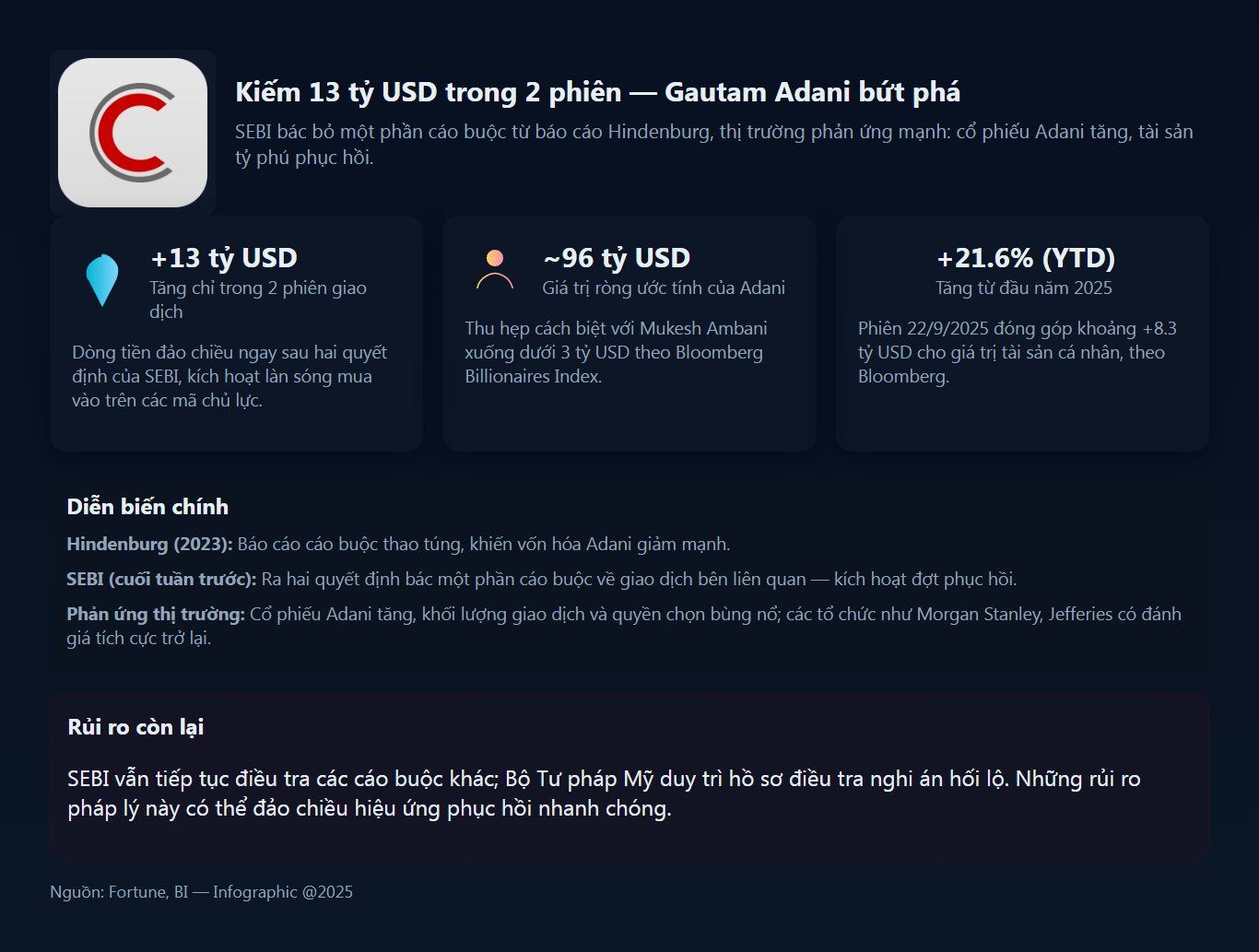

In just two trading sessions over the past weekend and the start of this week, Gautam Adani’s net worth surged by a staggering $13 billion, bringing his total wealth to nearly $96 billion.

This marks the most significant wealth increase for an Indian billionaire in recent years, occurring as the Adani Group was partially cleared of allegations that had lingered for over two years by India’s market regulator.

Restored Confidence

This explosive growth was triggered by the Securities and Exchange Board of India (SEBI), which dismissed some of the major allegations against the Adani Group last weekend.

Specifically, SEBI concluded that there was no evidence of the Adani Group using related-party transactions to divert or pump capital into listed companies.

This was a significant legal relief. Hindenburg had accused the Adani Group of using intermediary entities to circumvent disclosure rules, but SEBI affirmed that the named transactions did not constitute violations of related-party trading regulations at the time.

This ruling reinforced the fundamental belief that Hindenburg’s core allegations of fraud and stock manipulation were baseless, as the group had consistently maintained.

It’s worth recalling that Hindenburg Research’s bombshell report in 2023 caused the group’s market capitalization to plummet by over $100 billion in just a few weeks.

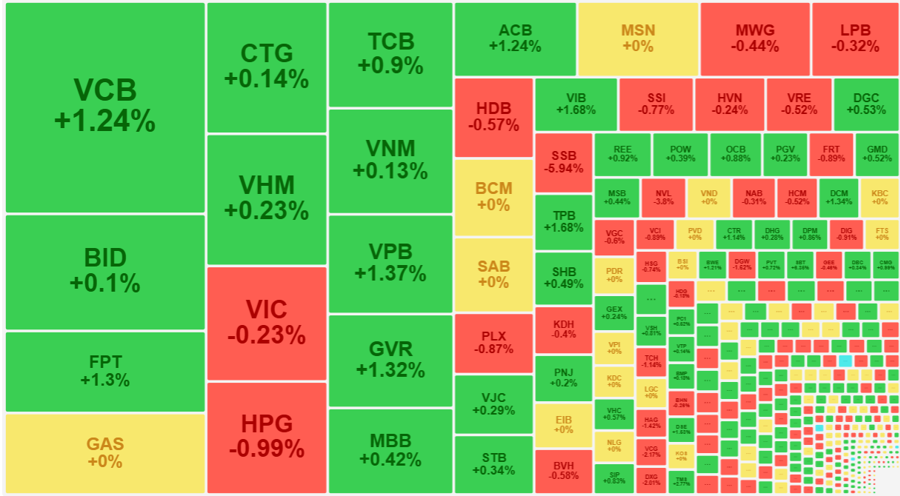

With this major hurdle removed, investor confidence and capital flowed back, driving a sharp rally in the group’s stocks.

According to the Bloomberg Billionaires Index, Adani’s wealth increased by $8.3 billion on September 22, 2025 alone, bringing his year-to-date gain to 21.6%.

Having fallen in the rankings after the Hindenburg crisis, Adani has now narrowed the gap with Mukesh Ambani, Asia’s richest person, to less than $3 billion. This rebound highlights the resilience of India’s markets, where investors are quick to re-engage following positive policy signals.

The market reaction was immediate and intense. The combined market capitalization of the Adani Group’s 10 listed companies surged by tens of billions of dollars.

Leading the relief rally were Adani Power and Adani Total Gas, which saw extraordinary growth. This was driven not only by SEBI’s ruling but also by the return of global financial institutions.

Notably, Morgan Stanley resumed coverage of Adani Power with an “Overweight” rating, while Jefferies provided a positive outlook for Adani Green Energy, emphasizing the significant growth potential of its infrastructure projects.

The enthusiasm extended beyond equity markets. In derivatives, options contracts linked to Adani Green Energy reached record levels, while Adani Enterprises saw its strongest bullish activity in nearly two years. Large block trades surged, reflecting the return of substantial capital to the Adani ecosystem.

Mukesh Ambani and Gautam Adani

The surge in trading volumes indicates that institutional investors, who had been cautious following the Hindenburg episode, are now re-entering to capitalize on opportunities as the largest legal overhang is lifted.

Analysts suggest that market focus will now shift from governance concerns to the group’s operational performance and its ability to execute massive energy and logistics projects.

Risks Remain

However, the picture is not entirely clear. SEBI noted that other investigations into remaining Hindenburg allegations are ongoing.

Additionally, the U.S. Department of Justice continues to investigate bribery allegations against the group, though no final conclusions have been reached. Thus, Adani has not fully escaped the legal shadow that has loomed over it for two years.

The long-term stability of the Adani empire will depend on its ability to resolve these lingering legal issues decisively.

Nonetheless, the current asset surge has significantly bolstered investor confidence, marking a critical turning point in the group’s recovery from one of India’s most significant corporate crises.

In summary, the $13 billion surge underscores the sensitivity of billionaire wealth to legal developments and market sentiment. It also highlights the unique appeal of India’s equity markets as global capital seeks opportunities in emerging economies.

Yet, the key question remains: Can Adani sustain this recovery if further investigations by SEBI or the U.S. Department of Justice yield unfavorable outcomes?

For a group that endured the largest shock in Indian market history, every regulatory decision and investigative update can swing its leader’s wealth by tens of billions of dollars. Gautam Adani’s $13 billion gain in two days is likely just another act in a market drama with many more twists to come.

Source: Fortune, BI

“VinFast’s Progress in India Two Years After Meeting with Indian Billionaire: A $10 Billion Investment Prospect”

The Adani Group has strong ties to the automotive industry, particularly in the realm of electric vehicles (EVs) and clean transportation solutions.

Unveiling the Billionaire Benefactor: A Million-Dollar Aid for Vietnam to Overcome Devastating Floods

Gautam Adani, the Indian billionaire and founder of the Adani Group, has donated $1 million to Vietnam for flood relief efforts. This generous gesture is just one example of Adani’s remarkable journey from a humble employee in a diamond company to becoming one of Asia’s richest and most influential businessmen.

Unveiling the Power Players: The Prime Minister’s Vision for a $200 Million Project Revolution by 2030

Upon surveying this project on September 1, the Prime Minister was pleased to announce that a significant number of prominent investors have expressed their interest.

The Biggest Indian Conglomerate Eyes Major Investments in Vietnam

Leaders of the Adani Group have revealed plans to invest in the Lien Chieu Port in Da Nang, Vietnam, with a proposed investment of over $2 billion. The group also intends to strengthen its collaboration with Vietnamese partners in aviation and logistics, including potential involvement in the development of Long Thanh International Airport Phase 2 and Chu Lai Airport.