According to the attached appendix, the maximum number of shares offered in the IPO is 202.3 million. The offering price has not been disclosed and will be determined by the Board of Directors based on market conditions, ensuring it does not fall below the book value as per the mid-year 2025 audited financial statements.

VPS’s IPO is scheduled to take place between Q4 2025 and Q1 2026. The offering is fully open to foreign investors, with the maximum foreign ownership ratio expected to be approved at 100% by the shareholders’ meeting.

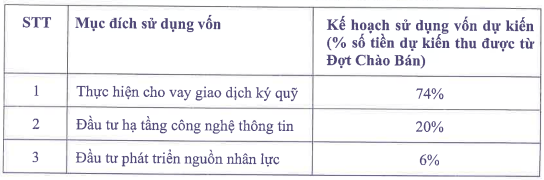

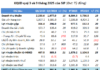

The majority of the proceeds from the IPO will be allocated to fund margin lending activities, while the remainder will be invested in technology infrastructure and workforce development.

|

Allocation of Funds Raised from the IPO

Source: VPS

|

Additionally, at the upcoming extraordinary general meeting, VPS will propose to shareholders the issuance of 710 million shares to increase equity capital from owners’ equity in Q4 2025. This will raise the company’s charter capital from 5.7 trillion VND to 12.8 trillion VND.

Furthermore, the leadership will also propose to cancel the issuance and private placement of convertible corporate bonds, along with the dismissal and election of additional Board of Directors members and auditors for the remainder of the 2025-2030 term, as well as other proposals.

– 4:57 PM, September 25, 2025

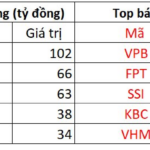

September 25th Session: Foreign Investors Net Sell VND 2.2 Trillion, Which Stocks Were Hit Hardest?

Foreign block transactions stand out as a notable drawback when they exhibit significant net selling across the entire market.

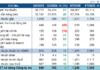

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.