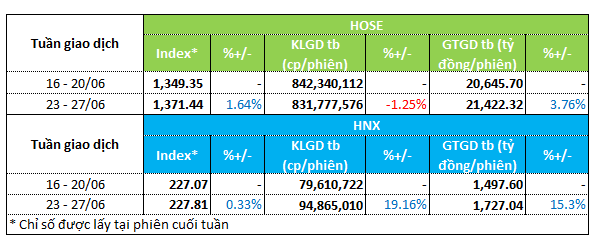

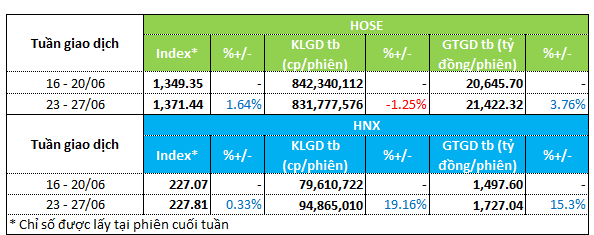

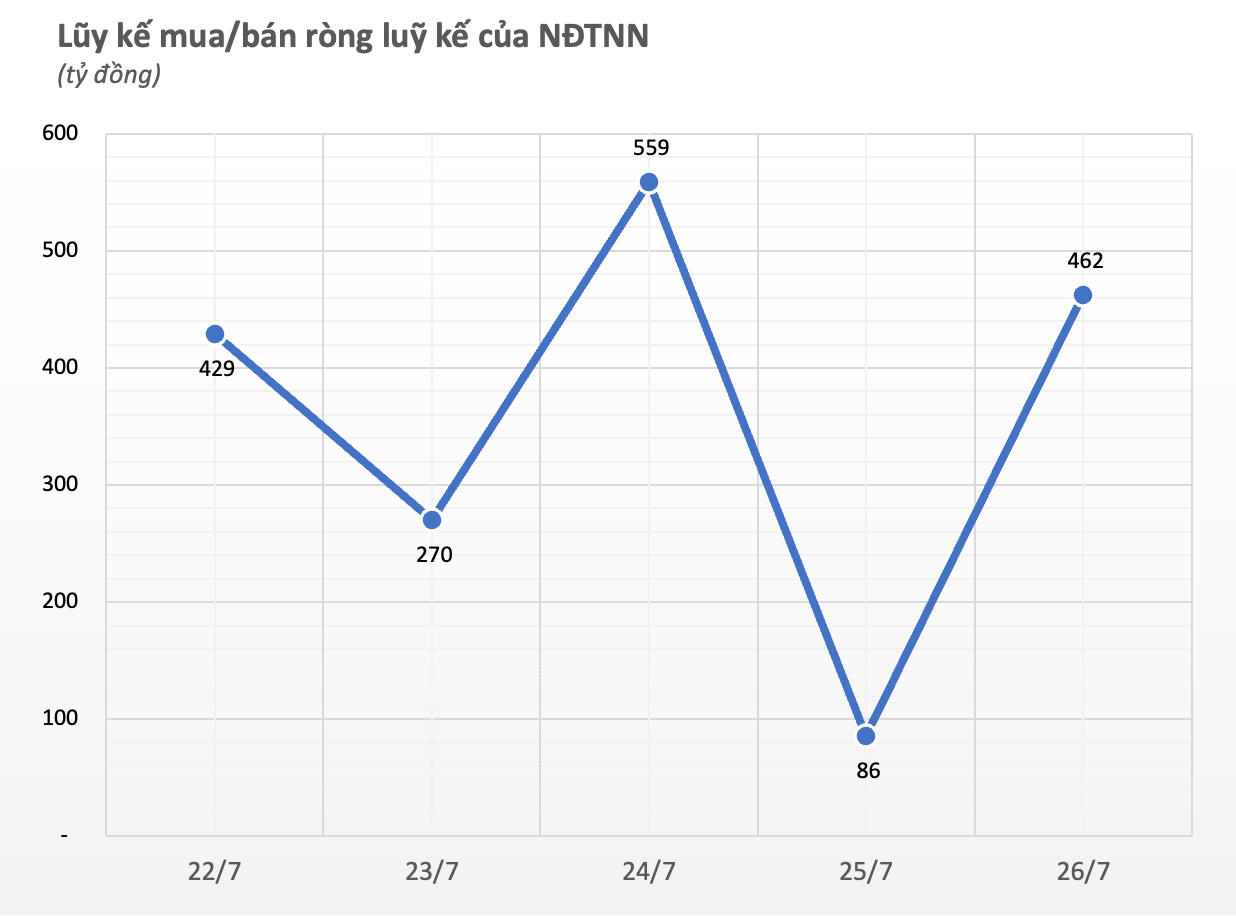

Week of June 23-27 saw positive momentum in the stock market with main indices rising on both listed exchanges. The VN-Index gained 1.6% to close at 1,371.44. The HNX-Index also rose, climbing 0.3% to 227.81.

HOSE witnessed an improvement in trading value, while volume slightly dipped. Specifically, trading volume on this exchange decreased by over 1% to 831.7 million units per session. However, trading value increased by nearly 4% to VND 21.4 trillion per session. On the HNX exchange, trading volume surged by almost 20% to 94.8 million units per session, with trading value also rising sharply by 15% to VND 1.7 trillion per session.

|

Market Liquidity Overview for Week of June 23-27

|

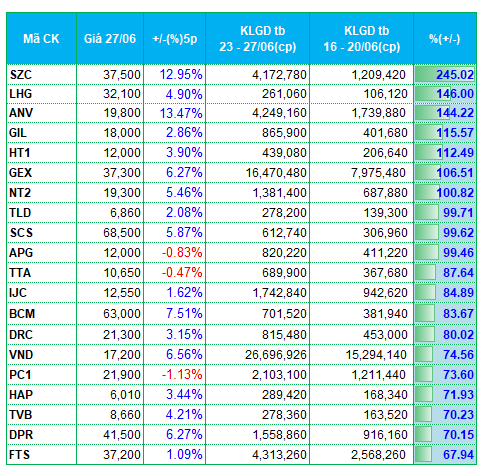

Amidst the market’s positive sentiment, several sectors witnessed an activation of cash flow, including industrial real estate and securities.

In the industrial real estate sector, numerous stocks observed a significant surge in liquidity. Notable mentions include SZC, LHG, IJC, and BCM. SZC took the lead with a liquidity increase of over 240% compared to the previous week, attaining a trading volume of 4.1 million units per session.

Along with the positive cash flow, the industrial real estate group also witnessed promising price movements. SZC climbed nearly 13% during the week, reaching VND 37,500 per share. BCM also rose by 7.5% to VND 63,000 per share.

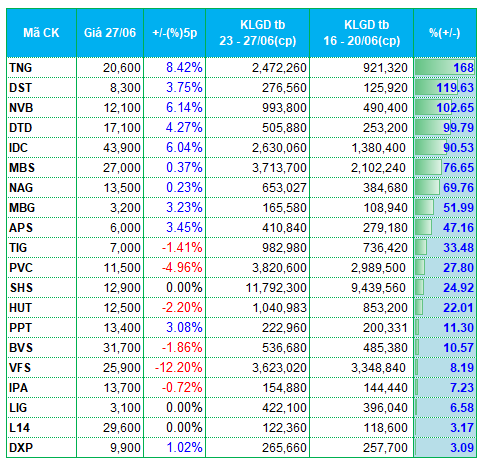

Regarding the securities group, APG, VND, TVB, FTS, MBS, APS, SHS, BVS, VFS, and IPA were among the top gainers in liquidity on the two listed exchanges. Despite improved liquidity, this group of stocks exhibited price divergence, with both green and red hues.

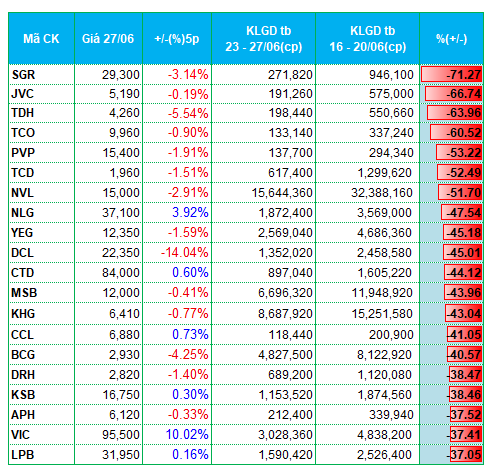

On the contrary, numerous real estate stocks witnessed capital outflows. SGR, TDH, NVL, NLG, KHG, CCL, BCG, DRH, VIC, AAV, and NDN were among the top losers in terms of trading volume, with decreases ranging from 30% to 60%.

Oil and gas stocks also signaled capital withdrawals, with PVP, PVB, and PVS experiencing significant declines in liquidity during the week.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX

|

The list of stocks with the highest liquidity increase/decrease is based on a minimum average trading volume of 100,000 units per session.

– 19:28 30/06/2025

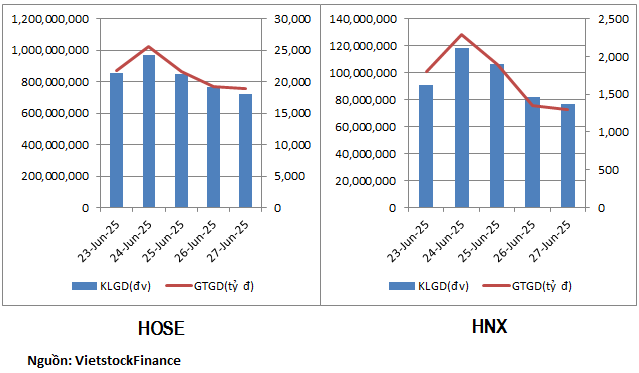

Market Beat: Foreigners Turn Net Buyers, VN-Index Hits 2-Year High

The trading session concluded with the VN-Index climbing 4.63 points (+0.34%), reaching 1,376.07. Meanwhile, the HNX-Index witnessed a rise of 1.41 points (+0.62%), closing at 229.22. The market breadth tilted towards the bulls, as advancers outnumbered decliners by a margin of 469 to 269. Similarly, the VN30 basket echoed this bullish sentiment, displaying 16 gainers, 10 losers, and 4 unchanged stocks.

Vietstock Daily: Liquidity Recovery Anticipated

The VN-Index sustains its upward momentum, closely hugging the upper band of the Bollinger Bands. The MACD indicator continues to widen the gap with the signal line, providing a bullish signal and indicating sustained positive short-term sentiment. However, a caveat lies in the trading volume, which has not yet surpassed the 20-session average, reflecting investors’ lingering caution. If this trend persists in upcoming sessions, the risk of a corrective shake-up warrants attention.