Fueled by the government’s commitment to economic growth and a low-interest rate environment, Vietnam’s stock market is experiencing a surge in positivity. As of now, the benchmark HoSE index has climbed an impressive 33.01%.

However, this consistent rise in the VN-Index has presented a challenge for investment funds. Data from Fmarket reveals that many funds are struggling to keep pace with the VN-Index, lagging behind in performance for the year 2025 (as of September 15th) compared to the HoSE benchmark.

Experts attribute this to the VN-Index’s strong performance in 2025, particularly its remarkable surge in July and August. During this period, investment flows were concentrated in specific sectors and stocks, making it crucial for investors to target the right industries, stocks, and timing to achieve high returns.

Unlike individual investors, investment funds cannot afford to “go all-in” on a single sector or stock. They are bound by diversification requirements, portfolio weight limits, and liquidity considerations. This inherent constraint makes it challenging for funds to consistently outperform the VN-Index.

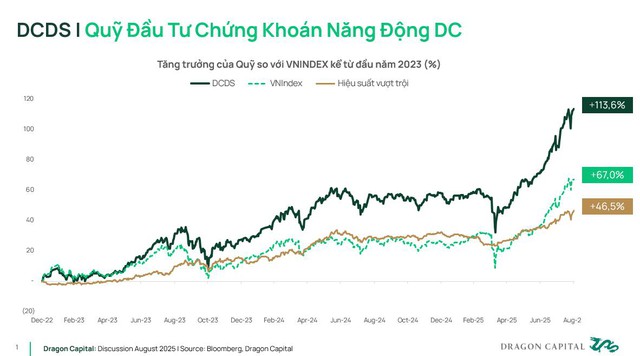

Amidst this landscape, the DCDS Dynamic Securities Investment Fund (DCDS) stands out. With a net asset value exceeding 300 billion VND, DCDS has managed to outperform the VN-Index. As of the September 15th valuation, DCDS fund units were priced at 109,435.73 VND per unit, representing a 34.38% increase since the beginning of the year.

Decoding DCDS’s Outperformance

DCDS’s ability to generate “alpha” while the HoSE index soared reflects its strategic portfolio construction and adaptable investment approach.

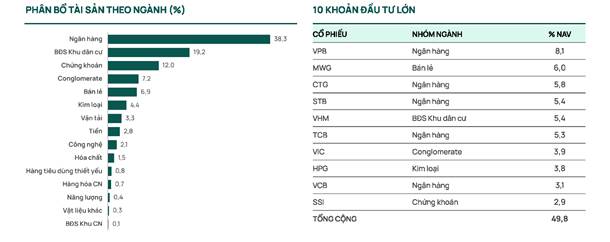

Prior to April, DCDS increased its cash position to 24%, strategically deploying capital during a market downturn. Two key picks during this period were VIC and VHM, both of which have demonstrated impressive growth and significantly contributed to the VN-Index’s recovery following the tariff shock.

Demonstrating its agility, DCDS reduced its holdings in VIC and VHM in late June 2025, shifting focus towards the banking sector with investments in TCB, STB, MBB, and CTG. This strategic move increased the fund’s banking sector exposure from 28.28% in May to 31.73% in June 2025.

Furthermore, DCDS acquired VPB shares in July 2025, initially representing 2.88% of its portfolio, and subsequently increased its holding to 8.07% by the end of August 2025.

Banking stocks, including VPB, played a pivotal role in driving the VN-Index to new highs in July and August. Notably, VPB alone achieved a remarkable 89.2% return during this two-month period.

DCDS’s nimble pivoting strategy has resulted in impressive gains from its investment activities over the past three months, significantly contributing to its outperformance relative to the VN-Index.

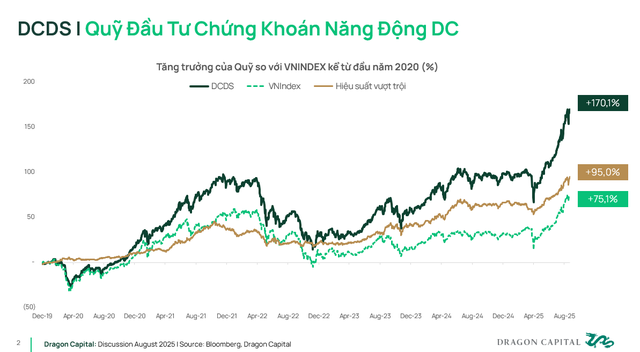

Looking beyond 2025, DCDS’s performance over the past three and five years is equally impressive.

A five-year period is considered a sufficient timeframe to accurately assess an investment fund’s performance, providing insights into the fund manager’s stock selection, asset allocation, and risk management capabilities. DCDS’s five-year performance is truly remarkable, boasting a 170.1% return, significantly outpacing the VN-Index’s 75.1% gain.

This exceptional performance can be attributed to DCDS’s ability to invest in a broader range of stocks, typically holding 50-60 stocks compared to the 20-40 stocks held by other funds. This diversification allows DCDS to actively manage its portfolio while ensuring liquidity, even as the fund’s assets grow alongside the expanding market.

Despite its larger asset size compared to other funds, DCDS consistently ranks among the top performers in the market due to its highly diversified portfolio and agile, prudent management.

DCDS’s long-term growth trajectory instills confidence in investors, encouraging them to invest in DCDS fund units or adopt strategies like Systematic Investment Plans (SIP) or Dollar-Cost Averaging (DCA). This confidence is reflected in the fact that 30% of investors holding DCDS for over two years have achieved returns exceeding 45%.

Human Capital: The Key to Success

While portfolio composition and investment strategy are crucial, the success of an investment fund ultimately hinges on the expertise of its management team.

Established in May 2004, the DCDS team boasts over two decades of experience navigating the Vietnamese stock market, weathering storms like the 2008 financial crisis and the Covid-19 pandemic. This wealth of experience provides the team with a keen understanding of market trends and investor sentiment.

The DCDS management team comprises seasoned professionals. Dr. Le Anh Tuan, Head of Investments and CEO of Dragon Capital Vietnam since October 1, 2025, brings 16 years of industry experience. Vo Nguyen Khoa Tuan, Senior Securities Operations Director (16 years), Nguyen Sang Loc, Portfolio Manager (15 years), and Luong Thi My Hanh, Domestic Asset Management Director (21 years), all possess extensive expertise and a proven track record.

The human element is the cornerstone of DCDS’s success, enabling the fund to consistently pursue its “weather all weathers” strategy, delivering strong performance regardless of market conditions.

In conclusion, DCDS’s exceptional performance in 2025 (and over the past three and five years) is a testament to the synergy between Vietnam’s stable macroeconomy, a thriving stock market, and the fund’s agile, intelligent investment strategy executed by a highly experienced management team.

A Rare Bright Spot in Today’s Stock Market Session

A sea of red engulfed banking stocks today, with STB plunging 3.16%, BID retreating 2.45%, EIB shedding 2.06%, VCB dipping 1.41%, and both VPB and HDB also suffering losses exceeding 1%. The banking sector emerged as the primary drag on the index, pulling it downward.