As of the November 7th session, the USD Index (DXY), which gauges the greenback’s strength against a basket of six major currencies, closed at 99.47 points, marking a 0.2-point decline compared to the previous week.

Remarks from Mr. Trump weakened U.S. consumer sentiment, coupled with a partial U.S. government shutdown delaying official economic data releases. This heightened concerns about America’s economic growth prospects. The postponed jobs report left investors directionless, dampening market sentiment and driving the U.S. dollar lower.

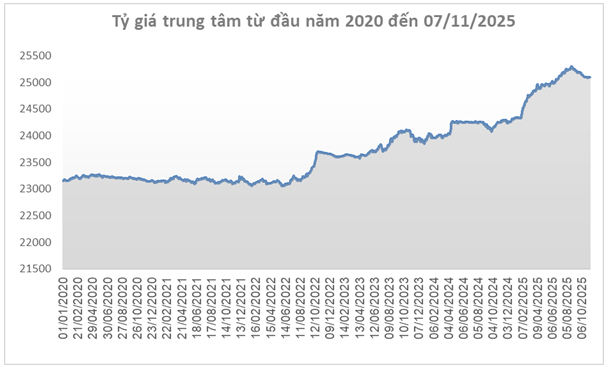

Source: SBV

|

In Vietnam, the State Bank set the November 7th central exchange rate at 25,103 VND/USD, a 10-dong increase from the previous week, ending a five-week downward streak. With a ±5% band, commercial banks’ exchange rates can fluctuate between 23,848 and 26,358 VND/USD.

The Foreign Exchange Management Department listed the reference exchange rate at 23,898 – 26,308 VND/USD (buy – sell), up 9 and 11 dong respectively from the prior week.

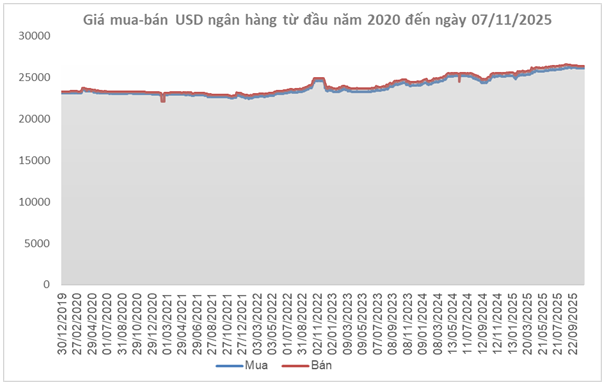

Source: VCB

|

Among banks, Vietcombank ended the week at 26,088 – 26,358 VND/USD, an 11-dong increase in both directions.

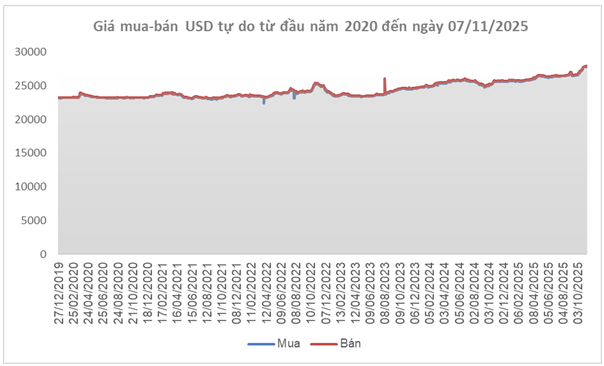

Source: VietstockFinance

|

In the free market, the USD/VND rate eased slightly after weeks of sharp increases, falling to 27,770 – 27,850 VND/USD (buy – sell), down 30 dong on the buying side and unchanged on the selling side from the previous week, halting a four-week rally.

– 16:28 09/11/2025

USD Sustains Its Safe-Haven Status

During the week of October 20–24, 2025, the USD rebounded in international markets, despite weaker-than-expected U.S. inflation data—a factor that bolstered expectations of a Federal Reserve rate cut at their upcoming meeting the following week.