Preliminary statistics from the General Department of Vietnam Customs reveal that Vietnam’s exports of computers, electronic products, and components surged past $10 billion in August, marking a significant increase from the previous month. Over the first eight months of 2025, this sector has generated $66.8 billion in revenue, a 43.1% rise compared to the same period last year.

This category continues to dominate Vietnam’s export landscape, accounting for 21.6% of the nation’s total export turnover, far outpacing other major export groups.

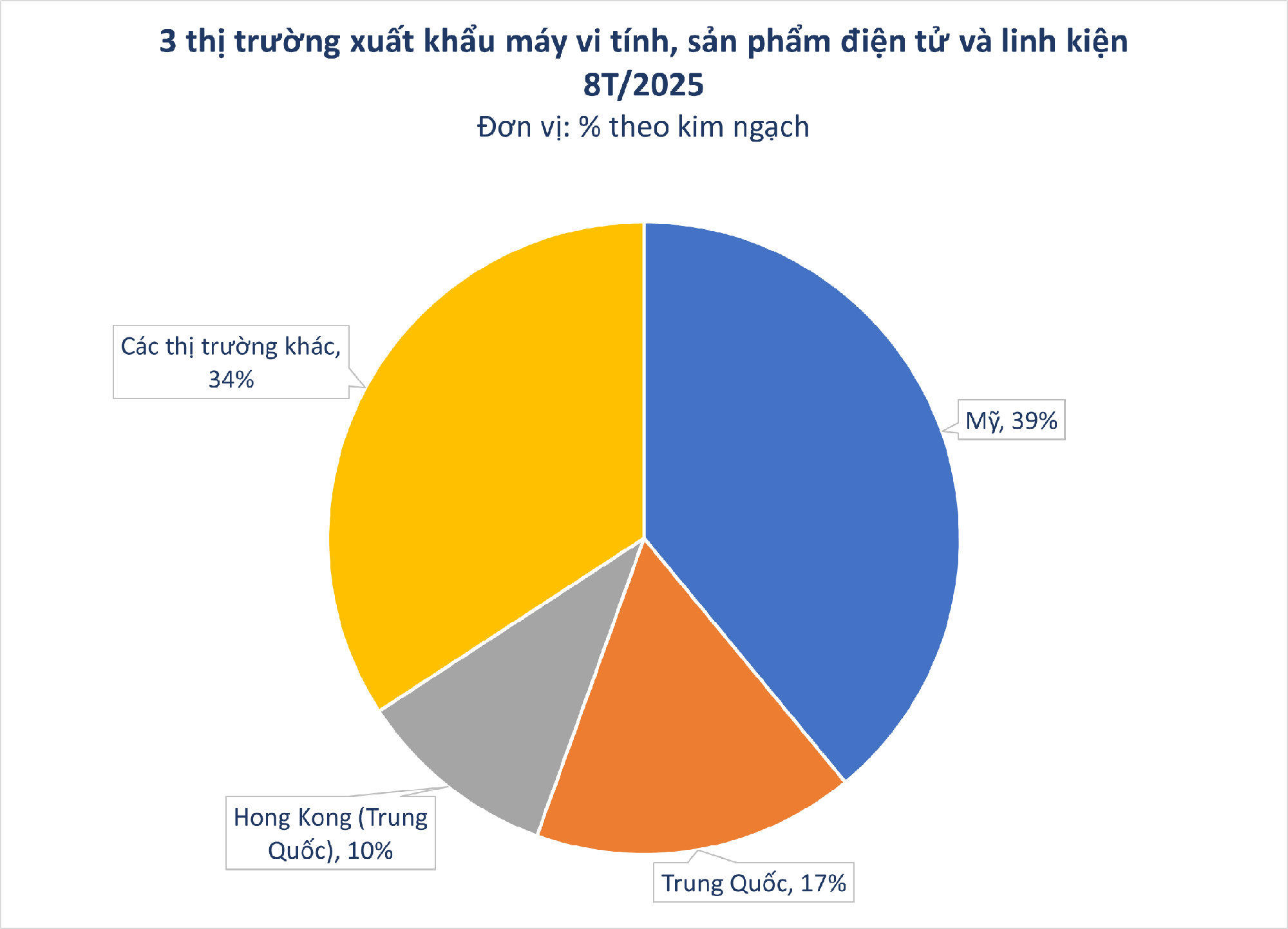

The United States has been a key driver of this growth, maintaining its position as Vietnam’s largest export market. In the first eight months of the year, exports to the U.S. reached $26 billion, a remarkable 68% increase from the same period in 2024. These exports represent the highest-value category among all goods shipped to the U.S., making up over 26% of Vietnam’s total exports to the country.

Vietnam’s total exports to the U.S. in the first eight months of 2025 exceeded $99 billion, resulting in a trade surplus of $86.9 billion. This highlights the robust growth of Vietnamese exports to the U.S., particularly following the reduction of the retaliatory tariff imposed by President Donald Trump to 20%.

According to the White House and U.S. Customs, Vietnamese exports in this category face a 9.1% tariff, compared to the average 10.2% tariff applied to other countries, giving Vietnam a significant competitive edge globally.

Amid shifting global geopolitical and technological landscapes, Vietnam is steadily transitioning from a “manufacturing hub” to a high-tech innovation center in the region.

Vietnam’s electronics industry is well-positioned for growth, benefiting from its strategic location within a rapidly developing and dynamic industrial region. Additionally, the country’s domestic market of over 100 million people and direct access to ASEAN’s 600 million consumers further enhance its advantages.

The future growth potential of the electronics and technology sector remains strong, despite global economic fluctuations, trade tensions, and geopolitical conflicts impacting supply chains and logistics. Investment in this sector continues to flow into Vietnam, as evidenced by ongoing, upcoming, and planned projects.

Major technology giants such as Samsung, LG, Foxconn, Fukang Technology, Canon, Intel, Compal, Pegatron, and Luxshare have established multi-billion-dollar manufacturing facilities in Vietnam, significantly boosting production capacity and cementing the country’s role as a critical link in the global electronics value chain.

Economic experts predict that the positive momentum in production and exports will continue, as indicated by the increased foreign currency expenditure on importing machinery, equipment, and key export-oriented goods. If current electronics export orders are sustained, imports of computers, electronic products, and components could reach $100 billion.

U.S. Export Revenue Surpasses $637 Billion Milestone

In the first half of September, the import-export turnover surpassed $39 billion, pushing the nation’s total export turnover since the beginning of the year to over $637 billion.

The Great Recruitment Surge: How the Textile Industry Bounced Back with a Hiring Spree

The second quarter of 2025 witnessed a remarkable rebound in the textile industry, evident not only in the surge of orders but also in the workforce numbers. However, this increase in personnel and labor costs raises questions about the sustainability of the labor-intensive growth model, especially with the accelerating pace of automation and technological advancements.