Selling pressure was intense this morning, causing stock prices to plummet in the latter half of the trading session. From a positive start with more stocks gaining than losing when the VN-Index peaked, the situation reversed by the end of the morning session, with twice as many declining stocks as advancing ones.

VCB, up a strong 2.11%, added nearly 2.4 points to the VN-Index, but the index still closed down 1.45 points or 0.11% from the reference level. Even the strongest stock in the blue-chip group faced significant pressure: it had the highest liquidity in the market at VND449.6 billion, but its price couldn’t hold at the peak and fell about 1.02% from its high, which coincided with the VN-Index’s peak around 10:15 am.

The VN30 basket swung from having 24 gainers to 18 decliners and only 9 gainers. Among the top 10 stocks by market capitalization, only VCB, BID (+0.55%), FPT (+0.42%), and MBB (+0.39%) were in the green, while the rest declined. Even these resilient stocks showed notable weakness.

Of the nine stocks swimming against the tide in the blue-chip basket, GVR (+1.82%), VJC (+1.36%), and BVH (+1.51%) stood out with their gains. However, their limited market capitalization meant their impact on the index was minimal. The trio contributed about 0.8 points, just enough to offset the pressure from VHM’s 0.91% decline. On the positive side, the decliners took a while to slip into the red, indicating some resilience.

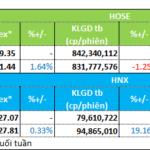

The VN30-Index ended the morning session down 0.33%, with liquidity slightly up 3.8% from the previous morning. The increase in liquidity was mainly due to VCB’s exceptional trading volume. The stock’s matched orders surged six-fold from the previous morning, equivalent to VND378 billion, while the basket’s total increase was only VND204 billion. This suggests that many other stocks in the basket saw a decline in trading activity.

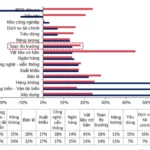

Looking at the broader HoSE exchange, liquidity fell about 5.5% from the previous morning, indicating weak overall market participation. Mid and small-cap stocks also lacked demand and declined across the board. The Midcap index was down 0.53%, and the Smallcap index lost 0.45%. HoSE’s breadth ended with 101 gainers and 199 losers.

Among the decliners, 77 stocks fell by 1% or more, accounting for nearly 20% of the floor’s total trading value. This can be seen as a faint positive signal, as selling pressure hasn’t pushed stock prices deeper into negative territory, and selling volume isn’t excessive. The expansion in declines is mainly due to weak buying rather than aggressive selling. Notable stocks in this category include MSN (-1.82%) with VND239.5 billion in matched orders, GEX (-1.34%) with VND217.5 billion, VND (-2.03%) with VND143.8 billion, DXG (-2.37%) with VND129.9 billion, DGC (-1.38%) with VND93.2 billion, and DIG (-1.69%) with VND98.6 billion…

On the advancing side, liquidity was even more concentrated due to the overall weak market conditions. Only 13 stocks on the HoSE exchange maintained double-digit percentage gains with liquidity above VND10 billion. Apart from VCB, two notable investment stocks were VCG (+4.54%) with VND436.8 billion in liquidity and HHV (+1.21%) with VND132.2 billion. However, these two stocks also faced intense pressure. VCG fell 1.91% from its opening price, and HHV dropped 2.72%. GVR, HAG, CMG, and VJC were among the few stocks with liquidity hovering around VND50 billion.

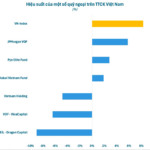

Today’s weak performance wasn’t due to any particular news or event but rather the daily dynamics of supply and demand. Since the VN-Index broke through its mid-term peak on June 24, the market has been highly polarized, and only a few stocks have offered attractive short-term returns. Investors are cautious about putting substantial money into the market and instead focus on speculative trading in individual stocks.

Foreign investors recorded a sudden net sell-off of VND814.4 billion on the HoSE exchange, mainly due to block trades in HDB and VJC. VJC saw a net sell-off of VND389.1 billion, and HDB recorded a net sell-off of VND324.1 billion. Aside from these two stocks, there weren’t any significant trades. Notable net sells included GEX (-VND44.2 billion), HPG (-VND43.9 billion), FRT (-VND26.4 billion), and HDG (-VND22.1 billion). On the net buy side, a few stocks stood out: MSN (+VND30.5 billion), FPT (+VND29.1 billion), VCB (+VND28.6 billion), HVN (+VND24.7 billion), NLG (+VND21.2 billion), and VCG (+VND21 billion).

The Stock Market: Get Ready for a Flood of Crucial Insights

The VN-Index reached new heights during the final trading week of June. As the market moves past this information vacuum, it braces for a deluge of significant news, including the outcome of tariff negotiations and, most notably, the wave of second-quarter financial results.

The Little Engine That Could: Small-Cap Stocks Chugging Along Nicely

The optimistic sentiment continues to bolster the market’s slow but steady ascent, despite lackluster performances from leading stocks. While the blue-chips struggled to keep pace with the indices, the small and mid-cap stocks witnessed notable price advancements. Trading liquidity on the two exchanges witnessed a 10% increase, indicating a potential shift in investor appetite.