At the discussion session on “Stock Market in the Face of New Opportunities” held on the afternoon of September 25th as part of the Vietnam Wealth Advisors Summit (VWAS), leading securities experts shared insightful perspectives on long-term investment prospects and opportunities.

Discussion session on “Stock Market in the Face of New Opportunities” at the Vietnam Wealth Advisors Summit (VWAS) on September 25th

|

Long-term growth trend is undeniable

Highlighting a key insight from Dr. Le Duc Khanh – Director of Analysis at VPS, this year’s stock market has seen numerous stocks surpass historical highs, with a continued upward trend fueled by economic growth prospects and optimism about Vietnam’s future. Investment inflows are rising, though the number of investors remains small relative to the population.

Technical analysis reveals that after surpassing the 2022 peak, the market is targeting at least 1,800 points. Looking further ahead, the market remains in a long-term uptrend. In terms of capital flow, stocks that have surged will enter an accumulation phase, while attention shifts to sectors that have yet to see significant growth.

The market’s potential by 2026 remains substantial. However, selecting the right stock groups will be crucial, focusing on sectors with attractive valuations, limited previous growth, and strong prospects.

Dr. Le Duc Khanh (VPS) speaking at the discussion session

|

According to Do Minh Trang – Director of Market Analysis and Strategy at ACBS, the current trading range of 1,650 – 1,700 points does not fully reflect the economy’s growth potential but rather mirrors corporate earnings. Thanks to pre-tax rate hikes, many companies’ profits have exceeded expectations.

In the base scenario, a VN-Index of 1,700 – 1,750 points is reasonable. The recent market pause is normal, as investors remain cautious amid news such as Q3 GDP, macroeconomic data, and market upgrades. This is a consolidation phase, strengthening the price foundation before the next rally.

If the positive scenario unfolds, a stronger uptrend in the next six months is entirely possible. With a valuation of around one standard deviation and current profit growth, a suitable level would be 2,000 – 2,100 points.

Another positive note from Ms. Trang is the shift in capital structure. Previously, 85% of liquidity came from retail investors, but now domestic institutions account for 40% (with proprietary trading playing a minor role), while retail investors have dropped to 45%. This indicates that smart money is increasingly coming from domestic institutions, bolstering confidence in economic and market prospects.

Ms. Do Minh Trang (ACBS) speaking at the discussion session

|

Long-term vision unlocks significant opportunities

Echoing sentiments from VPS and ACBS, Dang Thanh Tung – Director of Operations at Dragon Capital Vietnam believes the Vietnamese stock market shows many positive signals for continued growth.

“From market upgrades and accelerated public investment disbursement to external factors like the Fed’s rate cuts, all support the market. While listed goods remain limited, a positive sign is the increasing number of high-quality, efficient companies preparing to list.” – Mr. Tung shared.

While short-term challenges may arise, the long-term outlook is clear. The government has set ambitious yet achievable goals, beneficial for the economy. Looking at historical markets with similar growth rates, stock markets often double, driven by corporate profit growth and market revaluation.

On this journey, volatility is inevitable but becomes an opportunity for long-term investors. Dragon Capital’s strategy focuses on companies with genuine competitive advantages, sustainable growth potential, and clear intrinsic value creation. Simultaneously, portfolio flexibility adapts to global and domestic fluctuations, balancing value creation with effective risk management.

Sharing his strategy-building approach, Tran Vinh Quang – CEO of Thien Viet Asset Management (TVAM) offered three key principles for all investors.

First, believe that the Vietnamese stock market is in a long-term growth channel. Despite short-term fluctuations, trust this trend. Second, respect all market developments and outcomes. Finally, establish a personal investment framework, continuously refine it, and stay open to learning.

Mr. Tran Vinh Quang (TVAM) speaking at the discussion session

|

Choosing “traditional” or “new” sectors

Addressing promising sectors for future investment, Ms. Do Minh Trang emphasized that banking remains the largest pillar, contributing about 60% of capital to the economy and over 50% of listed company profits. With P/E and P/B ratios still low historically, long-term holding at appropriate weights is advisable.

The second sector is residential real estate. The market’s recovery from late 2024 is driven by large projects and has yet to extend to small and medium-sized enterprises, but the landscape will shift in 2025 – 2026 with legal resolutions, boosting mid-tier real estate profits.

Third is the public investment group with long-term prospects. Listed companies in construction materials, steel, plastics, stone, aggregates, and infrastructure will benefit. Input costs for construction material and public investment companies currently enjoy low raw material prices due to China’s slow economic recovery, while domestic demand remains strong, widening profit margins.

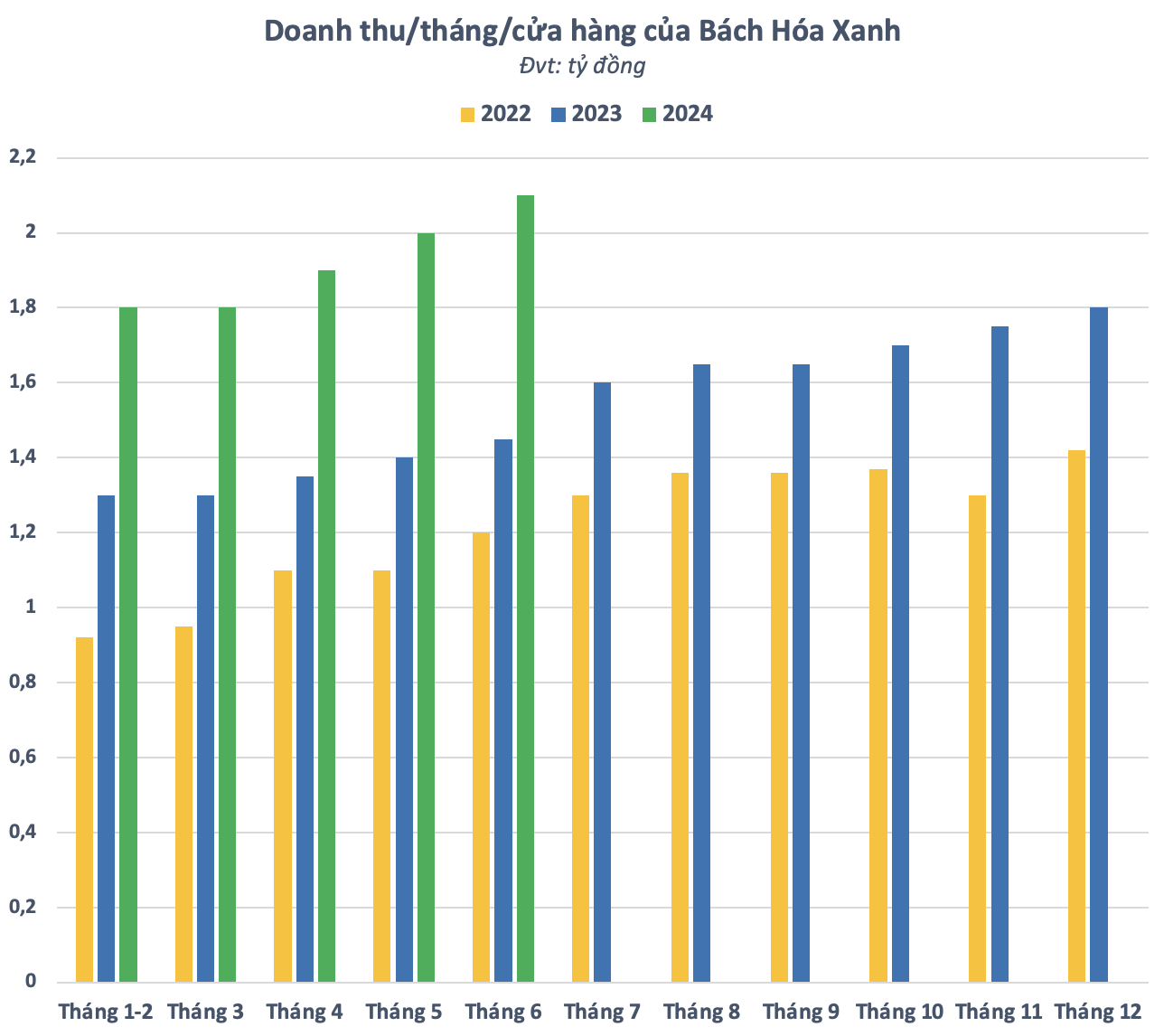

Lastly, retail. With GDP growth, stimulus policies, and domestic consumption recovery, the retail sector—less affected by taxes, trade, or exchange rates—will be supported.

Mr. Tran Vinh Quang agreed with these sectors, emphasizing the importance of stock selection within them. Banking stocks vary widely in performance; some focus on consumer lending, others on large projects or digital transformation. Thus, specific stock selection within sectors is crucial.

Beyond these traditional sectors, according to Mr. Dang Thanh Tung, key sectors like electronics, manufacturing, and energy will drive economic growth over the next 5 – 10 years, gradually gaining long-term market recognition.

– 18:07 26/09/2025

“All Recent Reforms Aim to Elevate Vietnam’s Market Status, Says Mr. Bui Hoang Hai (SSC)”

At the Vietnam Financial Advisors Summit (VWAS) held on the afternoon of September 25th under the theme “New Era, New Momentum,” Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that market upgrading is not merely an endpoint but a means to achieve a more transparent, stable, and efficiently operating market. This transformation aims to provide investors with greater opportunities to pursue profitable returns.

Confident Stock Upgrades: Billion-Dollar Foreign Funds Highlight Top Picks for the Next Wave

Pyn Elite Fund anticipates that FTSE Russell will upgrade Vietnam’s market status to Emerging Market (EM) as early as October or by March 2026 at the latest.