2025, the combined revenue of TGDĐ and ĐMX reached an impressive VND 8.3 trillion, marking a 13% increase from the previous month and a 3% growth compared to the same period last year.

The Mobile World Group “Makes a Comeback” in the E-commerce Race with MWG Shop

“MWG’s suite of brands, including The Gioi Di Dong, Dien May Xanh, TopZone, and AVAKids, have made their debut on a new e-commerce platform. With a diverse range of products and services, MWG is set to revolutionize the online shopping experience for consumers across the country. The company’s expansion into e-commerce showcases its commitment to innovation and staying at the forefront of the retail industry.”

“Petrosetco Plans to Buy Back 1.11 Million ESOP Shares”

Petrosetco plans to repurchase 1.11 million ESOP shares issued in 2021 from employees who left the company during the restricted trading period. The repurchase price is set at VND 10,939 per share.