At the specialized discussion session titled “IPO Playbook for Startups in Vietnam,” organized by Genesia Ventures in Ho Chi Minh City, experts from Genesia Ventures Vietnam and VinaCapital shared insights on the topic. They emphasized that an IPO should not be seen as the ultimate goal but rather as a means to achieve broader business development objectives, marking the beginning of a journey toward standardized cash flow, business models, corporate governance, and sustainable growth strategies in the public market.

Specialized discussion session “IPO Playbook for Startups in Vietnam” held on October 31, 2025

|

Vietnam – A Leading Liquid Capital Market in the Region

Vietnam’s startup ecosystem is increasingly vibrant, and an IPO (Initial Public Offering) is considered a significant milestone, signaling a company’s maturity. According to Mr. Duy Lê, Board Member & Deputy CEO of VinaCapital, “Vietnam is currently one of the most liquid markets in Southeast Asia—a key factor for startups to seriously consider domestic listings instead of international markets. Vietnam can achieve daily trading volumes of $1–2 billion, while in Indonesia, the Philippines, or Thailand, this figure is only around $600–700 million.”

Mr. Duy Lê – Board Member & Deputy CEO of VinaCapital

|

He added that Vietnam is becoming an attractive destination for both domestic and international investors. “The issue isn’t capital availability but the quality and capacity of businesses to absorb it. When a business is of high quality, capital will naturally flow in,” he stated.

This liquidity abundance demonstrates Vietnam’s massive “capital pool,” ready to invest in quality businesses. This capital comes from both domestic investors—amid low deposit interest rates—and significant interest from international institutional investment funds.

Leading global private equity (PE) firms such as Warburg Pincus, TPG, and CVC Capital Partners have executed numerous deals worth hundreds of millions of dollars in Vietnam, highlighting the growing appeal of the domestic capital market.

Three Core Factors for a Successful Startup IPO

According to Mr. Duy Lê, to prepare for an IPO, businesses must focus on three key pillars: Product, Cash Flow, and Corporate Governance.

First, product and growth model: Startups may accept losses in the early stages to prioritize growth, but in the long term, the product must deliver real value, with a clear business model and market expansion potential. “Investors don’t just look at current revenue; they assess long-term growth capabilities—whether the business can capture market share and create sustainable value,” Mr. Duy Lê noted.

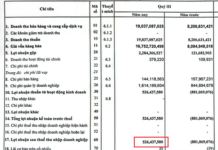

Cash Flow – The Lifeblood of Business: “Cash flow is like the lifeblood of a business. You can have profits on paper, but without cash flow, you’ll fail,” Mr. Duy Lê candidly shared. Many companies attempt to “beautify” financial reports, but professional investors always evaluate based on actual operating cash flow, which reflects the true health of the business. After a period of rapid growth, startups must demonstrate stable cash flow generation, as this is a critical factor in determining IPO value.

A clear 3–5-year financial plan, profit forecasts, capital needs, and specific capital usage plans are essential to convince investors and the State Securities Commission.

Corporate Governance – The Foundation of Trust: According to Mr. Duy Lê, governance is often overlooked but is critical to IPO success: “From the start, companies must work with lawyers to prepare corporate governance and financial reports to international standards. Without early standardization, addressing issues during the listing process becomes extremely challenging.”

Standardization includes: Transparent ownership structure; establishment of an independent board of directors; compliance with disclosure regulations for all stakeholders: suppliers, employees, shareholders, government, and the community.

Ms. Hoàng Thị Kim Dung – Country Director of Genesia Ventures Vietnam

|

Ms. Hoàng Thị Kim Dung, Country Director of Genesia Ventures Vietnam, shared insights from Japan, “In Japan, there’s an annual ‘short review’—a brief but detailed assessment to ensure businesses stay on track and meet governance, financial, and transparency standards required by the Tokyo Stock Exchange,” she said.

She added that maintaining this periodic review process helps businesses accumulate experience and a culture of compliance, which Vietnamese startups should view as a long-term strategic project rather than a last-minute task before an IPO.

– 10:57 07/11/2025

SCIC’s 10-Month Profit Surges to Nearly VND 11,400 Billion: On Track to Become the Government’s Premier Investment Fund

SCIC is proactively advocating for the Ministry of Finance and the Government to issue a separate Decree, establishing a favorable legal framework for state capital investment and management in the upcoming period. This initiative also seeks to enable a transition to a Government Investment Fund (Sovereign Wealth Fund) operational model.

Over 300 Trillion VND Lined Up for Investment in Lam Dong: Unveiling Mega Projects by Novaland, Sun Group, Tan Hoang Minh, DGC, and THACO

Following the merger, Lam Dong Province—Vietnam’s largest locality—is experiencing a surge in investment activity. Proposed capital for major projects has surpassed VND 330 trillion (over USD 12.5 billion), fueled by streamlined legal frameworks and infrastructure development initiatives.