Gemadept Joint Stock Company (GMD-HOSE) announces the Board of Directors’ resolution on the record date for the 2024 cash dividend payment.

Accordingly, on July 10, 2025, Gemadept will finalize the list of shareholders eligible for the 2024 cash dividend payout at a rate of 20% (each share will receive VND 2,000).

With approximately 420.2 million GMD shares currently in circulation, Gemadept is expected to disburse nearly VND 840.4 billion for this dividend payment. The payment date is set for July 17, 2025.

It is worth noting that GMD successfully held its 2025 Annual General Meeting of Shareholders. The company proposed two scenarios: a registered scenario and an ambitious scenario. The registered scenario targets revenue of VND 4,850 billion, representing a 100% increase compared to the performance in 2024, and expected pre-tax profit of VND 1,800 billion, a 101% surge.

On the other hand, the ambitious scenario projects revenue of VND 4,950 billion, indicating a 121% jump, and expected pre-tax profit from business operations of VND 2,000 billion, a 48% increase compared to the results in 2024.

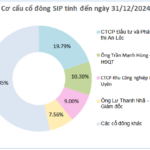

Moreover, the General Meeting of Shareholders approved the plan to repurchase up to 21 million GMD shares, equivalent to 5% of the total outstanding shares of the company. The primary objective of this repurchase is to safeguard the interests of the company and its shareholders when the market price of the shares is lower than their intrinsic value.

The total repurchase value, based on the par value, is nearly VND 210.1 billion. The capital for this repurchase will be sourced from surplus funds as per the audited or reviewed consolidated financial statements of the company at the nearest period.

The company’s Board of Directors will implement the share repurchase plan when the trading price of the company’s shares falls below 1.5 times the book value per share. The repurchase will be executed after receiving written notification from the State Securities Commission (SSC) regarding the receipt of complete documents related to the company’s share repurchase report.

If the aforementioned share repurchase plan is successful, Gemadept’s charter capital will decrease from over VND 4,201.9 billion to VND 3,991.8 billion.

According to VCSC, both scenarios presented by GMD fall short of their current forecasts. The revenue targets equate to 93-95% of VCSC’s 2025 estimates, while the projected core profit before tax is only 80-90% of their forecast. This is attributed to lower-than-expected revenue growth and profit margin expansion.

GMD’s 2025 throughput targets:

– GML: 1.7 – 1.8 million TEU (-2.5% to +3.3% YoY; 98% – 103% of VCSC’s 2025 forecast)

– NDV: 1.35 million TEU (unchanged YoY; 95% of VCSC’s 2025 forecast)

Goals for attracting new weekly services in 2025:

– GML: In addition to the four new services to non-US markets in Q2 2025, GMD aims to attract at least one more new service by the end of 2025 to ensure throughput growth and market diversification. VCSC believes this additional service will also target a non-US market.

– NDV: GMD targets to attract one to two new services by the end of 2025 in preparation for NDV3.

Regarding the financial results for the first half of 2025: The management has announced expected figures with revenue reaching VND 2,760 billion (+28% YoY; 53% of VCSC’s 2025 forecast) and core pre-tax profit amounting to VND 1,100 billion (+23% YoY; 49% of VCSC’s 2025 forecast).

Should You Buy or Sell When the VN-Index Nears 1,400 Points?

The business results for the first half of the year, alongside the looming deadline for the postponement of the reciprocal tax agreement between Vietnam and the US, are set to impact the stock market in the week ahead.